International Evidence On

Sticky Consumption Growth

July 1, 2010

| Christopher D. Carroll1 |

| . |

_____________________________________________________________________________________

Abstract

This paper estimates the degree of ‘stickiness’ in aggregate consumption

growth (sometimes interpreted as reflecting consumption habits) for thirteen

advanced economies. We find that, after controlling for measurement

error, consumption growth has a high degree of autocorrelation, with

a stickiness parameter of about 0.7 on average across countries. The

sticky-consumption-growth model outperforms the random walk model of

Hall (1978), and typically fits the data better than the popular Campbell and

Mankiw (1989) model, though in a few countries the sticky-consumption-growth

and Campbell–Mankiw models work about equally well.

-

Keywords

-

Consumption, Sticky Expectations, Habits

-

JEL codes

-

E21, F41

| | | (Contains data and estimation software producing paper’s results) |

1Carroll: Department of Economics, Johns Hopkins University, Baltimore, MD, http://www.econ2.jhu.edu/people/ccarroll/,

ccarroll@jhu.edu, Phone: (410) 516 7602 2Slacalek: European Central Bank, Frankfurt am Main, Germany,

http://www.slacalek.com/, jiri.slacalek@ecb.europa.eu, Phone: +49 69 1344 5047 3Sommer: International

Monetary Fund, Washington, DC, http://martinsommeronline.googlepages.com/, msommer@imf.org, Phone: (202) 623

9998

1 Introduction

A large literature ranging across macroeconomics, finance, and international economics

has argued that ‘habit formation’ can explain many empirical facts related to consumption

dynamics.

The core empirical pattern driving all these findings appears to be that

aggregate consumption growth is too ‘sticky’ to be explained with standard

models. Other explanations for the persistence of aggregate spending growth, or

‘excess smoothness’ (in Campbell and Deaton (1989)’s terminology), include

consumers’ inattentiveness to macroeconomic news (Sims (2003); Reis (2006);

Carroll and Slacalek (2007)), or their inability to distinguish micro- from

macro-economic shocks (Pischke (1995)). Further explanations could

undoubtedly be imagined.

But a full consensus has not emerged on whether empirical data are

irreconcilable with Hall (1978)’s benchmark random walk model of consumption.

Hall’s model implies that consumption growth is unpredictable (excess

smoothness is zero). However, standard extensions of the Hall model can

generate some degree of stickiness in consumption growth. For example, excess

smoothness might merely reflect the fact that spending decisions are made

more frequently than consumption data are measured (Working (1960);

this viewpoint has recently been advocated in papers by Ludvigson and

Lettau (2001); Lettau and Ludvigson (2004)). Also, in the presence of

uncertainty, the precautionary motive slows down consumers’ response to shocks,

which could also explain part (though not all) of the excess smoothness

(Ludvigson and Michaelides (2001)). Another possibility, not often mentioned

but nevertheless worth serious consideration, is that the smoothness of measured

spending reflects data construction methods (e.g. for components of spending for

which quarterly observations are imputed using annual data sources). Finally,

many of the papers in the habit formation literature have not carefully

examined the possibility that their results might reflect the presence of

some ‘rule-of-thumb’ consumers, who simply set consumption equal to

income in each period, as proposed in influential papers by Campbell and

Mankiw (1989, 1991).

Motivated by this debate and by the fact that much of the empirical evidence

on excess smoothness has come from a single country (the U.S.), this paper

provides systematic estimates of three simple canonical models of consumption

dynamics using data for all advanced economies for which we were able to

construct appropriate datasets (thirteen countries in all). We compare the

random walk model of Hall (1978) with two alternatives: the Campbell and

Mankiw (1989) model, and a model that permits (but does not require) excess

smoothness. We remain deliberately agnostic (in this paper) about whether such

smoothness reflects habits, inattention, or other factors; our aim is simply to

document the key stylized facts that should be matched by any model of

aggregate consumption dynamics.

Using both instrumental variables (IV) (section 3.1) and Kalman filter

structural (section 3.2) estimation methods, we find strong evidence of excess

smoothness (‘stickiness’) in consumption growth in every country in our

sample.

Although there is some variation across countries in the estimated degree of

stickiness, in every country we can reject the hypothesis that the stickiness

coefficient is zero (the random walk theory), while in no country can we reject

the hypothesis that it is 0.7 in quarterly data. Furthermore, wherever

there is a clear distinction between the two non-random-walk models,

the sticky consumption growth model outperforms the rule-of-thumb

model, usually by a decisive statistical margin. (In a few cases, the two

non-random-walk models are not statistically distinguishable from each

other.)

The large size of our estimated stickiness parameter may come as a surprise to

some readers, because the serial correlation coefficient for spending growth in the

raw data is much lower than 0.7 (for instance, in U.S. data the OLS estimate of

the AR(1) coefficient for nondurables and services consumption growth is about

0.35). The discrepancy reflects our use of econometric methods that are robust to

the presence of measurement error. Consistent with Sommer (2007)’s findings for

the United States, our estimates suggest that in most countries at least half of

the quarterly variation in consumption growth can be interpreted either as

measurement error or as truly transitory spending disturbances unrelated to the

theoretical consumption model (caused, for example, by unseasonal weather,

which can have a nontrivial effect at the quarterly frequency in most

countries).

The remainder of the paper is organized as follows. Section 2 outlines two

theoretical frameworks that generate sticky consumption growth and provide the

conceptual framework for our estimation strategy. Section 3 presents the main

empirical results and Section 4 concludes.

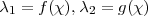

2 Two Theories of Stickiness

This section sketches the two most popular theoretical frameworks—habit

formation and sticky expectations—that can generate serial correlation in

aggregate consumption growth. In the habit formation model, the serial

correlation coefficient  reflects the strength of habits (if

reflects the strength of habits (if  , the model

collapses to the Hall random walk model); in the sticky information model,

, the model

collapses to the Hall random walk model); in the sticky information model,

is the fraction of aggregate expenditure by households that have

not fully updated their information set about the latest macroeconomic

developments (and again,

is the fraction of aggregate expenditure by households that have

not fully updated their information set about the latest macroeconomic

developments (and again,  corresponds to the Hall model).

Because the implications of the two frameworks are indistinguishable

in aggregate data, our empirical evidence is consistent with either

model.

corresponds to the Hall model).

Because the implications of the two frameworks are indistinguishable

in aggregate data, our empirical evidence is consistent with either

model.

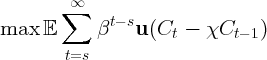

2.1 Habit Formation

Muellbauer (1988) proposed a simple model of habit persistence, in which the

representative consumer maximizes time-nonseparable utility

| (1) |

subject to the usual transversality condition and the dynamic budget

constraint:

| (2) |

where  is the discount factor,

is the discount factor,  is the consumption level,

is the consumption level,  is market

resources (net worth plus current income),

is market

resources (net worth plus current income),  is the constant interest factor,

and

is the constant interest factor,

and  is noncapital income.

is noncapital income.  in (1) represents the ‘habit stock,’ i.e., the

reference level of consumption to which the consumer compares the current

consumption level. The parameter

in (1) represents the ‘habit stock,’ i.e., the

reference level of consumption to which the consumer compares the current

consumption level. The parameter  captures the strength of habits. After

rewriting the utility function as

captures the strength of habits. After

rewriting the utility function as  , one

can see that, for

, one

can see that, for  , the consumer derives utility from both the level

and the change in consumption.

, the consumer derives utility from both the level

and the change in consumption.

Dynan (2000) shows that for a habit-forming consumer with Constant

Relative Risk Aversion (CRRA) outer utility  and

and

, a first order approximation to the Euler equation leads to

consumption dynamics that satisfy:

, a first order approximation to the Euler equation leads to

consumption dynamics that satisfy:

| (3) |

where  mainly reflects innovations to lifetime

resources.

Hence, in contrast to the standard intertemporally separable utility specification,

some of period

mainly reflects innovations to lifetime

resources.

Hence, in contrast to the standard intertemporally separable utility specification,

some of period  ’s consumption growth is predictable at time

’s consumption growth is predictable at time  , and the

strength of habits

, and the

strength of habits  can be measured directly by estimating an AR(1)

regression like (3) on aggregate consumption data.

can be measured directly by estimating an AR(1)

regression like (3) on aggregate consumption data.

2.2 Sticky Expectations

Carroll and Slacalek (2007) present an alternative model that also generates

sticky aggregate consumption growth, but without departing from the

conventional intertemporally separable utility specification. The key assumption

is that consumers are mildly inattentive to macro developments—for

example, some households do not immediately notice shocks to aggregate

macroeconomic indicators such as productivity growth or the unemployment

rate.

Assume that consumers maximize the discounted sum of time separable utility

subject to the budget constraint (2). In a Hall (1978) model

with quadratic utility, in which households use all available information, the

optimal consumption level follows a random walk:

subject to the budget constraint (2). In a Hall (1978) model

with quadratic utility, in which households use all available information, the

optimal consumption level follows a random walk:  . Numerical

simulations in Carroll and Slacalek (2007) show that when quadratic utility is

replaced with CRRA utility and the model is solved with realistic calibrations of

idiosyncratic and aggregate uncertainty, the log of aggregate consumption is close

to a random walk with drift (the drift reflects the precautionary motive and the

attendant nonlinearities):

. Numerical

simulations in Carroll and Slacalek (2007) show that when quadratic utility is

replaced with CRRA utility and the model is solved with realistic calibrations of

idiosyncratic and aggregate uncertainty, the log of aggregate consumption is close

to a random walk with drift (the drift reflects the precautionary motive and the

attendant nonlinearities):  .

.

Suppose now that the economy consists of a continuum of inattentive but

otherwise-standard CRRA-utility consumers, each of whom updates the

information about his permanent income with probability  in each period. For

each consumer, this probability is assumed to be independent of the date when

he last updated his information set (and independent of his income, wealth,

or other characteristics). This assumption resembles firm behavior in

Calvo (1983)’s model of price setting, which is commonly used in the monetary

economics literature. Carroll and Slacalek (2007) show that the change in

the log of aggregate consumption,

in each period. For

each consumer, this probability is assumed to be independent of the date when

he last updated his information set (and independent of his income, wealth,

or other characteristics). This assumption resembles firm behavior in

Calvo (1983)’s model of price setting, which is commonly used in the monetary

economics literature. Carroll and Slacalek (2007) show that the change in

the log of aggregate consumption,  , approximately follows an

AR(1) process, whose autocorrelation coefficient approximates the share

of consumers (

, approximately follows an

AR(1) process, whose autocorrelation coefficient approximates the share

of consumers ( ) who do not have up-to-date information about

macroeconomic developments. That is, consumption growth is well approximated

by:

) who do not have up-to-date information about

macroeconomic developments. That is, consumption growth is well approximated

by:

| (4) |

In addition, in the spirit of Akerlof and Yellen (1985) and Cochrane (1991), Carroll

and Slacalek (2007) show that the utility loss from the infrequent updating of

expectations is very small under standard calibrations of the model with  per

quarter.

per

quarter.

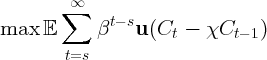

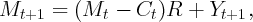

3 Empirical Results

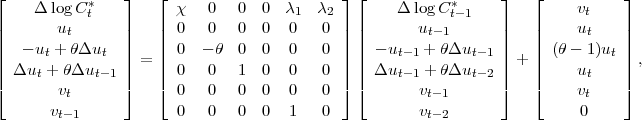

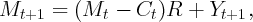

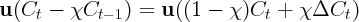

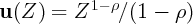

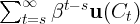

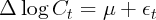

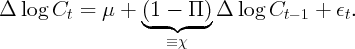

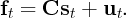

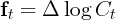

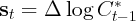

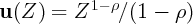

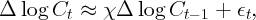

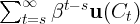

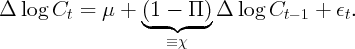

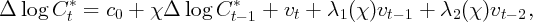

This section tests the model of sticky consumption growth (3) and (4)

against the alternatives of rule-of-thumb behavior and the random

walk hypothesis. The organizing framework for our empirical analysis

is a specification for consumption growth from the excess sensitivity

literature,

which has been expanded here to include a term capturing stickiness of

consumption growth:

![Δ log C = ς + χ E [Δ log C ] + η E [Δ log Y ] + α E [a ] + ϵ ,

t t- 2 t- 1 t- 2 t t- 2 t- 1 t](cssIntlStickyC31x.png) | (5) |

where  is household income and

is household income and  denotes the ratio of household (net)

assets to permanent income. The first two right-hand side regressors correspond

to two of the tested theories of consumption behavior: inattentiveness or habit

formation (

denotes the ratio of household (net)

assets to permanent income. The first two right-hand side regressors correspond

to two of the tested theories of consumption behavior: inattentiveness or habit

formation ( ) and rule-of-thumb consumers (

) and rule-of-thumb consumers ( ). Under the

third tested theory—the random walk hypothesis—the coefficients

). Under the

third tested theory—the random walk hypothesis—the coefficients  and

and  should both be zero. The third term in the equation above (

should both be zero. The third term in the equation above ( ) is included

as a control—any of the three theories allow for some direct effect of

asset holdings on consumption growth, either due to effects related to

uncertainty (which induces a precautionary saving motive) or due to time

variation in interest rates (which we assume is captured by time variation in

) is included

as a control—any of the three theories allow for some direct effect of

asset holdings on consumption growth, either due to effects related to

uncertainty (which induces a precautionary saving motive) or due to time

variation in interest rates (which we assume is captured by time variation in

).

).

There are at least three reasons to expect the OLS estimates of coefficients in

(5) to be biased and inconsistent. First, as argued by Wilcox (1992) and

Sommer (2007), quarterly consumption data may be contaminated with

substantial measurement error. Second is the undoubted existence of transitory

spending disturbances such as those related to weather (or even, for some smaller

countries, one-time events like the hosting of the Olympics). Standard theoretical

models ignore these kinds of shocks, yet back-of-the-envelope calculations

suggest their effects could be substantial in quarterly data. Our final

reason for expecting OLS to be biased is the well-known problem of time

aggregation.

We develop the points about importance of measurement error and transitory

spending fluctuations using the United States as an example. The Bureau of

Economic Analysis (2006) describes the methodology by which aggregate

expenditures on nondurable goods are estimated using data on retail sales at a

sample of retail outlets; since only a subset of retail stores are surveyed,

the retail sales figures must contain sampling error. As an example of a

“transitory disturbance,” under some plausible assumptions, Hurricane

Katrina may have reduced quarterly personal consumption expenditure

(PCE) growth by about 1 percentage point on an annualized basis in

Q3:2005.

However, even a much more benign event such as mild winter can reduce

annualized quarterly consumption growth significantly—for instance, by about

1/4 percentage point in the United States in Q1:2006—through lower outlays on

energy.

To address these three estimation issues (measurement error, transitory

consumption, and time aggregation) in quarterly consumption data, we use two

econometric methods. The first technique attempts to overcome these problems

using instrumental variables estimation. As with any IV method, validity of the

results depends on our ability to find suitable instruments (though the extensive

literature on the predictability of consumption growth provides good candidates).

As an alternative for those who dislike IV regressions, our second technique uses

the Kalman filter and structural modeling assumptions to separate ‘true’

consumption growth from its transitory components and measurement

error.

In this case, the usual caveat applies: The validity of this maximum

likelihood method hinges on the assumed structure of the

stochastic processes for measurement error and ‘true’ consumption

dynamics.

We view the similarity between the results obtained from these two different

methods, along with the coherence of our results with the large literature on

habit formation in macroeconomics, as persuasive evidence that stickiness in

consumption growth is a robust phenomenon.

3.1 Sticky Consumption Growth in IV Regressions

3.1.1 Dataset

Equation (5) is estimated using aggregate quarterly data for thirteen advanced

economies ranging roughly over the past forty years (table 5 provides data details).

Our preferred measure of consumption is the sum of expenditures on nondurable

goods and services. However, this measure is available only for six countries in

our sample (Canada, France, Germany, Italy, the U.K. and the U.S.); total

personal consumption expenditures are therefore used for the other sample

countries.

Finally,  and

and  are measured as household disposable

income and the ratio of financial wealth to disposable income,

respectively.

are measured as household disposable

income and the ratio of financial wealth to disposable income,

respectively.

3.1.2 Instruments

The main advantage of IV estimation is that with appropriate instruments, there

is no need to make assumptions about the stochastic structure of measurement

error and other transitory fluctuations in quarterly consumption growth. The

only requirements are that the instruments are uncorrelated with measurement

error and temporary consumption fluctuations, but correlated with the

instrumented variables.

Under habit formation or sticky expectations, Sommer (2007) shows that time

aggregation makes “true” consumption growth  (i.e., consumption

growth without measurement error and transitory consumption) follow an

ARMA(1,2) process:

(i.e., consumption

growth without measurement error and transitory consumption) follow an

ARMA(1,2) process:

| (6) |

where the  s are complicated functions of

s are complicated functions of  . In addition, the

MA(2) coefficient

. In addition, the

MA(2) coefficient  is close to zero for all reasonable values of

is close to zero for all reasonable values of

, so that

, so that  is approximately ARMA(1,1). Given these

considerations, equation (5) can be estimated using the IV estimator

with instruments lagged at least twice (e.g., dated as of time

is approximately ARMA(1,1). Given these

considerations, equation (5) can be estimated using the IV estimator

with instruments lagged at least twice (e.g., dated as of time  and

earlier).

and

earlier).

The baseline instrument set for the IV regressions consists of

variables that are strongly correlated with consumption growth

and yet unlikely to be correlated with measurement error: the

unemployment rate, a long-term interest rate, and an index of price

volatility.

Consumer sentiment is also used as an instrument whenever available (the G-7

countries and Australia), as in Carroll, Fuhrer, and Wilcox (1994) and

others.

3.1.3 Estimation Results

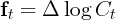

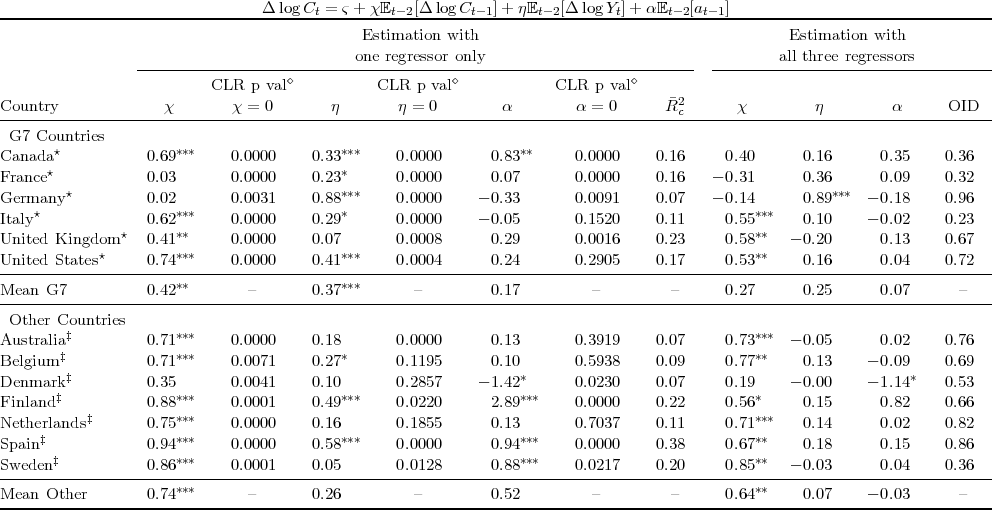

Table 1 summarizes the baseline estimation results for four

alternative econometric specifications nested in equation

(5).

The left panel reports the results from univariate regressions in which

each right-hand side variable enters the estimated specification as

the only regressor. The first column presents the IV estimates of

consumption persistence  , which are for all countries much higher

than the (unreported) OLS estimates and are always highly statistically

significant.

The IV estimates of consumption persistence in table 1 are on average about

0.7—a strong rejection of the random walk proposition which implies a

coefficient of zero. The second column reports p values of the null hypothesis

, which are for all countries much higher

than the (unreported) OLS estimates and are always highly statistically

significant.

The IV estimates of consumption persistence in table 1 are on average about

0.7—a strong rejection of the random walk proposition which implies a

coefficient of zero. The second column reports p values of the null hypothesis

implied by the heteroscedasticity and autocorrelation robust version of

the conditional likelihood ratio (HAR-CLR) test of Andrews, Moreira, and

Stock (2004). The test is robust to potentially weak instruments and is

effectively uniformly most powerful among tests invariant to rotations of the

instruments. The

implied by the heteroscedasticity and autocorrelation robust version of

the conditional likelihood ratio (HAR-CLR) test of Andrews, Moreira, and

Stock (2004). The test is robust to potentially weak instruments and is

effectively uniformly most powerful among tests invariant to rotations of the

instruments. The  values indicate that the zero restriction on

values indicate that the zero restriction on  is soundly

rejected in almost all countries.

is soundly

rejected in almost all countries.

The third column estimates the Campbell–Mankiw model. Our results

are broadly consistent with the evidence presented in Campbell and

Mankiw (1991): Rule-of-thumb consumers (for whom, by assumption,

consumption equals current income) are on average estimated to earn about

of aggregate income. Interestingly, the estimates of

of aggregate income. Interestingly, the estimates of  in the left

panel are often less significant than those of consumption persistence

in the left

panel are often less significant than those of consumption persistence  and are in three or four cases insignificant (depending on whether the

standard or HAR-CLR p values are used). This means that—aside from the

question of how the Campbell–Mankiw model stands up against the

alternative of habit formation or sticky expectations—rule-of-thumb spending

behavior cannot be reliably detected in about a third of our sample

countries.

and are in three or four cases insignificant (depending on whether the

standard or HAR-CLR p values are used). This means that—aside from the

question of how the Campbell–Mankiw model stands up against the

alternative of habit formation or sticky expectations—rule-of-thumb spending

behavior cannot be reliably detected in about a third of our sample

countries.

The fifth column investigates the relative importance of wealth (expressed as

the ratio of net financial assets to income) in aggregate consumption dynamics.

The coefficient on the wealth–to–income ratio,  , turns out to be statistically

significant only in four countries, although the HAR-CLR

, turns out to be statistically

significant only in four countries, although the HAR-CLR  values suggest

more often that

values suggest

more often that  is not zero. In addition, the coefficient

is not zero. In addition, the coefficient  has in most

countries the opposite sign to that predicted by either precautionary saving

theory or intertemporal substitution as channelled through the interest rate.

This is unsurprising for at least two reasons. First, the overwhelming significance

of consumption (and also income) in the previous regressions implies a severe

omitted-variable bias problem with the univariate regression that only includes

wealth. Second, the previous literature generally finds little evidence of interest

rate or precautionary saving effects in aggregate consumption growth

data.

has in most

countries the opposite sign to that predicted by either precautionary saving

theory or intertemporal substitution as channelled through the interest rate.

This is unsurprising for at least two reasons. First, the overwhelming significance

of consumption (and also income) in the previous regressions implies a severe

omitted-variable bias problem with the univariate regression that only includes

wealth. Second, the previous literature generally finds little evidence of interest

rate or precautionary saving effects in aggregate consumption growth

data.

The last column of the left panel displays the adjusted  s from the

first-stage regressions of consumption growth on instruments (denoted

s from the

first-stage regressions of consumption growth on instruments (denoted  ).

This measure of the strength of instruments ranges between 0.1 and 0.2 for most

countries.

).

This measure of the strength of instruments ranges between 0.1 and 0.2 for most

countries.

The right panel of table 1 reports estimation results when all three regressors

are included in equation (5). The results strongly suggest that past consumption

growth is by far the strongest predictor of current consumption growth. The

average persistence parameter in the country regressions falls only very slightly

compared with the average estimates from univariate regressions reported in the

left panel (from  to

to  ) and remains statistically significant at

the five percent level in ten of our thirteen countries. The predicted income

growth term dominates the lagged consumption term only in one country,

Germany.

The last column of the right panel reports the p-values of the Hansen’s

overidentification test—results of which imply that the null of instrument

exogeneity cannot be rejected.

) and remains statistically significant at

the five percent level in ten of our thirteen countries. The predicted income

growth term dominates the lagged consumption term only in one country,

Germany.

The last column of the right panel reports the p-values of the Hansen’s

overidentification test—results of which imply that the null of instrument

exogeneity cannot be rejected.

Table 2 averages the coefficient estimates from table 1 across various country

groups. As in table 1, while the average consumption persistence  falls

relatively little after income and wealth are added to the estimated equations

(compare the right and left panels of the table), the income and wealth

coefficients become essentially zero. The result holds for all five groups of

countries reported in the table which suggests considerable homogeneity in

falls

relatively little after income and wealth are added to the estimated equations

(compare the right and left panels of the table), the income and wealth

coefficients become essentially zero. The result holds for all five groups of

countries reported in the table which suggests considerable homogeneity in  among advanced economies, a fact already apparent in the previous table with

the results for individual countries.

among advanced economies, a fact already apparent in the previous table with

the results for individual countries.

Table 3, whose format is identical to table 1, estimates aggregate consumption

dynamics with an alternative instrument set, in which long-run interest rates and

price volatility have been replaced with income growth and the interest-rate

spread.

The estimation results are broadly consistent with our baseline: (i) the

coefficient on lagged consumption growth in univariate regressions is large and

significant for ten countries, (ii) in the regressions that include all three

regressors, the coefficients on instrumented income growth and wealth

tend to be small and less often statistically significant compared with

univariate regressions, and (iii) lagged consumption growth beats lagged

income in nine horse-race regressions (but gets badly beaten in German

data).

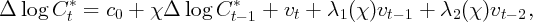

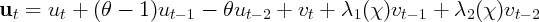

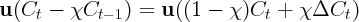

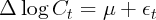

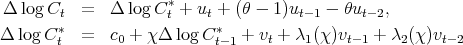

3.2 Kalman Filter/Maximum Likelihood Evidence on Sticky Consumption

Growth

As a more efficient alternative to IV, we also estimate the dynamics of

consumption growth using the Kalman filter. To proceed, it is necessary

to specify an assumption about the stochastic process of measurement

error. We follow the methodology of Sommer (2007) and assume that

measurement error in the log-level of consumption follows an MA(1)

process.

Observed consumption growth,  , can be written as the sum of ‘true’

consumption growth,

, can be written as the sum of ‘true’

consumption growth,  , and a measurement error,

, and a measurement error,  , as follows:

, as follows:

As noted above,  s are not free parameters but are complicated functions of

s are not free parameters but are complicated functions of

. The Kalman filter jointly estimates the sticky expectations coefficient

. The Kalman filter jointly estimates the sticky expectations coefficient  and the degree of the first autocorrelation in measurement errors,

and the degree of the first autocorrelation in measurement errors,  . The filter

also generates separate estimates of ‘true’ consumption growth,

. The filter

also generates separate estimates of ‘true’ consumption growth,  , and

the measurement error component,

, and

the measurement error component,  . For the purposes of this subsection, we

assume that the correlation structure of measurement error remains unchanged

over the sample period.

. For the purposes of this subsection, we

assume that the correlation structure of measurement error remains unchanged

over the sample period.

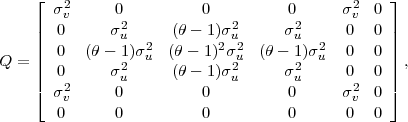

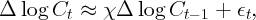

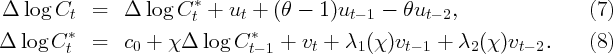

The model described in equations (7) and (8) has been rewritten in a

state-space form (see appendix B) and estimated using consumption data for the

countries in our dataset (listed in table 5). Table 4 presents the estimation

results. As in the case of the IV estimation, the coefficient reflecting consumption

growth stickiness,  , is large and highly statistically significant in almost

all sample countries. The value of

, is large and highly statistically significant in almost

all sample countries. The value of  typically ranges between 0.6 and

0.8, with only Denmark and the United Kingdom having coefficients

estimated below 0.4. For the United States, the estimated consumption

persistence is about 0.7, which is consistent with previous studies (e.g.

Fuhrer (2000)).

typically ranges between 0.6 and

0.8, with only Denmark and the United Kingdom having coefficients

estimated below 0.4. For the United States, the estimated consumption

persistence is about 0.7, which is consistent with previous studies (e.g.

Fuhrer (2000)).

It is encouraging that the Kalman filter estimates of consumption persistence

tend to be close to the IV estimates. This suggests that stickiness of

consumption growth is a robust feature of the data that appears similarly even

when viewed through quite different lenses.

The estimation results also suggest that measurement error in the level of

consumption is positively and significantly autocorrelated in about half of our

sample countries—a fact that is not surprising given the interpolation techniques

that are often used by statistical agencies when constructing quarterly

consumption data.

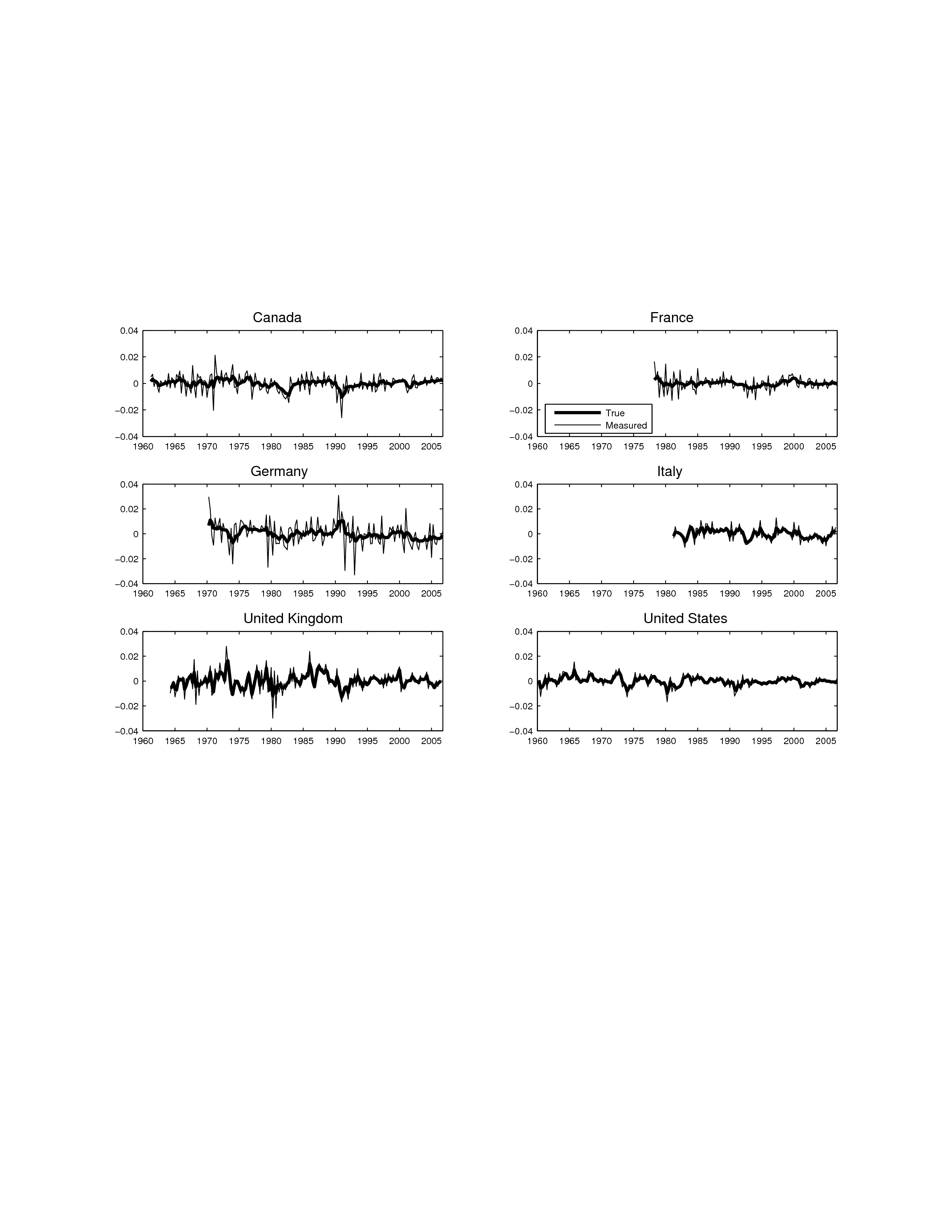

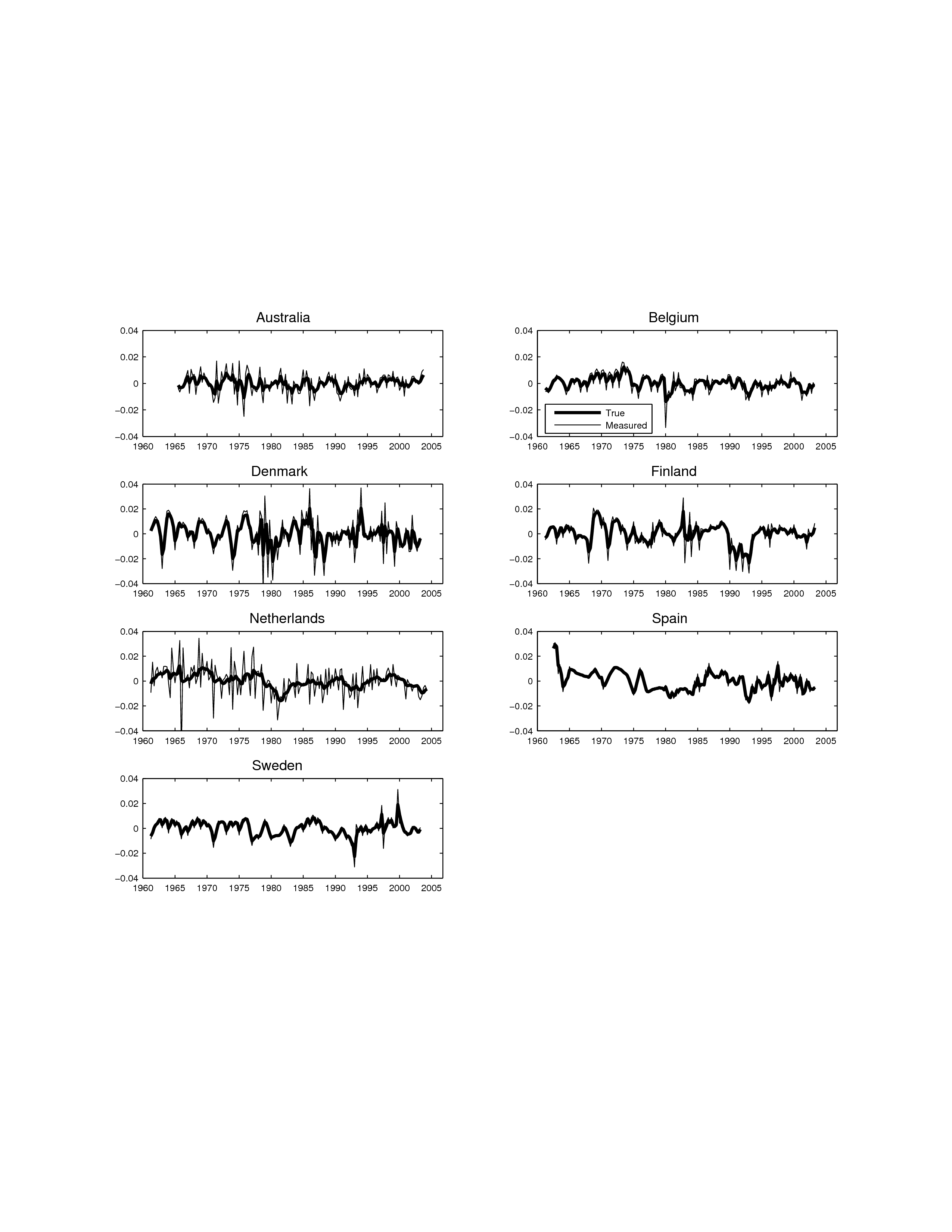

The Kalman filter’s estimate of “true” consumption growth,  , is presented,

along with the raw data, in figures 1 and 2. The Kalman filter estimation suggests

that the share of transitory components in published quarterly consumption data

is large (about 50 percent for the United States and even more for some

countries).

To see how the restrictions on

, is presented,

along with the raw data, in figures 1 and 2. The Kalman filter estimation suggests

that the share of transitory components in published quarterly consumption data

is large (about 50 percent for the United States and even more for some

countries).

To see how the restrictions on  s imposed by the theoretical model with habits

affect estimates of

s imposed by the theoretical model with habits

affect estimates of  , we have also experimented with several versions of model

(7)–(8) in which

, we have also experimented with several versions of model

(7)–(8) in which  s are free parameters (rather than known functions of

s are free parameters (rather than known functions of  ). In

such models, consumption sluggishness

). In

such models, consumption sluggishness  robustly turns out to be similar to

the values shown in Table 4. However, the fact that in a few cases

robustly turns out to be similar to

the values shown in Table 4. However, the fact that in a few cases  s appear

unrealistic (greater than one or smaller than minus one) suggests that

imposing theoretical restrictions is helpful in identifying them (rather than

s appear

unrealistic (greater than one or smaller than minus one) suggests that

imposing theoretical restrictions is helpful in identifying them (rather than

).

).

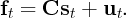

3.2.1 Relationship with the Structural Estimation Literature

The state-space representation (7)–(8) fits nicely into the structural DSGE

framework recently proposed by Ireland (2004), who estimates a small

log-linearized model with the Kalman filter. Control variables  in

his model can be solved in terms of state variables

in

his model can be solved in terms of state variables  and residuals

and residuals

:

:

| (9) |

Ireland, p. 1210 views the disturbances  as follows: “the residuals [

as follows: “the residuals [ ] may

… soak up both measurement errors, but they can be interpreted more liberally

as capturing all of the movements and co-movements in the data that

the real business cycle model, because of its elegance and simplicity,

cannot explain.” Once we plug our transition equation for consumption

growth (8) into the measurement equation (7), the Kalman filter model

we estimate above has exactly the structure (9) with

] may

… soak up both measurement errors, but they can be interpreted more liberally

as capturing all of the movements and co-movements in the data that

the real business cycle model, because of its elegance and simplicity,

cannot explain.” Once we plug our transition equation for consumption

growth (8) into the measurement equation (7), the Kalman filter model

we estimate above has exactly the structure (9) with  ,

,

,

,  and

and  .

.

Thus the state-space representation (7)–(8) can be interpreted as a

stripped-down version of Ireland’s model with consumption habits in which

measured consumption is affected by a combination of measurement errors  and shocks

and shocks  to “true” consumption

to “true” consumption  . As our main goal is to estimate

consumption stickiness

. As our main goal is to estimate

consumption stickiness  , we do not take a stand on where the consumption

shocks

, we do not take a stand on where the consumption

shocks  come from (be it news about income, wealth, interest rates, fiscal

policy or something else). Our model is simple enough to be estimable using

classical techniques, including the maximum likelihood estimator, so that data

have complete control over the estimates of

come from (be it news about income, wealth, interest rates, fiscal

policy or something else). Our model is simple enough to be estimable using

classical techniques, including the maximum likelihood estimator, so that data

have complete control over the estimates of  , in contrast to larger-scale DSGE

models, which are often inevitably estimated with Bayesian methods with

informative priors.

, in contrast to larger-scale DSGE

models, which are often inevitably estimated with Bayesian methods with

informative priors.

4 Conclusions

Hall (1978) provided macroeconomists with a clean theoretical benchmark to

which actual consumption data could be compared: Consumption growth should

be essentially unpredictable. In contrast with this benchmark, we find that, when

econometric techniques that account for measurement error are used,

consumption growth exhibits a high degree of persistence or “momentum.” The

stickiness of aggregate consumption growth can be interpreted as reflecting the

behavior of fully informed households with a strong consumption habit, or the

behavior of an aggregate economy in which households are not always perfectly

up to date in their knowledge of macroeconomic developments. Fitting the model

to data from thirteen countries, we estimate that consumption growth

persistence is always significantly above the random-walk benchmark of 0 and is

never robustly different from about 0.7. Our analysis also suggests that, on

balance, the model of sticky consumption growth describes aggregate

consumption data better than the rule-of-thumb model of Campbell and

Mankiw (1989), although our point estimates do typically indicate that a

modest proportion of aggregate income (in the range of 10–20 percent)

may be received by households who consume their current income every

quarter.

Our findings imply that the large literature claiming to find evidence of sticky

consumption growth in the U.S. probably cannot be explained away as reflecting

time aggregation problems or other mistreatment of the data, suggesting that

many of the insights gleaned from that literature are likely applicable to other

countries as well. (However, it is worth bearing in mind that analyses that rely

heavily on the literal interpretation of the habits-in-the-utility-function

framework, such as calculations of the welfare cost of aggregate fluctuations, may

not hold up under alternative interpretations of consumption growth

stickiness.)

Our analysis also strengthens a key policy message about the sluggish average

response of consumption to monetary and fiscal policy innovations highlighted

earlier in the context of the habit formation literature—an important policy

consideration at the current cyclical juncture in many countries, including in the

United States.

Table 2: Consumption Dynamics—Groups of Countries (Simple Averages)

Notes: Instruments: Lags  and

and  of the unemployment rate, long-run interest rate, price volatility and consumer

sentiment. Left Panel: Regressions were estimated with one regressor only. Right Panel: Regressions were estimated with all three

regressors. Robust standard errors are in parentheses.

of the unemployment rate, long-run interest rate, price volatility and consumer

sentiment. Left Panel: Regressions were estimated with one regressor only. Right Panel: Regressions were estimated with all three

regressors. Robust standard errors are in parentheses.  Statistical significance at

Statistical significance at  percent. Standard errors

are simple averages of individual countries in a given group.

percent. Standard errors

are simple averages of individual countries in a given group.

All countries: Canada, France, Germany, Italy, the United Kingdom, the United States, Australia, Belgium, Denmark, Finland, the

Netherlands, Spain, Sweden. G7 countries: Canada, France, Germany, Italy, the United Kingdom, the United States. Anglo–Saxon

Countries: Australia, Canada, the United Kingdom, the United States. Euro Area Countries: France, Germany, Italy, Belgium,

Finland, the Netherlands, Spain. European Union: France, Germany, Italy, the United Kingdom, Belgium, Denmark, Finland, the

Netherlands, Spain, Sweden.

Appendix A: Description of Data

Data for the G-7 economies are from the Haver Analytics database. Data for other countries are from

the database of the NiGEM model of the NIESR Institute, London. The original sources for most of

these data are OECD, Eurostat, national statistical offices and central banks. Income is measured as

personal disposable income. Wealth is approximated using data on the net financial wealth. All series

were deflated with consumption deflators and expressed in per capita terms. The population series are

from DRI International and were interpolated from annual data to quarterly observations.

Japan is not included in our sample as creating a quarterly dataset with consumption

data going prior to 1980 would involve splicing consumption series based on three very

different methodologies. Adjustments to the Japanese national accounts methodology in 2002

and 2004 have significantly improved the reliability of quarterly consumption series but

the current-methodology data are only available since Q1:1994 (International Monetary

Fund (2006)).

We thank Roberto Golinelli for consumer sentiment series for G7 countries and Australia used

(and described in detail) in Golinelli and Parigi (2004). (We have not used consumer

sentiment series for the remaining countries, because the data are not available before

1985.) We are grateful to Carol Bertaut and Nathalie Girouard for providing us with the

data used in Bertaut (2002) and Catte, Girouard, Price, and Andre (2004), respectively.

Ray Barrell, Amanda Choy and Robert Metz answered our questions about the NiGEM’s

database.

Table 5: Consumption Data, Its Sources, and Samples for IV Regressions

| Country | Time Frame | Consumption/Source | Income/Source | Wealth/Source |

| G7 Countries

|

| Canada | Q4:1970–Q3:2002 | NDS/Haver | PDI/Haver | NFW/NiGEM |

| France | Q1:1985–Q4:2003 | NDS/Haver | PDI/Haver | NFW/NiGEM |

Germany | Q4:1975–Q4:2002 | NDS/Haver | PDI/Haver | NFW/NiGEM |

| Italy | Q1:1981–Q4:2003 | NDS/Haver | PDI/Haver | NFW/NiGEM |

| United Kingdom | Q1:1974–Q4:2003 | NDS/Haver | PDI/Haver | NFW/NiGEM |

| United States | Q3:1962–Q2:2004 | NDS/Haver | PDI/Haver | NFW/NiGEM |

| Other Countries

|

| Australia | Q4:1975–Q4:1999 | PCE/Haver | PDI/Haver | NFW/NiGEM |

| Belgium | Q2:1980–Q4:2002 | PCE/NiGEM&MEI | PDI/NiGEM&MEI | NFW/NiGEM |

| Denmark | Q1:1977–Q2:2003 | PCE/NiGEM&MEI | PDI/NiGEM&MEI | NFW/NiGEM |

| Finland | Q3:1973–Q2:2003 | PCE/NiGEM&MEI | PDI/NiGEM&MEI | NFW/NiGEM |

| Netherlands | Q1:1975–Q4:2002 | PCE/NiGEM&MEI | PDI/NiGEM&MEI | NFW/NiGEM |

| Spain | Q1:1978–Q4:1999 | PCE/NiGEM&MEI | PDI/NiGEM&MEI | NFW/NiGEM |

| Sweden | Q1:1977–Q4:2002 | PCE/NiGEM&MEI | PDI/NiGEM&MEI | NFW/NiGEM |

| |

Notes: PCE Total personal consumption expenditures, NDS

Total personal consumption expenditures, NDS Nondurables and services, PDI

Nondurables and services, PDI Personal disposable

income, NFW

Personal disposable

income, NFW Net financial wealth,

Net financial wealth,  : Regressions for Germany were estimated with a reunification dummy in Q1:1991;

Source: Haver—Haver Analytics, NiGEM—Database of the NiGEM model of the NIESR Institute, London, MEI—Main Economic

Indicators of OECD.

: Regressions for Germany were estimated with a reunification dummy in Q1:1991;

Source: Haver—Haver Analytics, NiGEM—Database of the NiGEM model of the NIESR Institute, London, MEI—Main Economic

Indicators of OECD.

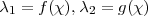

Appendix B: Details of the Kalman Filter Estimation

Following Sommer (2007), equations (7) and (8) can be rewritten in the state-space form with the

measurement equation:

and the state-evolution equation:

and with the associated covariance matrices  and

and

respectively.

The state-space form is estimated with the Kalman filter using the consumption series described in

table 5. The coefficients  and

and  are not free parameters but instead depend on the consumption

persistence coefficient

are not free parameters but instead depend on the consumption

persistence coefficient  :

:  . Our Kalman filter estimation incorporates this

relationship between

. Our Kalman filter estimation incorporates this

relationship between  ,

,  , and

, and  .

.

Figures 1 and 2 display the measured consumption growth  and true consumption

and true consumption

estimated using the Kalman smoother based on the above state-space model.

estimated using the Kalman smoother based on the above state-space model.

References

AKERLOF, GEORGE A., AND JANET L. YELLEN (1985): “A Near-Rational Model of the

Business Cycle, with Wage and Price Intertia,” The Quarterly Journal of Economics, 100(5),

823–38.

AN, SUNGBAE, AND FRANK SCHORFHEIDE (2007): “Bayesian Analysis of DSGE Models,”

Econometric Reviews, 2–4(26), 113–172.

ANDREWS, DONALD W. K., MARCELO MOREIRA, AND JAMES H. STOCK (2004):

“Optimal Invariant Similar Tests for Instrumental Variables Regression,” technical working

paper 299, NBER.

ARUOBA, S. BORAGAN (2008): “Data Revisions Are Not Well Behaved,” Journal of Money,

Credit, and Banking, 40(2-3), 319–340.

BERTAUT, CAROL C. (2002): “Equity Prices, Household Wealth, and Consumption Growth

in Foreign Industrial Countries: Wealth Effects in the 1990s,” Board of Governors of the

Federal Reserve System International Finance Discussion Papers 724.

BRAUN, PHILIP A., GEORGE M. CONSTANTINIDES, AND WAYNE E. FERSON (1993):

“Time Nonseparability in Aggregate Consumption: International Evidence,” European

Economic Review, 37, 897–920.

BUREAU OF ECONOMIC ANALYSIS (2006): “Updated Summary NIPA Methodologies,”

Survey of Current Business, November, Bureau of Economic Analysis, available at

http://www.bea.gov/scb/pdf/2006/11November/1106_nipa_method.pdf.

CALVO, GUILLERMO A. (1983): “Staggered Contracts in a Utility-Maximizing Framework,”

Journal of Monetary Economics, 12, 383–98.

CAMPBELL, JOHN Y., AND ANGUS S. DEATON (1989):

“Why Is Consumption So Smooth?,” Review of Economic Studies, 56, 357–74, Available at

http://ideas.repec.org/a/bla/restud/v56y1989i3p357-73.html.

CAMPBELL, JOHN Y., AND N. GREGORY MANKIW (1989): “Consumption, Income and

Interest Rates: Reinterpreting the Time Series Evidence,” in NBER Macroeconomics Annual,

ed. by Olivier J. Blanchard, and Stanley Fischer, Cambridge, MA. MIT Press.

__________ (1991): “The Response of Consumption to Income: A Cross-Country

Investigation,” European Economic Review, 35(4), 723–756.

CAMPBELL, JOHN Y., AND JOHN H. COCHRANE (1999): “By Force of Habit: A

Consumption-Based Explanation of Aggregate Stock Market Behavior,” Journal of Political

Economy, 107(2), 205–251.

CARROLL, CHRISTOPHER D. (2003): “Macroeconomic Expectations of Households

and Professional Forecasters,” Quarterly Journal of Economics, 118(1), 269–298, At

http://www.econ2.jhu.edu/people/ccarroll/epidemiologyQJE.pdf.

CARROLL, CHRISTOPHER D., JEFFREY C. FUHRER, AND DAVID W. WILCOX (1994):

“Does Consumer Sentiment Forecast Household Spending? If So, Why?,” American Economic

Review, 84(5), 1397–1408.

CARROLL, CHRISTOPHER D., JODY R. OVERLAND, AND DAVID N. WEIL (1997):

“Comparison Utility in a Growth Model,” Journal of Economic Growth, 2(4), 339–367,

Available at http://www.econ2.jhu.edu/people/ccarroll/compare.pdf.

__________ (2000): “Saving and Growth with Habit Formation,” American Economic Review,

90(3), 341–355, Available at http://www.econ2.jhu.edu/people/ccarroll/AERHabits.pdf.

CARROLL, CHRISTOPHER D., AND ANDREW A. SAMWICK (1997): “The Nature of

Precautionary Wealth,” Journal of Monetary Economics, 40(1), 41–71, Available at

http://www.econ2.jhu.edu/people/ccarroll/nature.pdf.

CARROLL, CHRISTOPHER D., AND JIRI SLACALEK (2007): “Sticky Expectations and

Consumption Dynamics,” Manuscript, Johns Hopkins University.

CATTE, PIETRO, NATHALIE GIROUARD, ROBERT PRICE, AND CHRISTOPHE ANDRE

(2004): “Housing Markets, Wealth and the Business Cycle,” OECD Economics Department

Working Papers 394, OECD.

COCHRANE, JOHN H. (1991): “The Sensitivity of Tests of the Intertemporal Allocation of

Consumption to Near-Rational Alternatives,” American Economic Review, 79, 319–37.

CONSTANTINIDES, GEORGE M. (1990): “Habit Formation: A Resolution of the Equity

Premium Puzzle,” Journal of Political Economy, 98, 519–43.

DYNAN, KAREN E. (2000): “Habit Formation in Consumer Preferences: Evidence from

Panel Data,” American Economic Review, 90(3).

FERSON, WAYNE E., AND GEORGE M. CONSTANTINIDES (1991): “Habit Persistence and

Durability in Aggregate Consumption: Empirical Tests,” Journal of Financial Economics,

29(2), 199–240.

FLAVIN, MARJORIE B. (1981): “The Adjustment of Consumption to Changing

Expectations About Future Income,” Journal of Political Economy, 89, 974–1009, Available

at http://ideas.repec.org/a/ucp/jpolec/v89y1981i5p974-1009.html.

FRIEDMAN, MILTON A. (1957): A Theory of the Consumption Function. Princeton

University Press.

FUCHS-SCHüNDELN, NICOLA, AND MATTHIAS SCHüNDELN (2005): “Precautionary Savings

and Self-Selection: Evidence from the German Reunification “Experiment”,” Quarterly

Journal of Economics, 120(3), 1085–1120.

FUHRER, JEFFREY C. (2000): “Habit Formation in Consumption and Its Implication for

Monetary-Policy Models,” American Economic Review, 90(3), 367–390.

GOLINELLI, ROBERTO, AND GIUSEPPE PARIGI (2004): “Consumer Sentiment and Economic

Activity: A Cross Country Comparison,” Journal of Business Cycle Measurement and

Analysis, 1(2), 147–170.

GOURINCHAS, PIERRE-OLIVIER, AND JONATHAN PARKER (2002): “Consumption Over the

Life Cycle,” Econometrica, 70(1), 47–89.

GRUBER, JOSEPH W. (2004): “A Present Value Test of Habits and the Current Account,”

Journal of Monetary Economics, 51(7), 1495–1507.

HALL, ROBERT E. (1978): “Stochastic Implications of the Life-Cycle/Permanent Income

Hypothesis: Theory and Evidence,” Journal of Political Economy, 96, 971–87, Available at

http://www.stanford.edu/~rehall/Stochastic-JPE-Dec-1978.pdf.

__________ (1988): “Intertemporal

Substitution in Consumption,” Journal of Political Economy, XCVI, 339–357, Available at

http://www.stanford.edu/~rehall/Intertemporal-JPE-April-1988.pdf.

INTERNATIONAL MONETARY FUND (2006): “Japan: Report on the Observance of Standards

and Codes—Data Module, Response by the Authorities, and Detailed Assessments Using the

Data Quality Assessment Framework (DQAF),” IMF Country Report 06/115, International

Monetary Fund, March.

IRELAND, PETER N. (2004): “A Method for Taking Models to the Data,” Journal of

Economic Dynamics and Control, 28, 1205–1226.

LETTAU, MARTIN, AND SYDNEY LUDVIGSON (2004): “Understanding Trend and Cycle in

Asset Values: Reevaluating the Wealth Effect on Consumption,” American Economic Review,

94(1), 276–299.

LJUNGQVIST, LARS, AND HARALD UHLIG (2000): “Tax Policy and Aggregate Demand

Management under Catching Up with the Joneses,” American Economic Review, 90(3),

356–366.

LUDVIGSON, SYDNEY, AND MARTIN LETTAU (2001): “Consumption, Aggregate Wealth,

and Expected Stock Returns,” Journal of Finance, 56(3), 815–49.

LUDVIGSON, SYDNEY, AND ALEXANDER MICHAELIDES (2001): “Does Buffer Stock Saving

Explain the Smoothness and Excess Sensitivity of Consumption?,” American Economic

Review, 91(3), 631–647.

LUENGO-PRADO, MARíA JOSé, AND BENT E. SØRENSEN (2008): “What Can Explain

Excess Smoothness and Sensitivity of State-Level Consumption?,” The Review of Economics

and Statistics, 90(1), 65–80.

MANKIW, N. GREGORY (1982): “Hall’s Consumption Hypothesis and Durable Goods,”

Journal of Monetary Economics, 10(3), 417–425.

MANKIW, N. GREGORY, AND RICARDO REIS (2001): “Sticky Information Versus Sticky

Prices: A Proposal to Replace the New Keynesian Phillips Curve,” Quarterly Journal of

Economics, 117(4), 1295–1328.

MICHAELIDES, ALEXANDER (2002): “Buffer Stock Saving and Habit Formation,”

Manuscript, London School of Economics.

MUELLBAUER, JOHN (1988): “Habits, Rationality and Myopia in the Life Cycle

Consumption Function,” Annales d’Economie et de Statistique, 9, 47–70.

OKUN, ARTHUR M. (1981): Prices and Quantities: A Macroeconomic Analysis. Brookings

Institution Press.

PISCHKE, JöRN-STEFFEN (1995): “Individual Income, Incomplete Information, and

Aggregate Consumption,” Econometrica, 63(4), 805–40.

REIS, RICARDO (2006): “Inattentive Consumers,” Journal of Monetary Economics, 53(8),

1761–1800.

SHORE, STEPHEN H., AND JOSHUA S. WHITE (2006): “External Habit Formation and

the Home Bias Puzzle,” working paper, The Wharton School, University of Pennsylvania.

SIMS, CHRISTOPHER A. (2003):

“Implications of Rational Inattention,” Journal of Monetary Economics, 50(3), 665–690,

available at http://ideas.repec.org/a/eee/moneco/v50y2003i3p665-690.html.

SMETS, FRANK, AND RAF WOUTERS (2003): “An Estimated Dynamic Stochastic General

Equilibrium Model of the Euro Area,” Journal of European Economic Association, 5(1),

1123–1175.

SOMMER, MARTIN (2007): “Habit Formation and Aggregate Consumption Dynamics,” The

B.E. Journal of Macroeconomics—Advances, 7(1), Article 21.

VISSING-JØRGENSEN, ANNETTE (2002): “Limited Asset Market Participation and the

Elasticity of Intertemporal Substitution,” Journal of Political Economy, 110(825–53),

339–357.

WILCOX, DAVID W. (1992): “The Construction of the U.S. Consumption Data: Some Facts

and Their Implications for Empirical Research,” American Economic Review, 82(4), 922–941.

WORKING, HOLBROOK (1960): “Note on the Correlation of First Differences of Averages in

a Random Chain,” Econometrica, 28(4), 916–18.

reflects the strength of habits (if

reflects the strength of habits (if  , the model

collapses to the Hall random walk model); in the sticky information model,

, the model

collapses to the Hall random walk model); in the sticky information model,

is the fraction of aggregate expenditure by households that have

not fully updated their information set about the latest macroeconomic

developments (and again,

is the fraction of aggregate expenditure by households that have

not fully updated their information set about the latest macroeconomic

developments (and again,  corresponds to the Hall model).

Because the implications of the two frameworks are indistinguishable

in aggregate data, our empirical evidence is consistent with either

model.6

corresponds to the Hall model).

Because the implications of the two frameworks are indistinguishable

in aggregate data, our empirical evidence is consistent with either

model.6

![Δ log C = ς + χ E [Δ log C ] + η E [Δ log Y ] + α E [a ] + ϵ ,

t t- 2 t- 1 t- 2 t t- 2 t- 1 t](cssIntlStickyC31x.png)

![Δ logCt = ς + χEt-2[Δ logCt-1]+ η Et- 2[Δ logYt]+ α Et-2[at-1]](cssIntlStickyC128x.png)

![Δ log C = ς + χ E [Δ log C ] + ηE [Δ log Y ] + αE [a ]

t t-2 t- 1 t-2 t t-2 t-1](cssIntlStickyC808x.png)

![Δ log Ct = ς + χEt- 2[Δ logCt- 1]+ ηEt-2[Δ log Yt]+ αEt-2[at- 1]](cssIntlStickyC1059x.png)

![⌊ * ⌋

Δ log Ct

|| ut ||

Δ logC = c + [100100 ]|| - ut + θΔut || + 0,

t 0 || Δut + θΔut -1 ||

⌈ vt ⌉

vt- 1](cssIntlStickyC2028x.png)