2021-11-16, Christopher D. Carroll qModel

This handout presents a discrete-time version of the Abel (1981)-Hayashi (1982)

marginal model of investment.

A corresponding Jupyter Notebook implements numerical solutions to the model using HARK and dolo.

To simplify some algebra, we assume that a unit of investment purchased

in period does not become productive until

; the cost at

reflects the present discounted value of the period-

price of

capital.1

Adjustment costs are priced the same

way.2

3

4

The model assumes that firms maximize the net profits payable to

shareholders, definable as the present discounted value of after-tax revenues after

subtracting off costs of investment:

|

| (1) |

Next period’s capital is what remains of this period’s capital after depreciation, plus current investment,5

|

| (2) |

If capital markets are efficient, will also be the stock market value

(‘equity’ is the mnemonic) of the profit-maximizing firm because it is precisely

the amount that a rational investor will be willing to pay if they care only

about discounted after-tax income derived from owning (a share of) the

firm.

We can simplify by thinking about the firm’s shareholders as the suppliers of

physical capital, not just financial capital. In this interpretation, represents

not just the value of the physical machinery owned by the firm, but also the

number of shares of stock outstanding in the firm. We can think of the firm in

this way if we suppose that every time the firm purchases new physical capital, it

does so by issuing new shares at a price equal to the marginal valuation of the

firm’s capital stock, purchasing the unit of capital at the price given by the

after-tax cost of that capital (and after paying any associated adjustment

costs).6

The Bellman equation for the firm’s value can be derived from

|

| (3) |

which is equivalent to

|

| (4) |

and defining as the derivative of adjustment costs with respect to the level

of investment,7

the first order condition for optimization with respect to

(or, equivalently,

) is

|

| (5) |

Thus: The PDV of the marginal cost (after tax, including adjustment costs) of an additional unit of investment should match the discounted expected marginal value of the resulting extra capital.

Recalling that , the Envelope theorem for this problem can be

used on either (3) or (4):

|

| (6) |

and equivalently for period so that (5) can be rewritten as the Euler

equation for investment,

|

| (7) |

It will be useful to define the net investment ratio as the Greek letter

(the absence of a dot distinguishes

from the level of investment

),

|

| (8) |

which measures how much investment differs from the proportion necessary

to maintain the capital stock unchanged. It has derivatives

|

| (9) |

We now specify a convex (quadratic) adjustment cost function as

|

| (10) |

with derivatives

|

| (11) |

so the Euler equation for investment (7) can be written

|

| (12) |

To begin interpreting this equation, consider first the case where the costs of

adjustment are zero, . In this case

and the Euler equation

reduces to

|

| (13) |

Simplifying further, suppose that capital prices are constant at and

the ITC is unchanging so that the after-tax price of capital is constant at

.

Then since

, the equation becomes

|

| (14) |

This says that the cost of buying one unit of capital, , is equal to the

opportunity cost in lost interest plus the value lost to depreciation,

,

which must match the (after-tax) payoff from ownership of that capital. This

corresponds exactly to the formula for the equilibrium cost of capital in the

HallJorgenson model: In the presence of an investment tax credit at rate

,

the after-tax price of capital is

, and the firm will adjust its holdings of

capital to the point where

|

| (15) |

Now define as the marginal value to the firm of ownership of one

more unit of capital at the beginning of period

; using this definition the

envelope condition can be written

|

| (16) |

where the last approximation uses in the form

. (16) can be rearranged as

|

| (17) |

This equation can best be understood as an arbitrage equation

for the share price of the company if capital markets are

efficient.8

The first term on the RHS is the flow of income that would be obtained

from putting the value of an extra unit of capital in the bank. The term in

brackets

is the flow value of having an extra unit of capital inside the firm:

Extra after-tax revenues are measured by the first term, the second term

accounts for the effect of the extra capital on costs of adjustment, and the final

term reflects the cost to the firm of the extra depreciation that results from

having more capital.

Think first about the case, in which the firm’s value, share

price, and size will be unchanging because the marginal value of capital inside

the firm is equal to the opportunity cost of employing that capital outside the

firm (leaving it in the bank). If these two options yield equivalent returns, it is

because the firm is already the ‘right’ size and should be neither growing nor

shrinking.

Now consider the case where , because

|

| (18) |

This says that an extra unit of capital is more valuable inside the

firm than outside it, which means that 1) is above its steady-state

value; 2) the firm will have positive net investment; and 3) the firm’s

share value will be falling over time (because the level of its share value

today is high, reflecting the fact that the high marginal valuation

of the firm’s future investment has already been incorporated into

9

Now define ‘marginal ’ as the value of an additional unit of capital inside

the firm divided by the after-tax purchase price of an additional unit of

capital,

|

| (19) |

The investment first order condition (5) implies

|

| (20) |

which constitutes the implicit definition of a function

|

| (21) |

and notice that this implies

The capital accumulation equation can be rewritten as

|

| (22) |

To construct a phase diagram involving , we need to transform our equation

(16) for the dynamics of

into an equation for the dynamics of

. As a

preliminary, define the proportional change in the after-tax price of capital

as

|

| (23) |

Recalling that , dividing both sides of (16) by

yields

|

|

Now assuming that ,

,

, and

are all ‘small’ so that their

interactions are approximately 0, we have

|

| (24) |

Simplifying further, if the ITC is unchanging, and the pretax price of capital is

unchanging at , and

, (24) becomes

|

| (25) |

where

|

| (26) |

combines the effects of the corporate tax and the investment tax credit into a single tax term.

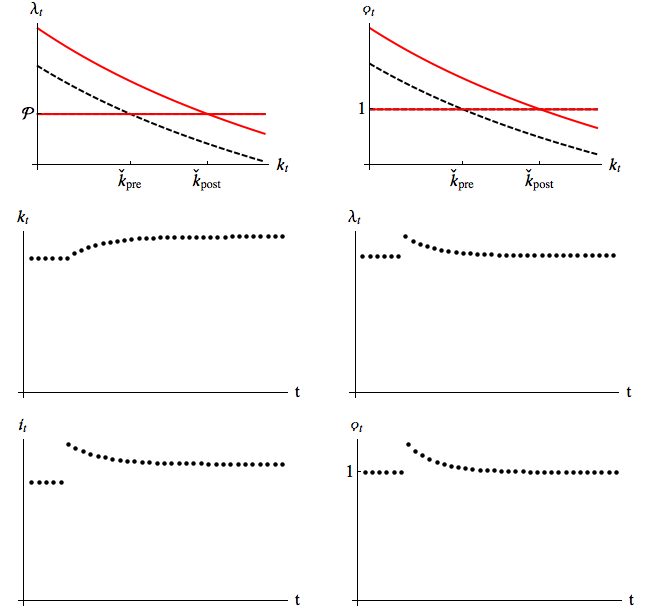

Figure 1 presents two phase diagrams, one for and

and one for

and

.

For most purposes, diagram is simpler, because our facts about the

function imply that the

locus is always a horizontal line at

.

This is because

always corresponds to the circumstance in which the

value of a unit of capital inside the firm,

, matches the after-tax cost of a unit

of capital,

;

is the only value of

at which the firm does not wish to

change size (

).

The slope of the locus is easiest to think about near the steady

state value of

where we can approximate

.

Pick a point on the locus. Now consider a value of

that

is slightly larger. From (25), at the initial value of

we would have

. Thus, the value of

corresponding to

must

be one that balances the higher

by a higher value of

, which is to say a

lower value of

. This means that higher

will be associated with lower

so

that the locus is downward-sloping.

For appropriate choices of parameter values the problem satisfies the usual conditions for stability and will therefore have a saddle path solution, as depicted in the diagram.

The diagram is virtually indistinguishable from the

diagram; the

only difference is that the

locus is located at the point

(i.e. the marginal value of investment is equal to the price of a unit

of investment). The distinction between the diagrams reflects the fact

that an increase in the investment tax credit will result in a rise in the

steady-state value of

which implies a fall in the pretax marginal product of

capital.

The key to understanding the model’s dynamics (as, really, with all

infinite horizon models) is to figure out the steady state toward which it is

heading, then to work out how it gets there. The key to the steady state,

in turn, is that the capital stock will eventually reach a point where

.

Suppose that the production function for the firm suddenly, permanently, and

unexpectedly improves; specifically, leading up to period the firm was in

steady state, but in periods

and beyond the production function will be

for some

where

and

indicate the production

functions before and after the increase in productivity.

Note first that none of the tax terms has changed, and in the long run there

is nothing to prevent the firm from adjusting its capital stock to the

point consistent with the new level of productivity and then leaving

it fixed there so that . Thus (25) implies that at the new

steady state

we will have

which

implies

, since the steady state value of

never changes:

. That is, with higher productivity, the equilibrium capital stock is

larger, but the equilibrium tax adjusted marginal product of capital is the

same.

Obviously in order to get from an initial capital stock of to a larger

equilibrium capital stock of

the firm will need to engage in investment in

excess of the depreciation rate, incurring costs of adjustment. In the

absence of a change in the environment, expected costs of adjustment will

always be declining toward zero, because the firm’s capital stock will

always be moving toward its equilibrium value in which those costs are

zero.

So we can tell the story as follows. Suppose that leading up to period the

firm was in its steady-state. When the productivity shock occurs,

jumps up.

had been zero (because the firm was at steady state), but now the firm

wishes it had more capital because extra capital would reduce future adjustment

costs (the firm knows that its old steady-state capital stock is now too small,

so it will have to be engaging in

for a while), so

becomes

negative (that is, the firm knows that having more capital will reduce

the adjustment costs associated with the higher investment that it will

be undertaking). The combination

therefore becomes a

larger positive number, so at the initial level of

the RHS of (25)

would imply

less than zero, so the new

locus

must be higher (because the equilibrating value of

is higher for any

). The saddle path is therefore also higher. So

, and therefore

,

jump up instantly when the new higher level of productivity is revealed,

corresponding also to an immediate increase in the firm’s share price (the

marginal valuation of an additional unit of capital), since

has not

changed.

The phase diagrams with the saddle paths before and after the productivity increase together with the impulse response functions are plotted in figure 2.

Again starting from the steady state equilibrium, suppose unexpectedly

and permanently decreases, which could happen because of a cut in

corporate taxes or an increase in the ITC. (25) implies that in steady

state

|

| (27) |

Dynamically, the story is as follows. (25) implies that following the tax

change the locus must be higher because at any given

the

term is a larger negative number, while at the initial

the

term is also now negative; so the

locus shifts

up.

In contrast to the case with a productivity shock, the equilibrium marginal product of capital will be lower than before. Arbitrage equalizes the after-tax marginal product of capital with the interest rate, but with a lower tax rate, that equilibration will occur at a higher level of capital.

Notice that the qualitative story is the same whether the change in is due

to a permanent reduction in the corporate tax rate (increase in

) or a

permanent increase in the investment tax credit (reduction in

). In either case,

and investment jump upward at time

and then gradually decline back

downward (though the equilibrium level of investment is higher than before the

change).

There is, however, one interesting distinction between a decrease in

due to a reduction in corporate taxes and a decrease caused by an

increase in

. Since

, an increase in

reduces

and therefore

reduces the equilibrium value of

, while a change in

has no effect on

equilibrium

. This reflects a subtle distinction.

is the after-tax

marginal value of extra capital, and the equilibrium in this model will occur

at the point where that marginal value is equal to the marginal cost.

Changing

changes that marginal cost, so it changes the equilibrium

after-tax marginal value. Changing

does not change the marginal

cost of capital, so the equilibrium after-tax marginal value of capital

is unchanged. The marginal product of capital is lower after a tax cut

(equilibrium

is smaller), but that is exactly counterbalanced by the larger

value of

so that

is unchanged in the long run by the change in

.

The phase diagrams with the saddle paths before and after the corporate tax

reduction and the ITC increase, together with the impulse response functions,

are respectively plotted in figures 3 and 4. Note that the saddle path actually

jumps downward after the ITC increase. This is not an error; rather, recall that

reflects marginal value of a unit of capital inside the firm, and recall that the

price of purchasing that capital has gone down. Remembering that we are

assuming that capital can move in and out of the firm, this has the surprising

consequence that, for the original owners of the firm, the ITC is bad

news because it means that the capital they own has a lower value (its

value is ultimately tied to the price of capital, which has gone down).

For a potential new shareholder, the investment tax credit means that

you can obtain ownership of a share of the firm’s capital by buying the

capital at the ITC-discounted price, paying the adjustment costs, then

giving the capital to the firm. Thus, the ITC has the effect of increasing

the absolute value of a dollar of money relative to the value of a unit

of capital inside the firm. So in this special case, you should think of

the ITC as something that provides a discount to purchasing shares or

capital

. While the new saddle path for

is lower than the old one,

that does not reflect the adjustment for the fact that the new capital is

being purchased at a cheaper price. The dynamics of

, in this case, are

more intuitive than those of

:

unambiguously increases, reflecting

the fact that the value of capital to the firm exceeds its new (cheaper)

cost.

In sum: In terms of effects on capital, the outcome from a corporate tax cut

and an ITC tax cut are similar, but the analytics of are different, because the

former affects the after-tax interest rate while the latter affects the after-tax cost

of capital.

Now consider a circumstance where the firm knows that at some date in the

future, , the level of productivity will increase so that

for

.

The long run steady state is of course the same as in the example where the increase in productivity is immediately effective.

To determine the short run dynamics, notice several things. First, there can be

no anticipated big jumps in the share price of the firm (the marginal

productivity of capital inside the firm). Thus, if the productivity jump

occurs in period and the time periods are short enough, we must

have

|

| (28) |

But because the equilibrium capital stock is larger, we know that

and will stay negative thereafter (asymptoting to zero from below). This reflects

the fact that if you know you will need higher capital in the future, the most

efficient way to minimize the cost of obtaining that capital is to gradually start

building some of it even before you need it, rather than trying to do it all at

once. Note further that before period

the model behaves according to the

equations of motion defined by the problem under the

parameter

values,10

while at

and after it behaves according to the new

equations of

motion.

Putting all this together, the story is as follows. Upon announcement of the

productivity increase, jumps to the level such that, evolving exactly

according to its

equations of motion, it will arrive in period

at

a point exactly on the saddle path of the model corresponding to the

equations of motion. Thereafter it will evolve toward the steady

state, which will be at a higher level of capital than before,

,

because the greater productivity justifies a higher equilibrium capital

stock.

Thus, jumps up at time

, evolves to the northeast until time

, and

thereafter asymptotes downward toward the same equilibrium value it had

originally before the productivity change. Since

has not changed, the

dynamics of

and

are the same as those of

.

Consider now the consequences if a surprise increase in the investment tax credit

is passed at date that will become effective at date

.

Inspection of (25) might suggest that the effects of a future tax cut would be

identical to the effects of a future increase in , since the terms enter

multiplicatively via

. And indeed, with respect to the dynamics of

the

two experiments are basically the same. And of course the steady-state value of

is always equal to one.

During the transition, however, has interesting dynamics. From periods

to

, the ITC does not change, leaving

and the after-tax

marginal product of capital unchanged, and so the dynamics of

are basically

the same as those of

But between

and

,

cannot jump

but

does jump, which implies that

must jump (so there is a predictable

change in

).

Dynamics of investment are determined by dynamics of , so the path of

is: At

, a discrete jump up; between

and

, a gently

rising path; between

and

, an upward jump; and after

, a path that asymptotes downward toward the steady state level of

investment.

The steady-state effects on are of course determined by the same

considerations as apply to the unanticipated tax cut, so they depend on whether

the tax change is a drop in

or an increase in

.

Figures for a variety of other experiments have been constructed using the notebook. Such figures are contained in the “Figures” subdirectory.

Abel, Andrew B. (1981): “A Dynamic Model of Investment and Capacity Utilization,” Quarterly Journal of Economics, 96(3), 379–403.

Hayashi, Fumio (1982): “Tobin’s Marginal Q and Average Q: A Neoclassical Interpretation,” Econometrica, 50(1), 213–224, Available at http://ideas.repec.org/p/nwu/cmsems/457.html.

House, Christopher L., and Matthew D. Shapiro (2008): “Temporary Investment Tax Inventives: Theory with Evidence from Bonus Depreciation,” American Economic Review, 98(3), 737–768.

Phase diagrams with saddle paths (dashed-black and continuous-red lines respectively pre and post the productivity increase) and impulse response functions