Preliminary and Incomplete – Please Do Not

Quote

Digestible Microfoundations:

Buffer Stock Saving in a Krusell–Smith World

April 30, 2012

Christopher D. Carroll1

JHU

Jiri Slacalek2

ECB

Kiichi Tokuoka3

IMF

_____________________________________________________________________________________

Abstract

Krusell and Smith (1998) showed that it is possible to construct rational

expectations macroeconomic models with serious microfoundations. We argue

that three modifications to their framework are required to fulfill its promise.

First, we replace their assumption about household income dynamics with a

process that matches microeconomic data. Second, our agents have finite

lifetimes a la Blanchard (1985), which has both substantive and technical

benefits. Finally, we calibrate heterogeneity in time preference rates so

that the model matches the observed degree of inequality in the wealth

distribution. Our model has substantially different, and considerably more

plausible, implications for macroeconomic questions like the aggregate

marginal propensity to consume out of an economic ‘stimulus’ program.

-

Keywords

-

Microfoundations, Wealth Inequality, Marginal

Propensity to Consume

-

JEL codes

-

D12, D31, D91, E21

1Carroll: Department of Economics, Johns Hopkins University, Baltimore, MD,

http://www.econ2.jhu.edu/people/ccarroll/, ccarroll@jhu.edu 2Slacalek: European Central Bank,

Frankfurt am Main, Germany, http://www.slacalek.com/, jiri.slacalek@ecb.europa.eu 3Tokuoka:

International Monetary Fund, Washington, DC, ktokuoka@imf.org.

1 Introduction

Macroeconomists have sought credible microfoundations since the dawn of our

discipline. Keynes, his critics, and subsequent generations through Lucas (1976)

and beyond have agreed on this, if little else.

Since Keynes’s time, consumption modeling has been a battleground between

two microfoundational camps. ‘Bottom up’ modelers (e.g. Modigliani and

Brumberg (1954); Friedman (1957)) drew wisdom from microeconomic data and

argued that macro models should be constructed by aggregation from

microeconomic models that matched robust micro facts. ‘Top down’

modelers (e.g., Samuelson (1958); Diamond (1965); Hall (1978)) treated

aggregate consumption as reflecting the optimizing decisions of representative

agents; with only one such agent (or, at most, one per generation), these

models had ‘microfoundations’ under a generous interpretation of the

word.

The tractability of representative agent models has made them appealing for

business cycle analysis. But such models have never been easy to reconcile with either

macroeconomic

or microeconomic

evidence on consumption dynamics, nor with microeconomic theory which implies

that people who differ from each other (in age, preferences, wealth, liquidity

constraints, taxes, and other dimensions) should respond differently to any given

shock. If any of these differences matter (and it is hard to see how they could

not),

the aggregate size of a shock is not a sufficient statistic to calculate the

aggregate response; information about how the shock is distributed is

indispensable.

Bottom-up models, however, also have their problems. Even judged by a

sympathetic standard that asks how well they can match measured wealth

heterogeneity, bottom-up models have not been as successful as their champions

might have initially hoped. For example, bottom-up models calibrated to match

the wealth holdings of the median household generally fail to match the large

size of the aggregate capital stock, because they seriously underpredict the

upper parts of the wealth distribution (Carroll (2000b); Cagetti (2003)).

Alternatively, models calibrated to match the aggregate level of wealth greatly

overpredict wealth at the median (Hubbard, Skinner, and Zeldes (1994);

Carroll (2000b)). A further problem is that (at least until Krusell and

Smith (1998)) there has been no common answer to the question of how to

analyze systematic macroeconomic fluctuations (business cycles) in bottom-up

models.

This paper aims to reconcile the camps. We construct a workhorse

model that answers the main objections to both kinds of models by

making three modifications to the well-known Krusell–Smith (‘KS’)

framework.

First, we replace KS’s highly stylized assumptions about the nature of idiosyncratic

income shocks with a microeconomic labor income process that captures the

essentials of the empirical consensus from the labor economics literature about actual

income dynamics in micro data (with credibly calibrated transitory and permanent

shocks).

Second, agents in our model have finite lifetimes a la Blanchard (1985), permitting

a kind of primitive life cycle analysis and also solving some technical problems

created by the incorporation of permanent shocks. Finally, we obtain a necessary

extra boost to wealth inequality by calibrating a simple measure of heterogeneity in

‘impatience.’

The resulting framework differs sharply from the benchmark KS model in its

implications for important microeconomic and macroeconomic questions. A

timely macroeconomic example is the response of aggregate consumption to an

‘economic stimulus payment,’ interpreted here as a one-time lump sum transfer to

households. In response to a $1-per-capita payment, the baseline version of the KS

model implies that the annual marginal propensity to consume (MPC) is about

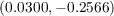

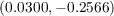

,

almost irrespective of how the cash is distributed across households. In contrast,

a version of our model that matches the distribution of liquid financial wealth

implies that if the entire tax cut were directed at households in the bottom half

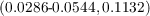

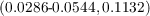

of the liquid financial-wealth-to-income distribution, the MPC would be

,

almost irrespective of how the cash is distributed across households. In contrast,

a version of our model that matches the distribution of liquid financial wealth

implies that if the entire tax cut were directed at households in the bottom half

of the liquid financial-wealth-to-income distribution, the MPC would be

, which counts as a big improvement in realism, given the vast

body of microeconomic evidence that consistently finds MPCs much

greater than the 3–5 percent figure that characterizes representative agent

models.

Furthermore, the model’s differences with the representative agent framework are

not peculiar to unusual events like a stimulus payment; to the extent that

different kinds of macroeconomic shocks tend systematically to be differently

distributed across the population (for example, labor income shocks may

affect a less wealthy set of households than capital income shocks), this

improvement in realism may also matter for general questions of macroeconomic

dynamics.

, which counts as a big improvement in realism, given the vast

body of microeconomic evidence that consistently finds MPCs much

greater than the 3–5 percent figure that characterizes representative agent

models.

Furthermore, the model’s differences with the representative agent framework are

not peculiar to unusual events like a stimulus payment; to the extent that

different kinds of macroeconomic shocks tend systematically to be differently

distributed across the population (for example, labor income shocks may

affect a less wealthy set of households than capital income shocks), this

improvement in realism may also matter for general questions of macroeconomic

dynamics.

Section 2 of the paper begins building the model’s structure by adding

microeconomic modeling elements to a benchmark representative agent model.

Using this model (without macroeconomic dynamics), the section closes by

estimating the degree of heterogeneity in impatience necessary to match the

degree of inequality in the U.S. wealth distribution; we find that relatively small

differences in impatience substantially affect the model’s fit to the wealth data.

Section 3 builds up the full version of the model by adding aggregate shocks of

the KS type, and presents detailed comparisons of our model with theirs.

Section 4 further improves the model by introducing an aggregate income

process that is analytically simpler than the KS ‘toy’ aggregate process, that we

believe is more empirically plausible as well, and that simplifies model

solution and simulation considerably. We offer this final, simpler version of

the model as our preferred jumping-off point for future macroeconomic

research.

2 The Model without Aggregate Uncertainty

2.1 The Perfect Foresight Representative Agent Model

To establish notation and a transparent benchmark, we begin by briefly

sketching a standard perfect foresight representative agent model.

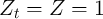

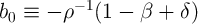

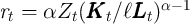

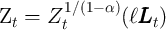

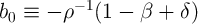

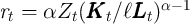

The aggregate production function is

| (1) |

where  is aggregate productivity in period

is aggregate productivity in period  ,

,  is capital,

is capital,  is time

worked per employee, and

is time

worked per employee, and  is employment. The representative agent’s goal is

to maximize discounted utility from consumption

is employment. The representative agent’s goal is

to maximize discounted utility from consumption

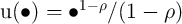

for a CRRA utility function

.

The representative agent’s state at the time of the consumption decision is

defined by two variables:

.

The representative agent’s state at the time of the consumption decision is

defined by two variables:  is market resources, and

is market resources, and  is aggregate

productivity.

is aggregate

productivity.

The transition process for  is broken up, for clarity of analysis and

consistency with later notation, into three steps. Assets at the end of the period

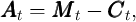

are market resources minus consumption, equal to

is broken up, for clarity of analysis and

consistency with later notation, into three steps. Assets at the end of the period

are market resources minus consumption, equal to

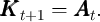

while next period’s capital is determined from this period’s assets via

The final step can be conceived as the transition from the beginning of period

when capital has not yet been used to produce output, to the middle of

that period, when output has been produced and incorporated into resources but

has not yet been consumed:

when capital has not yet been used to produce output, to the middle of

that period, when output has been produced and incorporated into resources but

has not yet been consumed:

where  is the

interest rate,

is the

interest rate,  is the wage rate,

and

is the wage rate,

and  is the depreciation factor for capital.

is the depreciation factor for capital.

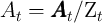

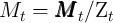

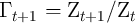

After normalizing by the productivity factor

,

the representative agent’s problem is

,

the representative agent’s problem is

where the non-bold variables are the corresponding bold variables divided

by  (e.g.,

(e.g.,  ,

,  );

);  ; and the

expectations operator

; and the

expectations operator  here signifies the perfection of the agent’s foresight

(but will have the usual interpretation when uncertainty is introduced

below).

here signifies the perfection of the agent’s foresight

(but will have the usual interpretation when uncertainty is introduced

below).

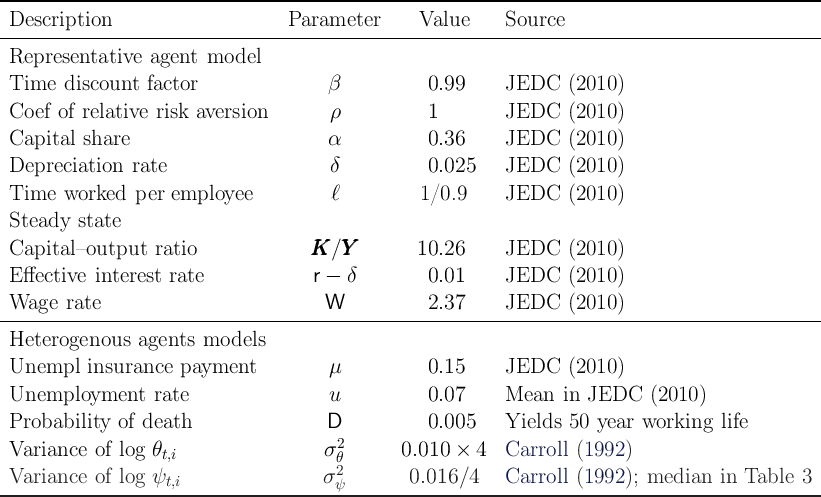

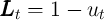

Table 1: Parameter Values and Steady State

Notes: The models are calibrated at the quarterly frequency, and the steady state values are calculated on a

quarterly basis.

Except where otherwise noted, our parametric assumptions match

those of the papers in the special issue of the Journal of Economic

Dynamics and Control (2010, Volume 34, Issue 1, edited by den Haan,

Judd, and Julliard) devoted to comparing solution methods for the KS

model (the parameters are reproduced for convenience in the top panel of

Table 1).

The model is calibrated at the quarterly frequency. When aggregate shocks are

shut down ( and

and  ), the model has a steady-state solution with a

constant ratio of capital to output and constant (gross) interest and wage factors,

which we write without time subscript as

), the model has a steady-state solution with a

constant ratio of capital to output and constant (gross) interest and wage factors,

which we write without time subscript as  and

and  and which are reflected in

Table 1.

and which are reflected in

Table 1.

Henceforth, we refer to the version of the model solved by the papers in the

special JEDC volume as the ‘KS-JEDC’ model, while we call the original KS

model solved in Krusell and Smith (1998) ‘KS-Orig’ model. (The only effective

difference between the two is the introduction (for realism) of unemployment

insurance in the KS-JEDC version, which does not matter much for any substantive

results.  )

)

2.2 The Household Income Process

For our purposes, the principal conclusion of the large literature on microeconomic

labor income dynamics is that household income can be reasonably well

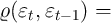

described as follows. The idiosyncratic permanent component of labor income  evolves according to

evolves according to

where  captures the predictable low-frequency (e.g., life-cycle and

demographic) components of income growth, and the Greek letter psi

mnemonically indicates the permanent shock to income. Actual income is the

product of permanent income, a mean-one transitory shock, and the wage

rate:

captures the predictable low-frequency (e.g., life-cycle and

demographic) components of income growth, and the Greek letter psi

mnemonically indicates the permanent shock to income. Actual income is the

product of permanent income, a mean-one transitory shock, and the wage

rate:

After taking logarithms, this income process is strikingly similar to

Friedman (1957)’s characterization of income as having permanent and transitory

components. Because this process has been used widely in the literature on

buffer stock saving, and though similar to Friedman’s formulation is not identical

to it, we henceforth refer to it as the Friedman/Buffer Stock (or ‘FBS’)

process.

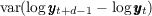

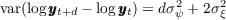

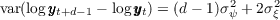

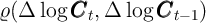

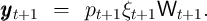

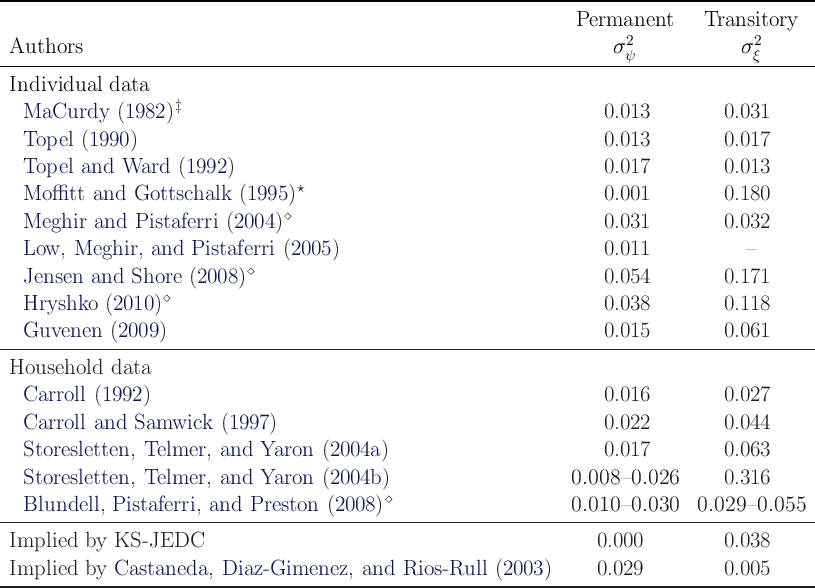

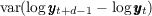

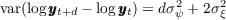

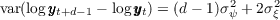

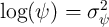

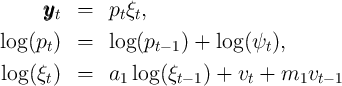

Table 2 summarizes the annual variances of log permanent shocks ( ) and

log transitory shocks (

) and

log transitory shocks ( ) estimated by a selection of papers from the extensive

literature.

Some authors have used a process of this kind to describe the labor income or

wage process for an individual worker (top panel) while others have used it to

describe the process for overall household income (bottom panel); it seems to

work reasonably well in both cases (though, obviously, with different estimates of

the variances). (Recent work by Sabelhaus and Song (2010) using newly

available data from Social Security earnings files finds that the variances of both

transitory and permanent shocks have declined during the “Great Moderation”

period at all ages; they also find distinct life cycle patterns of shocks by age, with

young people experiencing higher levels of both kinds of shocks than the

middle-aged).

) estimated by a selection of papers from the extensive

literature.

Some authors have used a process of this kind to describe the labor income or

wage process for an individual worker (top panel) while others have used it to

describe the process for overall household income (bottom panel); it seems to

work reasonably well in both cases (though, obviously, with different estimates of

the variances). (Recent work by Sabelhaus and Song (2010) using newly

available data from Social Security earnings files finds that the variances of both

transitory and permanent shocks have declined during the “Great Moderation”

period at all ages; they also find distinct life cycle patterns of shocks by age, with

young people experiencing higher levels of both kinds of shocks than the

middle-aged).

The second-to-last line of the table shows what labor economists would have found,

when estimating a process like the one above, if the empirical data were generated by

households who experienced an income process like the one assumed by the KS-JEDC

model.

This row of the table makes our point forcefully: The empirical procedures that

have actually been applied to empirical micro data, if used to measure the

income process households experience in a KS economy, would have

produced estimates of  and

and  that are orders of magnitude

different from what the actual empirical literature finds in actual data.

This discrepancy naturally makes one wonder whether the KS-JEDC

model’s well-known difficulty in matching the degree of wealth inequality is

largely explained by its highly unrealistic assumption about the income

process.

that are orders of magnitude

different from what the actual empirical literature finds in actual data.

This discrepancy naturally makes one wonder whether the KS-JEDC

model’s well-known difficulty in matching the degree of wealth inequality is

largely explained by its highly unrealistic assumption about the income

process.

Table 2: Estimates of Annual Variances of Log Income, Earning and Wage Shocks

Notes:  MaCurdy (1982) did not explicitly separate

MaCurdy (1982) did not explicitly separate  and

and  , but we have extracted

, but we have extracted  and

and  as

implications of statistics that his paper reports. First, we calculate

as

implications of statistics that his paper reports. First, we calculate  and

and

using his estimate (we set

using his estimate (we set  ). Then, following Carroll and Samwick (1997) we

obtain the values of

). Then, following Carroll and Samwick (1997) we

obtain the values of  and

and  which can match these statistics, assuming that the income

process is

which can match these statistics, assuming that the income

process is  and

and  (i.e., we solve

(i.e., we solve  and

and

).

).  Moffitt and Gottschalk (1995) estimated the income process

with random walk plus ARMA. Using income draws generated by their estimated process and following Carroll

and Samwick (1997), we have estimated the variances under the assumption that these income draws were

produced by the process

Moffitt and Gottschalk (1995) estimated the income process

with random walk plus ARMA. Using income draws generated by their estimated process and following Carroll

and Samwick (1997), we have estimated the variances under the assumption that these income draws were

produced by the process  where

where  .

.  Meghir and Pistaferri (2004), Jensen and

Shore (2008), Hryshko (2010), and Blundell, Pistaferri, and Preston (2008) assume that the transitory

component is serially correlated (an MA process), and report the variance of a subelement of the transitory

component. For example, Meghir and Pistaferri (2004) and Blundell, Pistaferri, and Preston (2008) assume

an MA(1) process

Meghir and Pistaferri (2004), Jensen and

Shore (2008), Hryshko (2010), and Blundell, Pistaferri, and Preston (2008) assume that the transitory

component is serially correlated (an MA process), and report the variance of a subelement of the transitory

component. For example, Meghir and Pistaferri (2004) and Blundell, Pistaferri, and Preston (2008) assume

an MA(1) process  and obtain estimates

and obtain estimates  =

= and

and

, respectively.

, respectively.  for these four articles reported in this table are calculated by

for these four articles reported in this table are calculated by

using their estimates.

using their estimates.

2.3 Finite Lifetimes and the Finite Variance of Permanent Income in the

Cross-Section

One might wish to use the FBS income process specified in subsection

2.2 as a complete characterization of household income dynamics, but

that idea has a problem: Since each household accumulates a permanent

shock in every period, the cross-sectional distribution of idiosyncratic

permanent income becomes wider and wider indefinitely as the simulation

progresses; that is, there is no ergodic distribution of permanent income in the

population.

This problem and several others can be addressed by assuming that the

model’s agents have finite lifetimes a la Blanchard (1985). Death follows a

Poisson process, so that every agent alive at date  has an equal probability

has an equal probability  of dying before the beginning of period

of dying before the beginning of period  . (The probability of NOT dying is

the cancelation of the probability of dying:

. (The probability of NOT dying is

the cancelation of the probability of dying:  ). Households engage in a

Blanchardian mutual insurance scheme: Survivors share the estates of those who

die. Assuming a zero profit condition for the insurance industry, the

insurance scheme’s ultimate effect is simply to boost the rate of return

(for survivors) by an amount exactly corresponding to the mortality

rate.

). Households engage in a

Blanchardian mutual insurance scheme: Survivors share the estates of those who

die. Assuming a zero profit condition for the insurance industry, the

insurance scheme’s ultimate effect is simply to boost the rate of return

(for survivors) by an amount exactly corresponding to the mortality

rate.

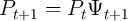

In order to maintain a constant population (of mass one, uniformly distributed

on the unit interval), we assume that dying households are replaced by an

equal number of newborns; we write the population-mean operator as

![∫ 1

M [∙t] = 0 ∙t,ιdι](BSinKS85x.png) . Newborns, we assume, begin life with a level of idiosyncratic

permanent income equal to the mean level of idiosyncratic permanent income in

the population as a whole. Conveniently, our definition of the permanent shock

implies that in a large population, mean idiosyncratic permanent income

will remain fixed at

. Newborns, we assume, begin life with a level of idiosyncratic

permanent income equal to the mean level of idiosyncratic permanent income in

the population as a whole. Conveniently, our definition of the permanent shock

implies that in a large population, mean idiosyncratic permanent income

will remain fixed at ![M [p] = 1](BSinKS86x.png) forever, while the mean of

forever, while the mean of  is given

by

is given

by

and

the variance of  by

by

Of course for all of this to be valid, it is necessary to impose the parametric

restriction ![/ 2

/D E [ψ ] < 1](BSinKS91x.png) (a requirement that does not do violence to the data, as

we shall see). Intuitively, the requirement is that, among surviving consumers,

income does not spread out so quickly as to overwhelm the compression of the

permanent income distribution that arises because of the equalizing force of

death and replacement.

(a requirement that does not do violence to the data, as

we shall see). Intuitively, the requirement is that, among surviving consumers,

income does not spread out so quickly as to overwhelm the compression of the

permanent income distribution that arises because of the equalizing force of

death and replacement.

Since our goal here is to produce a realistic distribution of permanent

income across the members of the (simulated) population, we measure the

empirical distribution of permanent income in the cross section using

data from the Survey of Consumer Finances (SCF), which conveniently

includes a question asking respondents whether their income in the survey

year was about ‘normal’ for them, and if not, asks the level of ‘normal’

income.

This corresponds well with our (and Friedman (1957)’s) definition of permanent

income  (and Kennickell (1995) shows that the answers people give to this

question can be reasonably interpreted as reflecting their perceptions of their

permanent income), so we calculate the variance of

(and Kennickell (1995) shows that the answers people give to this

question can be reasonably interpreted as reflecting their perceptions of their

permanent income), so we calculate the variance of ![i i i

p ≡ p ∕M [p ]](BSinKS93x.png) among such

households.

among such

households.

The results from this exercise are reported in Table 3 (with a final

row that makes the point that both the KS-Orig and KS-JEDC models

assume that permanent shocks did not exist). Substituting these estimates

for  into (7) and (8), we obtain estimates of the variance of

into (7) and (8), we obtain estimates of the variance of  .

Reassuringly, we can interpret the variances of

.

Reassuringly, we can interpret the variances of  thus obtained as

being easily in the range of the estimated variances of

thus obtained as

being easily in the range of the estimated variances of  in

Table 2.

Such a correspondence, across two quite different methods of measurement,

suggests there is considerable robustness to the measurement of the size of

permanent shocks. (Below, we will choose a calibration for

in

Table 2.

Such a correspondence, across two quite different methods of measurement,

suggests there is considerable robustness to the measurement of the size of

permanent shocks. (Below, we will choose a calibration for  that is in the

middle range of estimates from either method.)

that is in the

middle range of estimates from either method.)

Table 3: Variance of Permanent Income

2.4 The Wealth Distribution with Transitory and Permanent Shocks

We now examine how wealth would be distributed in the steady-state

equilibrium of an economy with wage rates and interest rates fixed at the

steady state values calibrated in Table 1 of subsection 2.1, an income

process like the one described in subsection 2.2, and finite lifetimes per

subsection 2.3.

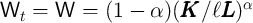

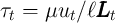

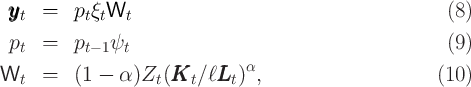

The process of noncapital income of each household follows

where  is noncapital income for the household in period

is noncapital income for the household in period  , equal to

the permanent component of noncapital income

, equal to

the permanent component of noncapital income  multiplied by a

transitory income shock factor

multiplied by a

transitory income shock factor  and wage rate

and wage rate  ; the permanent

component of noncapital income in period

; the permanent

component of noncapital income in period  is equal to its previous value,

multiplied by a mean-one iid shock

is equal to its previous value,

multiplied by a mean-one iid shock  ,

, ![E [ψ ] = 1

t t+n](BSinKS108x.png) for all

for all  .

.

is capital and

is capital and  is the employment rate (because

is the employment rate (because  is

the unemployment rate). Since there is no aggregate shock,

is

the unemployment rate). Since there is no aggregate shock,  ,

,  ,

,

, and

, and  are constant (

are constant ( ,

,  ,

,  , and

, and

).

).

Following the assumptions in the JEDC volume, the distribution of  is:

is:

where

is the unemployment insurance payment when unemployed and

is the unemployment insurance payment when unemployed and  is the rate of tax collected to pay unemployment benefits (see Table 1 for parameter

values).

The probability of unemployment is constant (

is the rate of tax collected to pay unemployment benefits (see Table 1 for parameter

values).

The probability of unemployment is constant ( ); later we allow

); later we allow  to

vary over time.

to

vary over time.

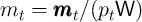

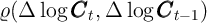

The decision problem for the household in period  can be written using

normalized variables; the consumer’s objective is to choose a series of

consumption functions

can be written using

normalized variables; the consumer’s objective is to choose a series of

consumption functions  between now and the end of the horizon that satisfy:

between now and the end of the horizon that satisfy:

where the non-bold ratio variables are defined as the bold (level) variables

divided by the level of permanent income  (e.g.,

(e.g.,  ).

The only state variable is (normalized) cash-on-hand

).

The only state variable is (normalized) cash-on-hand  . The household’s

employment status is not a state variable, unlike in the KS-JEDC model, where

tomorrow’s employment status depends on today’s status. This substantially

simplifies the analysis (which is useful for computational and analytical

purposes), arguably without too much sacrifice of realism (except possibly for

detailed studies of the behavior of households during extended unemployment

spells).

. The household’s

employment status is not a state variable, unlike in the KS-JEDC model, where

tomorrow’s employment status depends on today’s status. This substantially

simplifies the analysis (which is useful for computational and analytical

purposes), arguably without too much sacrifice of realism (except possibly for

detailed studies of the behavior of households during extended unemployment

spells).

Since households die with a constant probability  between periods, the effective

discount factor is

between periods, the effective

discount factor is  (in (13)); the effective interest rate is

(in (13)); the effective interest rate is  (combining (14)

and (15)).

(combining (14)

and (15)).

Aside from heterogeneity in impatience (introduced below), three parameters

characterize our modifications to the KS-JEDC model:  ,

,  , and

, and  .

.

implies the average length of working life is

implies the average length of working life is  quarters

=

quarters

=  years (dating from entry into the labor force at, say, age 25). The

variance of log transitory income shocks

years (dating from entry into the labor force at, say, age 25). The

variance of log transitory income shocks  is the value advocated in

Carroll (1992) (based on the Panel Study of Income Dynamics (PSID)

data),

as is

is the value advocated in

Carroll (1992) (based on the Panel Study of Income Dynamics (PSID)

data),

as is  (but note that this value also matches the median value in

Table 3).

(but note that this value also matches the median value in

Table 3).  Other parameter values (

Other parameter values ( ,

,  ,

,  , and

, and  ) are from the JEDC volume

(Table 1).

) are from the JEDC volume

(Table 1).

The one remaining unspecified parameter is the time preference factor.

As a preliminary theoretical consideration, note that Carroll (2011)

(generalizing Deaton (1991) and Bewley (1977)) has shown that models of

this kind do not have a well-defined solution unless the condition holds:

where

Carroll (2011) dubs this inequality the ‘Growth Impatience Condition’ because

it guarantees that consumers are sufficiently impatient to prevent the indefinite

increase in the ratio of net worth to permanent income when income is growing

(see also Szeidl (2006)). This condition is an amalgam of the pure time

preference factor, expected growth, the relative risk aversion coefficient,

and the real interest factor. Thus, a consumer can be ‘impatient’ in the

required sense even if  , so long as expected income growth is

positive.

, so long as expected income growth is

positive.

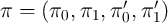

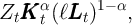

We begin by searching for the time preference factor  such that if all households

had an identical

such that if all households

had an identical  the steady-state value of the capital-to-output ratio (

the steady-state value of the capital-to-output ratio ( )

would match the value that characterized the steady-state of the perfect foresight

model.

)

would match the value that characterized the steady-state of the perfect foresight

model.

turns out to be

turns out to be  (recall that this is at a quarterly, not an annual,

rate).

(recall that this is at a quarterly, not an annual,

rate).

We now ask whether this model with realistically calibrated income and finite

lifetimes (henceforth, the model is referred to as the ‘ -Point’ model) can

reproduce the degree of wealth inequality evident in the micro data. An

improvement in the model’s ability to match the data is to be expected, since in

buffer stock models agents strive to achieve a target ratio of wealth to permanent

income. By assuming no dispersion in the level of permanent income across

households, KS’s income process disables a potentially vital explanation for

variation in the level of target wealth (and, therefore, on average, actual wealth)

across households.

-Point’ model) can

reproduce the degree of wealth inequality evident in the micro data. An

improvement in the model’s ability to match the data is to be expected, since in

buffer stock models agents strive to achieve a target ratio of wealth to permanent

income. By assuming no dispersion in the level of permanent income across

households, KS’s income process disables a potentially vital explanation for

variation in the level of target wealth (and, therefore, on average, actual wealth)

across households.

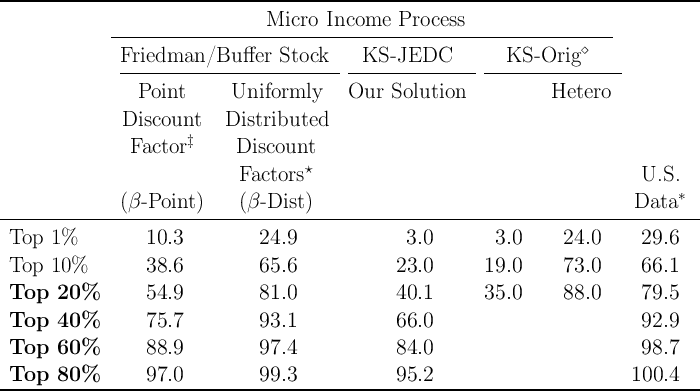

Table 4: Proportion of Net Worth by Percentile (in percent)

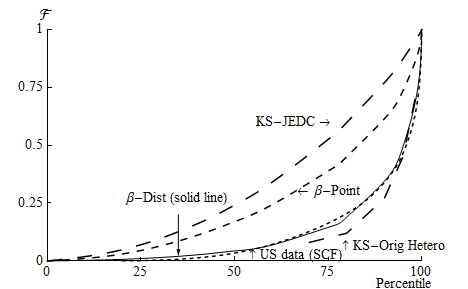

Table 4 shows that compared to the distribution of net worth

implied by our solution of the KS-JEDC model solved without an

aggregate shock (or the results of the KS-Orig model from Krusell and

Smith (1998)),

our  -Point model does indeed yield a substantial improvement

(compare the first, third and fourth columns to the last

column).

For example, in our

-Point model does indeed yield a substantial improvement

(compare the first, third and fourth columns to the last

column).

For example, in our  -Point model, the fraction of total net worth held by the

top 1 percent is about 10 percent, while the corresponding statistic is

only 3 percent in our solution of the KS-JEDC model (or the KS-Orig

model).

-Point model, the fraction of total net worth held by the

top 1 percent is about 10 percent, while the corresponding statistic is

only 3 percent in our solution of the KS-JEDC model (or the KS-Orig

model).

The KS-JEDC model’s failure to match the wealth distribution is not confined

to the top. In fact, perhaps a bigger problem is that the model generates a

distribution of wealth in which most households’ wealth levels are not very far

from the wealth target of a representative agent in the perfect foresight

version of the model. For example, in steady state about  percent

of all households in the KS-JEDC model have net worth between 0.5

times mean net worth and 1.5 times mean net worth; in the SCF data

from 1992–2004, the corresponding fraction ranges from only 20 to 25

percent.

percent

of all households in the KS-JEDC model have net worth between 0.5

times mean net worth and 1.5 times mean net worth; in the SCF data

from 1992–2004, the corresponding fraction ranges from only 20 to 25

percent.

But while the  -Point model fits the data better than the original KS model,

it still falls short of matching the empirical degree of wealth inequality. The

proportion of net worth held by households in the top 1 percent of the

distribution is three times smaller in the model than in the data (compare the

first and last columns in the table). This failure reflects the fact that, empirically,

the distribution of wealth is considerably more unequal than the distribution of

permanent income.

-Point model fits the data better than the original KS model,

it still falls short of matching the empirical degree of wealth inequality. The

proportion of net worth held by households in the top 1 percent of the

distribution is three times smaller in the model than in the data (compare the

first and last columns in the table). This failure reflects the fact that, empirically,

the distribution of wealth is considerably more unequal than the distribution of

permanent income.

2.5 Heterogeneous Impatience

As the simplest method to address this defect, we introduce heterogeneity in impatience:

Each household is now assumed to have an idiosyncratic (but fixed) time preference

factor.

We do not think of this assumption as only capturing actual variation in pure

rates of time preference across people (though such variation surely exists).

Instead, we view discount-factor heterogeneity as a shortcut that captures the

essential consequences of many other kinds of heterogeneity (e.g., heterogeneity

in age, income growth expectations, investment opportunities, tax schedules) as

well. To be more concrete, take the example of age. A robust pattern in most

countries is that income grows much faster for young people than for older

people. According to (16), young people should therefore tend to act, financially,

in a more ‘impatient’ fashion than older people. In particular, we should expect

them to have lower target wealth-to-income ratios. Thus, what we are

capturing by allowing heterogeneity in time preference factors is probably

also some portion of the difference in behavior that (in truth) reflects

differences in age instead of in time preference factors, and that would be

introduced into the model if we had a more complex specification of the life

cycle that allowed for different growth rates for households of different

ages.

One way of gauging a model’s predictions for wealth inequality is to ask how

well it is able to match the proportion of total net worth held by the

wealthiest  ,

,  ,

,  , and

, and  percent of the population. Because

these statistics have been targeted by other papers (e.g., Castaneda,

Diaz-Gimenez, and Rios-Rull (2003)), we adopt a goal of matching

them.

percent of the population. Because

these statistics have been targeted by other papers (e.g., Castaneda,

Diaz-Gimenez, and Rios-Rull (2003)), we adopt a goal of matching

them.

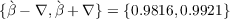

We replace the assumption that all households have the same time

preference factor with an assumption that, for some  , time preference

factors are distributed uniformly in the population between

, time preference

factors are distributed uniformly in the population between  and

and

(for this reason, the model is referred to as the ‘

(for this reason, the model is referred to as the ‘ -Dist’ model

below). Then, using simulations, we search for the values of

-Dist’ model

below). Then, using simulations, we search for the values of  and

and

for which the model best matches the fraction of net worth held

by the top

for which the model best matches the fraction of net worth held

by the top  ,

,  ,

,  , and

, and  percent of the population, while

at the same time matching the aggregate capital-to-output ratio from

the perfect foresight model. Specifically, defining

percent of the population, while

at the same time matching the aggregate capital-to-output ratio from

the perfect foresight model. Specifically, defining  and

and  as the

proportion of total aggregate net worth held by the top

as the

proportion of total aggregate net worth held by the top  percent in our

model and in the data, respectively, we solve the following minimization

problem:

percent in our

model and in the data, respectively, we solve the following minimization

problem:

| (17) |

subject to the constraint that the aggregate wealth (net worth)-to-output ratio in the

model matches the aggregate capital-to-output ratio from the perfect foresight model

( ):

):

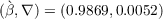

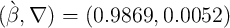

The

solution to this problem is  .

.

The introduction of even such a relatively modest amount of time preference

heterogeneity sharply improves the model’s fit to the targeted proportions of

wealth holdings (second column of the table). The ability of the model to match

the targeted moments does not, of course, constitute a formal test, except in the

loose sense that a model with such strong structure might have been unable

to get nearly so close to four target wealth points with only one free

parameter.

But the model also sharply improves the fit to locations in the wealth

distribution that were not explicitly targeted; for example, the net worth shares

of the top 10 percent and the top 1 percent are also included in the table, and

the model performs reasonably well in matching them.

Of course, Krusell and Smith (1998) were well aware that their baseline model

match the wealth distribution well. They, too, examined whether inclusion of a

form of discount rate heterogeneity could improve the model’s match to

the data. Specifically, they assumed that the discount factor takes one

of the three values ( ,

,  , and

, and  ), and that agents

anticipate that their discount factor might change between these values

according to a Markov process. As they showed, the model with this

simple form of heterogeneity (henceforth ‘KS-Orig Hetero’ model) did

improve the model’s ability to match the wealth holdings of the top

percentiles (see KS-Orig Hetero column in the table). Indeed, as inspection of

the long-dashing locus in Figure 1 shows, their model of heterogeneity

went a bit too far: It concentrated almost all of the net worth in the

top 20 percent of the population (though rather evenly among that top

20 percent). By comparison, the figure shows that our model does a

notably better job matching the data across the entire span of wealth

percentiles.

), and that agents

anticipate that their discount factor might change between these values

according to a Markov process. As they showed, the model with this

simple form of heterogeneity (henceforth ‘KS-Orig Hetero’ model) did

improve the model’s ability to match the wealth holdings of the top

percentiles (see KS-Orig Hetero column in the table). Indeed, as inspection of

the long-dashing locus in Figure 1 shows, their model of heterogeneity

went a bit too far: It concentrated almost all of the net worth in the

top 20 percent of the population (though rather evenly among that top

20 percent). By comparison, the figure shows that our model does a

notably better job matching the data across the entire span of wealth

percentiles.

The reader might wonder why we do not simply adopt the KS specification of

heterogeneity in time preference factors, rather than introducing our own novel

form of heterogeneity. The principal answer is that our purpose here is to define

a method of explicitly matching the model to the data via statistical estimation

of a parameter of the distribution of heterogeneity, letting the data speak flexibly

to the question of the extent of the heterogeneity required to match model to

data. A second point is that, having introduced finite horizons in order to yield

an ergodic distribution of permanent income, it would be peculiar to layer

on top of the stochastic death probability a stochastic probability of

changing one’s time preference factor within the lifetime; Krusell and Smith

motivated their differing time preference factors as reflecting different

preferences of alternative generations of a dynasty, but with our finite

horizons assumption we have eliminated the dynastic interpretation of the

model. Having said all of this, the common point across the two papers

is that a key requirement to make the model fit the data is a form of

heterogeneity that leads different households to have different target levels of

wealth.

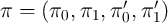

3 KS Aggregate Shocks

In this section, we examine a model with an FBS household income process

that also incorporates KS aggregate shocks, and investigate the model’s

performance in replicating aggregate statistics. Krusell and Smith (1998)

assumed that the level of aggregate productivity alternates between

if the aggregate state is good and

if the aggregate state is good and  if it is bad;

similarly,

if it is bad;

similarly,  where

where  if the state is good and

if the state is good and  if

bad. (For reference, we reproduce their assumed parameter values in

Table 5.)

if

bad. (For reference, we reproduce their assumed parameter values in

Table 5.)

Table 5: Parameter Values for Aggregate Shocks

The decision problem for an individual household in period  can be written

using normalized variables and the employment status

can be written

using normalized variables and the employment status  :

:

where

- the non-bold individual variables (lower-case variables except for

and

and  ) are the bold (level) variables divided by

) are the bold (level) variables divided by  (e.g.,

(e.g.,

,

,  ),

),

,

,

, and

, and

- the income process is the same as in (8)–(12) but the employment

transition process follows KS-JEDC.

There are more state variables in this version of the model than in the model

with no aggregate shock: The aggregate variables  and

and  , and the

household’s employment status

, and the

household’s employment status  whose transition process depends on the

aggregate state. Solving the full version of the model above with both aggregate

and idiosyncratic shocks is not straightforward; the basic idea for the solution

method is the key insight of Krusell and Smith (1998). See Appendix C for

details about our solution method.

whose transition process depends on the

aggregate state. Solving the full version of the model above with both aggregate

and idiosyncratic shocks is not straightforward; the basic idea for the solution

method is the key insight of Krusell and Smith (1998). See Appendix C for

details about our solution method.

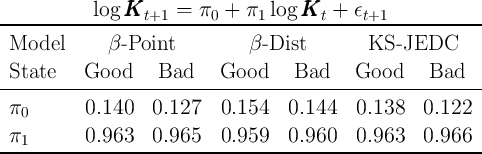

We now report the results of simulations, both for the model in which all

households have the same time preference factor ( -Point model) and for the

version with a uniform distribution of time preference factors (

-Point model) and for the

version with a uniform distribution of time preference factors ( -Dist model).

While the

-Dist model).

While the  -Point model uses

-Point model uses  estimated in Section 2, the

estimated in Section 2, the  -Dist model

uses parameter values reestimated by solving the minimization problem (17)

with the KS aggregate shocks (

-Dist model

uses parameter values reestimated by solving the minimization problem (17)

with the KS aggregate shocks ( ). Results using

our solution of the KS-JEDC model (with the KS aggregate shocks,

). Results using

our solution of the KS-JEDC model (with the KS aggregate shocks,

,

,  for all

for all  , and no death (

, and no death ( )) are also reported for

comparison.

)) are also reported for

comparison.

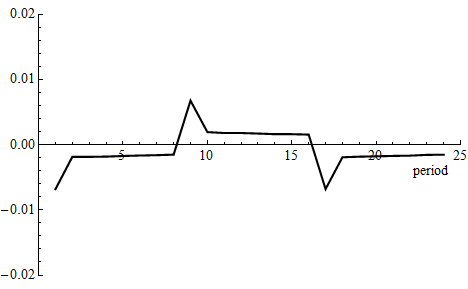

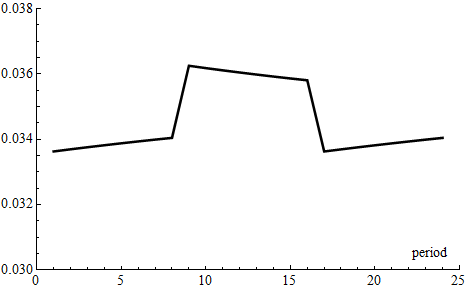

3.1 Some Macroeconomic Statistics

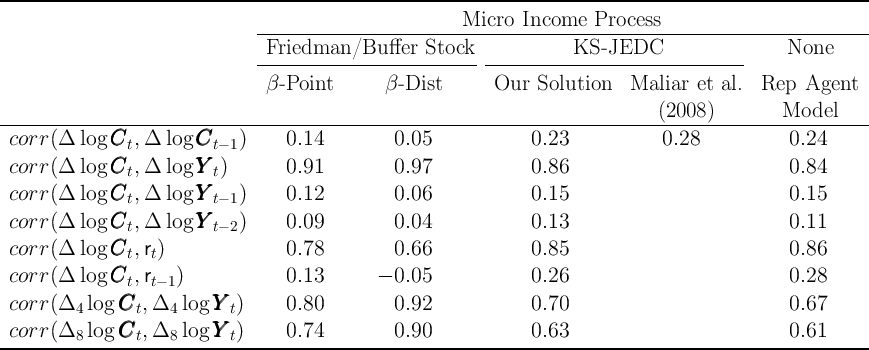

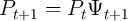

Table 6 shows some aggregate statistics that we think are useful for macroeconomic

analysis: The serial correlation of consumption growth, and correlation between

consumption growth, income growth, and interest rates at several frequencies.

The results are generally similar across the  -Point,

-Point,  -Dist, and KS-JEDC

models. They all produce positive

-Dist, and KS-JEDC

models. They all produce positive  , and high correlation

of consumption growth with (current) income growth or (current) interest rates.

The serial correlation of consumption growth in our solution of the

KS-JEDC model is similar to that reported by Maliar, Maliar, and

Valli (2008) who also solved the KS-JEDC model (fourth column of the

table).

, and high correlation

of consumption growth with (current) income growth or (current) interest rates.

The serial correlation of consumption growth in our solution of the

KS-JEDC model is similar to that reported by Maliar, Maliar, and

Valli (2008) who also solved the KS-JEDC model (fourth column of the

table).  We also report results for the representative agent model with the KS aggregate

income shock parameters (last column), the results of which are very close to

those of our solution of the KS-JEDC model.

We also report results for the representative agent model with the KS aggregate

income shock parameters (last column), the results of which are very close to

those of our solution of the KS-JEDC model.

Table 6: Aggregate Statistics with KS Aggregate Shocks

Notes:  and

and  are one-year and two-year growth rates, respectively.

are one-year and two-year growth rates, respectively.

The classic reference point for consumption growth measurement is the

random walk model of Hall (1978), and the large literature that rejects the

random walk proposition in favor of models that either contain some

‘rule-of-thumb’ consumers who set spending equal to income in every period

(Campbell and Mankiw (1989)) or, more popular recently, models with habit

formation or ‘sticky expectations’ (Carroll, Slacalek, and Tokuoka (2008)) that

imply serial correlation in consumption growth (see Carroll, Sommer, and

Slacalek (2011) for evidence).

The KS-JEDC model produces a relatively high correlation coefficient

, which is closer to the U.S. data (where the statistic is about

one-third) than that produced by standard consumption models stemming from

Hall (1978).

As noted already, our

, which is closer to the U.S. data (where the statistic is about

one-third) than that produced by standard consumption models stemming from

Hall (1978).

As noted already, our  -Point and

-Point and  -Dist models also imply positive

-Dist models also imply positive

, although not as high as that predicted by the

KS-JEDC model. At first blush, it seems puzzling that the KS-JEDC model,

which includes neither habits nor sticky expectations, generates a substantial

violation of the random walk proposition. This puzzle does not seem to have

been noticed in the previous literature on the KS-JEDC model, but after

some investigation we determined that the KS-JEDC model’s sticky

consumption growth is produced by the high degree of serial correlation in

interest rates in the model, which results from the assumption about the

process of aggregate productivity shocks (see Appendix D for details). The

interesting questions, in a model with time-varying interest rates, are,

first, whether one can reliably estimate an intertemporal elasticity of

substitution (IES) from the coefficient in a regression of consumption on the

predictable component of interest rates (as Hall (1988) attempts to do),

and, second, whether consumption growth is serially correlated after

accounting for the predictable component related to interest rates (no random

walk).

, although not as high as that predicted by the

KS-JEDC model. At first blush, it seems puzzling that the KS-JEDC model,

which includes neither habits nor sticky expectations, generates a substantial

violation of the random walk proposition. This puzzle does not seem to have

been noticed in the previous literature on the KS-JEDC model, but after

some investigation we determined that the KS-JEDC model’s sticky

consumption growth is produced by the high degree of serial correlation in

interest rates in the model, which results from the assumption about the

process of aggregate productivity shocks (see Appendix D for details). The

interesting questions, in a model with time-varying interest rates, are,

first, whether one can reliably estimate an intertemporal elasticity of

substitution (IES) from the coefficient in a regression of consumption on the

predictable component of interest rates (as Hall (1988) attempts to do),

and, second, whether consumption growth is serially correlated after

accounting for the predictable component related to interest rates (no random

walk).

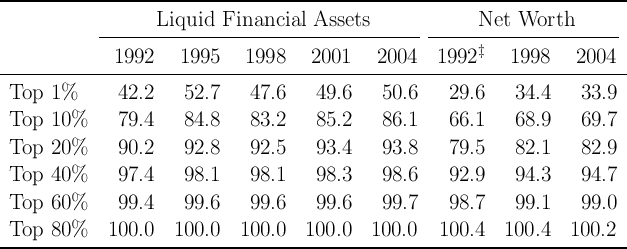

3.2 The Aggregate Marginal Propensity to Consume

A macroeconomic question of perhaps even greater interest is whether a

model that manages to match the distribution of wealth has similar, or

different, implications from the KS-JEDC or representative agent models

for the reaction of aggregate consumption to an economic ‘stimulus’

payment.

Specifically, we pose the question as follows. The economy has been in its

steady-state equilibrium leading up to date  . Before the consumption decision

is made in that period, the government announces the following plan: Effective

immediately, every household in the economy will receive a ‘stimulus check’

worth some modest amount $

. Before the consumption decision

is made in that period, the government announces the following plan: Effective

immediately, every household in the economy will receive a ‘stimulus check’

worth some modest amount $ (financed by a tax on unborn future

generations).

(financed by a tax on unborn future

generations).

In theory, the distribution of wealth across recipients of the stimulus checks has

important implications for aggregate MPC out of transitory shocks to income.

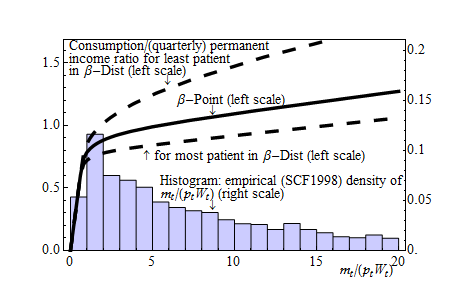

To see why, the solid line of Figure 2 plots our  -Point model’s individual

consumption function in the good (aggregate) state, with the horizontal axis

being cash on hand normalized by the level of (quarterly) permanent

income. Because the households with less normalized cash have higher

MPC,

the average MPC is higher when a larger fraction of households has less

(normalized) cash on hand.

-Point model’s individual

consumption function in the good (aggregate) state, with the horizontal axis

being cash on hand normalized by the level of (quarterly) permanent

income. Because the households with less normalized cash have higher

MPC,

the average MPC is higher when a larger fraction of households has less

(normalized) cash on hand.

There are many more households with little wealth in our  -Point model

than in the KS-JEDC model, as illustrated by comparison of the short-dashing

and the long-dashing lines in Figure 1. The greater concentration of wealth at

the bottom in the

-Point model

than in the KS-JEDC model, as illustrated by comparison of the short-dashing

and the long-dashing lines in Figure 1. The greater concentration of wealth at

the bottom in the  -Point model, which is the case in the data (see the

histogram in Figure 2), should produce a higher average MPC, given the

concave consumption function.

-Point model, which is the case in the data (see the

histogram in Figure 2), should produce a higher average MPC, given the

concave consumption function.

Indeed, the average MPC out of the transitory income (‘stimulus

check’) in our  -Point model is

-Point model is  in annual terms (first column of

Table 7),

about double the value in the KS-JEDC model

in annual terms (first column of

Table 7),

about double the value in the KS-JEDC model  (the fourth column of the

table) or the perfect foresight partial equilibrium model (0.04). Our

(the fourth column of the

table) or the perfect foresight partial equilibrium model (0.04). Our  -Dist model

(second column of the table) produces an even higher average MPC

-Dist model

(second column of the table) produces an even higher average MPC  ,

since in the

,

since in the  -Dist model there are more households who possess less wealth,

are more impatient, and have higher MPCs (Figure 1 and dashed lines in

Figure 2).

However, this is still at best only at the lower bound of typical empirical MPC

estimates which are typically between

-Dist model there are more households who possess less wealth,

are more impatient, and have higher MPCs (Figure 1 and dashed lines in

Figure 2).

However, this is still at best only at the lower bound of typical empirical MPC

estimates which are typically between  –

– or even higher (see Table 13 in

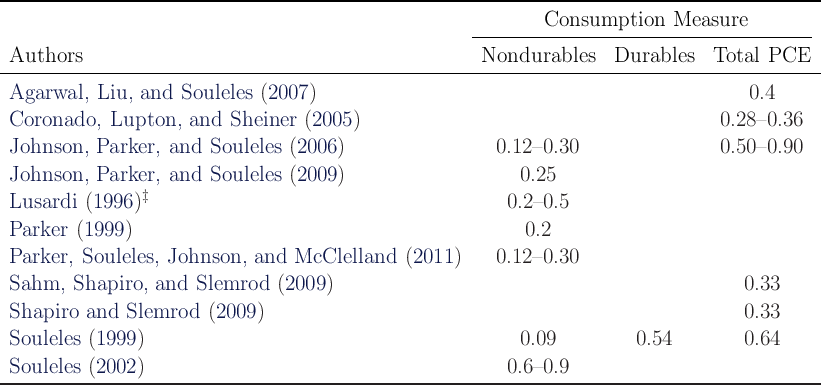

the Appendix E).

or even higher (see Table 13 in

the Appendix E).

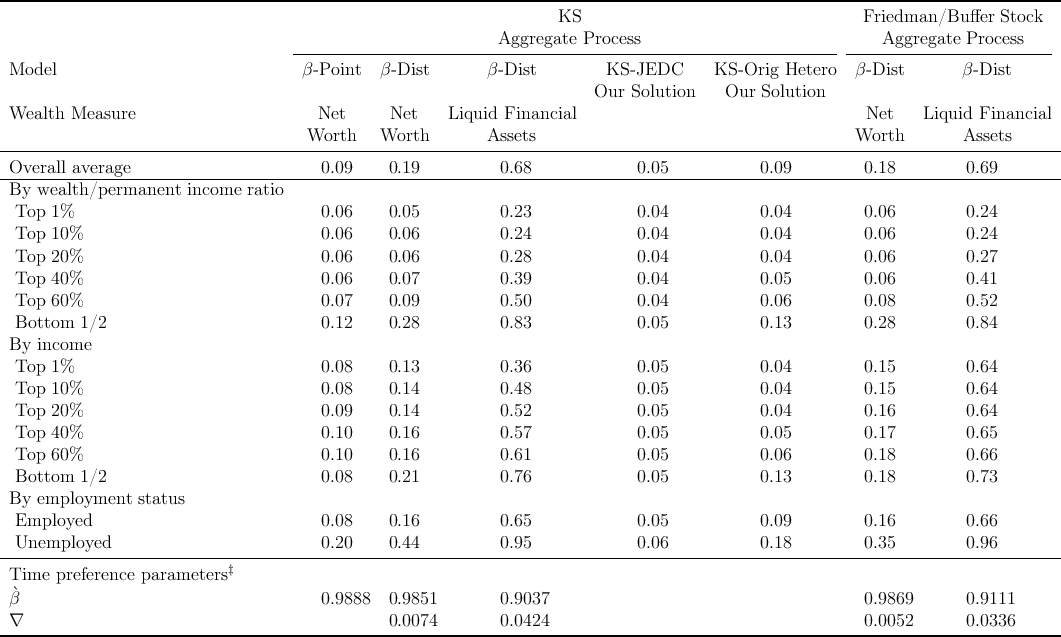

Table 7: Average Marginal Propensity to Consume in Annual Terms

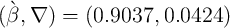

Thus far, we have been using total household net worth as our measure of

wealth. Implicitly, this assumes that all of the household’s debt and asset

positions are perfectly liquid and that, say, a household with home equity of

$50,000 and bank balances of $2,000 (and no other balance sheet items) will

behave in every respect similarly to a household with home equity of $10,000 and

bank balances of $42,000. This seems implausible. The home equity is

more illiquid (tapping it requires, at the very least, obtaining a home

equity line of credit, which requires an appraisal of the house and some

paperwork).

Otsuka (2003) formally analyzes the optimization problem of a consumer with

a FBS income process who can invest in an illiquid but higher-return asset

(think housing), or a liquid but lower-return asset (cash), and shows,

unsurprisingly, that the marginal propensity to consume out of shocks to liquid

assets is higher than the MPC out of shocks to illiquid assets. Her results would

presumably be even stronger if she had allowed that households hold so much of

their wealth in illiquid forms (housing, pension savings), for example, as a

mechanism to overcome self-control problems (see Laibson (1997) and many

others).

These considerations suggest that it may be more plausible, for purposes of

extracting a predictions about the MPC out of stimulus checks, to focus on

matching the distribution of liquid financial assets across households (that is,

assets which are of the same kind as represented by the stimulus check, once it

has been deposited into a bank account).

When we ask the model to estimate the time preference factors that allow it

to best match the distribution of liquid financial assets (instead of net

worth),

estimated parameter values are  and the average

MPC is

and the average

MPC is  (third column of the table), which lies in the upper part of the

range typically reported in the literature (see Table 13), and is considerably

higher than when we match the distribution of net worth. This reflects the fact

that matching the more skewed distribution of liquid financial assets than that of

net worth (Table 8) requires a wider distribution of the time preference factors,

which produces even more households with little wealth. The estimated

distribution of discount factors lies below that obtained by matching net worth

and is considerably more dispersed because of substantially lower median

and more unevenly distributed liquid financial wealth (compared to net

worth).

(third column of the table), which lies in the upper part of the

range typically reported in the literature (see Table 13), and is considerably

higher than when we match the distribution of net worth. This reflects the fact

that matching the more skewed distribution of liquid financial assets than that of

net worth (Table 8) requires a wider distribution of the time preference factors,

which produces even more households with little wealth. The estimated

distribution of discount factors lies below that obtained by matching net worth

and is considerably more dispersed because of substantially lower median

and more unevenly distributed liquid financial wealth (compared to net

worth).

Figure 3 shows the cumulative distribution functions of MPCs for the  -Dist

models estimated to match the empirical distribution of net worth and liquid

financial assets. The Figure illustrates the high values of implied MPCs obtained

for both models, especially the latter.

-Dist

models estimated to match the empirical distribution of net worth and liquid

financial assets. The Figure illustrates the high values of implied MPCs obtained

for both models, especially the latter.

MPCs are generally higher among low wealth/income households and

the unemployed in both our  -Point and

-Point and  -Dist models (rest of the

rows in Table 7). These results provide the basis for a common piece of

conventional wisdom about the effects of economic stimulus mentioned in our

introduction: If the purpose of the stimulus payments is to stimulate

consumption, it makes much more sense to target those payments to low-wealth

households than to distribute them uniformly to the population as a

whole.

-Dist models (rest of the

rows in Table 7). These results provide the basis for a common piece of

conventional wisdom about the effects of economic stimulus mentioned in our

introduction: If the purpose of the stimulus payments is to stimulate

consumption, it makes much more sense to target those payments to low-wealth

households than to distribute them uniformly to the population as a

whole.

4 A More Plausible and More Tractable ‘Friedman/Buffer Stock’ Aggregate

Process

The KS process for aggregate productivity shocks has little empirical foundation;

indeed, it appears to have been intended by the authors as an illustration of how

one might incorporate business cycles in principle, rather than a serious

candidate for an empirical description of actual aggregate dynamics. In this

section, we introduce an aggregate income process that is considerably more

tractable than the KS aggregate process and is also a much closer match to the

aggregate data. We regard the version of our model with this new income

process as the ‘preferred’ version for use as a starting point for future

research.

The aggregate production function is the same as equation (1), but following

Carroll, Slacalek, and Tokuoka (2008), the aggregate state (good or bad) no

longer exists in this model ( ). Aggregate productivity is instead captured

by

). Aggregate productivity is instead captured

by  . Specifically,

. Specifically,  ;

;  is aggregate permanent productivity, where

is aggregate permanent productivity, where

;

;  is the aggregate permanent shock; and

is the aggregate permanent shock; and  is the

aggregate transitory shock (note that

is the

aggregate transitory shock (note that  is the capitalized version of the Greek

letter

is the capitalized version of the Greek

letter  used for the idiosyncratic permanent shock; similarly (though less

obviously),

used for the idiosyncratic permanent shock; similarly (though less

obviously),  is the capitalized

is the capitalized  ). Both

). Both  and

and  are assumed to be log

normally distributed with mean one, and their log variances are from Carroll,

Slacalek, and Tokuoka (2008), who have estimated them using U.S. data

(Table 5).

are assumed to be log

normally distributed with mean one, and their log variances are from Carroll,

Slacalek, and Tokuoka (2008), who have estimated them using U.S. data

(Table 5).

Table 9: Aggregate Statistics in  -Dist Model under ‘Plausible’ Aggregate Process

-Dist Model under ‘Plausible’ Aggregate Process

The assumption that the structure of aggregate shocks resembles the structure

of idiosyncratic shocks is valuable not only because it matches the data better,

but also because it makes the model easier to solve. In particular, the elimination

of the ‘good’ and ‘bad’ aggregate states reduces the number of state variables to

two ( and

and  ) after normalizing the model by

) after normalizing the model by  (as elaborated in

Carroll, Slacalek, and Tokuoka (2008)). As in Section 2, employment status is

not a state variable (in eliminating the aggregate states, we also shut down

unemployment persistence, which depends on the aggregate state in the

KS-JEDC or KS-Orig model). As before, the main thing the household

needs to know is the law of motion of

(as elaborated in

Carroll, Slacalek, and Tokuoka (2008)). As in Section 2, employment status is

not a state variable (in eliminating the aggregate states, we also shut down

unemployment persistence, which depends on the aggregate state in the

KS-JEDC or KS-Orig model). As before, the main thing the household

needs to know is the law of motion of  , which can be obtained by

following essentially the same method as described in the Appendix

C.

, which can be obtained by

following essentially the same method as described in the Appendix

C.

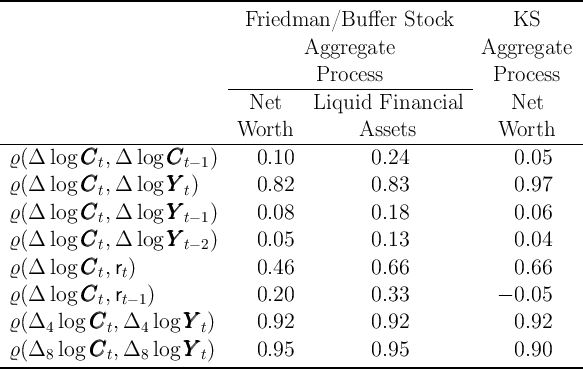

When matching the distribution of net worth, aggregate statistics produced by

the  -Dist model with our preferred (Friedman/Buffer Stock) aggregate process

are relatively similar to those under the KS aggregate process, despite the

difference in the aggregate process (first and third columns of Table 9). Given

that there is no aggregate state in the economy, we are using

-Dist model with our preferred (Friedman/Buffer Stock) aggregate process

are relatively similar to those under the KS aggregate process, despite the

difference in the aggregate process (first and third columns of Table 9). Given

that there is no aggregate state in the economy, we are using  and

and  estimated in Section 2 and assuming that the unemployment rate

estimated in Section 2 and assuming that the unemployment rate  is fixed at

0.07 (same as in Section 2). Our preferred version of the

is fixed at

0.07 (same as in Section 2). Our preferred version of the  -Dist model

maintains positive

-Dist model

maintains positive  , and high correlation of consumption

growth with income growth or interest rates. We have obtained similar results by

matching the distribution of liquid financial assets (second column of the

table).

, and high correlation of consumption

growth with income growth or interest rates. We have obtained similar results by

matching the distribution of liquid financial assets (second column of the

table).

More importantly, the preferred version of the  -Dist model can

produce high MPCs. For example, in the net worth case, the average MPC

is

-Dist model can

produce high MPCs. For example, in the net worth case, the average MPC

is  , which is very close to the estimate under the KS aggregate

process (compare second and last but one columns of Table 7). In the

liquid financial assets case, the average MPC is higher at

, which is very close to the estimate under the KS aggregate

process (compare second and last but one columns of Table 7). In the

liquid financial assets case, the average MPC is higher at  (last

column).

(last

column).

5 Conclusion

This paper found that the performance of a KS-type model in replicating

wealth distribution can be improved significantly by introducing i) a

microfounded income process, ii) finite lifetimes, and iii) heterogeneity in time

preference factors. Moreover, such modifications improve macroeconomic

characteristics of the model by substantially boosting the MPC out of transitory

income.

A Derivation of Variance of Permanent Income

The evolution of the square of  is given by

is given by

where  if household

if household  dies.

dies.

Because ![2

Et [(1 - dt+1,i) ] = 1 - D](BSinKS332x.png) and

and ![2

Et [d t+1,i] = D](BSinKS333x.png) , we have

, we have

and

Finally, the steady state expected level of ![M [p2] ≡ lim M [p2]

t→ ∞ t](BSinKS336x.png) can be found

from

can be found

from

B Estimating Moffitt and Gottschalk Income Process

This appendix estimates the annual income process à la Moffitt and

Gottschalk (1995) using quarterly income draws generated by our income

process (Section 2) with parameter values from Table 1. Moffitt and

Gottschalk (1995) assume log permanent income  follows a

random walk and log transitory income

follows a

random walk and log transitory income  ) an ARMA process:

) an ARMA process:

Like

Moffitt and Gottschalk (1995), we match the covariance matrix of the annual

income draws, and obtain estimate with the same signs as theirs obtained using

the PSID data; see Table 10, confirming that our calibration is qualitatively

consistent with Moffitt and Gottschalk’s.

Interestingly, even though our true quarterly transitory shock process is just

white noise, if we estimate the process on an annual basis we obtain

positive AR ( ) and negative MA (

) and negative MA ( ) coefficients, reflecting time

aggregation. This suggests that the positive

) coefficients, reflecting time

aggregation. This suggests that the positive  and negative

and negative  reported

in Moffitt and Gottschalk (1995) may be (at least) partly due to time

aggregation.

reported

in Moffitt and Gottschalk (1995) may be (at least) partly due to time

aggregation.

Table 10: Estimates of Moffitt and Gottschalk Annual Income Process

C Solution Method to Obtain Law of Motion

C.1 Solution Methods

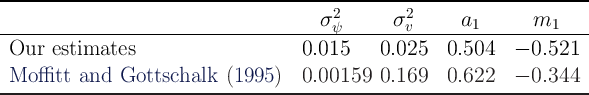

Broadly speaking, the literature takes one of the following two approaches in

solving the KS problem in Section 3:

- Relying on simulation to obtain the law of motion of per capita capital

- (In principle) not relying on simulation to obtain the law of motion of

per capita capital

Table 11 lists some existing articles that solve the KS-JEDC model

according to this categorization. All articles in the table except Kim, Kim,

and Kollmann (2010) solve the exact KS-JEDC model using various

methods.

The advantage of the first approach is that simulation performed to obtain the

law of motion generates micro data, which can be used directly to investigate

issues such as wealth distribution. The disadvantage is that this approach

is generally subject to cross-sectional sampling variation, because this

approach typically performs simulation using a finite number of households.

Young (2010) and Den Haan (2010b)’s approaches can also be categorized in

the first approach but avoid cross-sectional sampling variation by running

nonstochastic simulation that approximates the density of wealth with a

histogram.

The advantages of the second approach are: i) there is no cross-sectional

sampling variation; ii) it is generally faster than the first approach.

Using the second approach, Algan, Allais, and Den Haan (2008)

and Reiter (2010) find a wealth distribution function of various

moments,

while Reiter (2010) calculates a matrix for the transition probabilities of

individual wealth (see Appendix ?? for details about his technique). Kim, Kim,

and Kollmann (2010) use a perturbation method that linearizes the system.

Although they are not able to solve the exact same KS-JEDC model and thus

modify the form of the utility function, they can solve a related problem very

quickly.

We use the first approach because it directly generates various micro data

(e.g., individual wealth and MPC), which can be used to examine wealth

distribution and the aggregate MPC. Details about our algorithm are in the next

subsection.

Table 11: Methods of Solving KS-JEDC Model

C.2 Our Algorithm

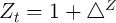

In solving the problem in section 3 we closely follow the stochastic simulation

method of Krusell and Smith (1998). Krusell and Smith find that per capita

capital today ( ) is sufficient to predict per capita capital tomorrow (

) is sufficient to predict per capita capital tomorrow ( ).

Our procedure is as follows:

).

Our procedure is as follows:

- Solve for the optimal individual decision rules given some ‘beliefs’

that

determine the (expected) law of motion of per capita capital. The law of

motion is takes the log-linear form given by

that

determine the (expected) law of motion of per capita capital. The law of

motion is takes the log-linear form given by  :

:

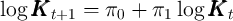

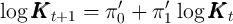

if the aggregate state in period  is good (

is good ( ), and

), and

if the aggregate state is bad ( ).

).

- Simulate the economy populated by

households (which experiments

determined is enough to suppress idiosyncratic noise) for

households (which experiments

determined is enough to suppress idiosyncratic noise) for  periods (following Maliar, Maliar, and Valli (2010)). When starting a

simulation,

periods (following Maliar, Maliar, and Valli (2010)). When starting a

simulation,  for all

for all  , the distribution of

, the distribution of  is generated

assuming

is generated

assuming  is equal to its steady state level (

is equal to its steady state level ( ) for all

) for all  , and

, and

(the aggregate state is good). (The steady state level of

(the aggregate state is good). (The steady state level of

is

is  . With

. With  for all

for all  ,

,

.) The newborn households start life with

.) The newborn households start life with  and

and

.

.

- Estimate

, which determines the law of motion of per capita capital,

using the last

, which determines the law of motion of per capita capital,

using the last  periods of data generated by the simulation (we

discard the first

periods of data generated by the simulation (we

discard the first  periods).

periods).

- Compute an improved vector for the next iteration by

is used for the

is used for the  -Dist model. (Our experiments found that we

can reach the solution faster with

-Dist model. (Our experiments found that we

can reach the solution faster with  .)

.)

We repeat this process until  with a given degree of

precision.

with a given degree of

precision.

From the second iteration and thereafter, we use the terminal distribution of wealth

(and permanent component of income ( )) in the previous iteration as the initial

one. For the case of the

)) in the previous iteration as the initial

one. For the case of the  -Dist model, the number of households is multiplied

by 10 in the final two (or three) iterations to reduce cross-sectional simulation

error.

-Dist model, the number of households is multiplied

by 10 in the final two (or three) iterations to reduce cross-sectional simulation

error.

While we can eventually obtain some solution whatever the initial

is, we use

is, we use  obtained using the representative agent model as the

starting point. This can significantly reduce the time needed to obtain the

solution.

obtained using the representative agent model as the

starting point. This can significantly reduce the time needed to obtain the