Dynamics of Wealth and Consumption:

New and Improved Measures for U.S. States

March 3, 2012

_____________________________________________________________________________________

Abstract

Case, Quigley, and Shiller (2005) persuasively argue that the well-known

conceptual difficulties in measuring aggregate “wealth effects” might be lessened

by the use of state-level data. Unfortunately, the data required for a convincing

implementation of their idea have been either virtually nonexistent (for financial

wealth) or of questionable quality (for consumption). Our main contributions

are to provide the first directly observed panel data on financial wealth

at the state level, and to construct improved measures of state-level

spending growth. Using these data, we estimate rudimentary “wealth effects”

regressions that find a strong relationship between twice-lagged housing

wealth growth and current spending growth, but we find no relationship

between lagged financial wealth growth and current spending growth.

1Zhou: xia_zhou@fanniemae.com, Federal National Mortgage Association, 3900 Wisconsin Ave, Washington,

DC 20016 2Carroll: ccarroll@jhu.edu, Department of Economics, 440 Mergenthaler Hall, Johns Hopkins

University, Baltimore, MD 21218, http://www.econ2.jhu.edu/people/ccarroll, and National Bureau of

Economic Research.

-

Keywords

-

housing wealth effect, financial wealth effect

-

JEL codes

-

E2, G1

1 Introduction

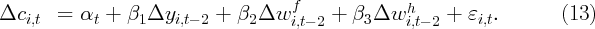

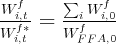

Macroeconomic forecasting models often incorporate a “wealth effect” which

asserts that movements in household net worth cause corresponding

movements in aggregate consumption. U.S. data showing a striking

negative relationship between the wealth-to-income ratio and the

personal saving rate (see Figure 1) are often presented in support of this

proposition, and statistical analysis finds a robust relationship between

aggregate wealth movements and subsequent household spending

growth.

But a skeptic could find plenty of reasons to doubt that this correlation reflects

causation from wealth movements to consumption or saving outcomes. First, the

association could reflect simultaneity. For instance, any shock to consumers’

optimism or pessimism could have an impact on housing prices, stock prices, and

consumption growth in the same direction. Second, endogeneity could also reflect

reverse causality of consumption on wealth (for example, a consumption boom

might bid up stock prices as expected profits rise). Finally, simple kinds of

measurement error could lead to the observed association. For example, suppose

that income  is measured with error. By construction, the personal saving

rate,

is measured with error. By construction, the personal saving

rate,  , will also be mismeasured in the same direction

as

, will also be mismeasured in the same direction

as  . At the same time, the measured wealth-income ratio

. At the same time, the measured wealth-income ratio  will be biased in the opposite direction, generating a spurious negative

relationship.

will be biased in the opposite direction, generating a spurious negative

relationship.

In an effort to get around these problems, a substantial literature has turned to

micro data. But household-level data suffer from serious measurement

problems. There is a very limited choice of household-level data available

for carrying out such studies in the U.S. For instance, the Panel Study

on Income Dynamics (PSID) only measures food consumption, while

the Consumer Expenditure Survey (CEX) has detailed but noisy data

on household expenditures and poor financial information. The Survey

of Consumer Finances (SCF) provides no measure of consumption at

all.

An alternative approach, one that potentially avoids some of the problems

related to both aggregate and household-level data, is to use regional

data. First, if there is sufficient variation across regions, the endogeneity

problem might be mitigated. For instance, consider a region-specific shock

to consumers’ confidence, one that might also have a large impact on

the consumption behavior of households in the region. However, if a

well-integrated stock market exists, this region-specific shock might not have as

great an impact on stock prices of persons who live in the region as a

corresponding aggregate shock to confidence would have on aggregate stock

prices. Therefore, the endogeneity problem between local wealth and local

consumption is alleviated to some extent. Furthermore, it can be argued that

regional data provides more comprehensive and better measures of the

relevant variables than household-level data. Finally, regional data is

more likely to cover a longer time period and therefore allow for richer

dynamics.

Case, Quigley, and Shiller (2005) pioneered the estimation of wealth effects

using regional data. We improve on their efforts in several ways. Most notably,

after showing that CQS used a flawed method to construct state-level

financial wealth, we construct a new panel dataset of financial wealth

for U.S. states, using anonymous proprietary account-level records of

geographic wealth holdings. We will argue that our new financial wealth

dataset is much more accurate than existing alternative measures used

previously in the literature. Another contribution of this paper is to construct

a significantly improved state-level proxy for consumption data. Our

two new datasets are then combined to provide new estimates of how

household spending changes following movements in stock and housing

wealth.

The rest of the paper is organized as follows: Section 2 reviews the related

literature; Section 3 discusses the limitations of the currently available state-level

consumption and stock wealth datasets; Section 4 describes the newly

constructed data; and Section 5 presents the model specification and regression

results, then uses those results to calculate the estimated contribution of

disparate cross-state housing wealth movements to differences in the runup in

consumption spending (prior to 2008) and the subsequent decline (after 2008).

Some very rough calculations suggest that only a small portion of the

post-2008 decline in spending can be attributed to the effects of housing price

declines (though the estimated long lags in the housing wealth effect

suggest that spending weakness may continue for some time). Section 6

concludes.

2 Recent Evidence

The existing literature on whether the marginal propensity to consume

(MPC) differs out of different components of wealth is small. Davis and

Palumbo (2001b) compared the stock market wealth effect with the

non-stock-market wealth effect using U.S. aggregate data. The results, derived

from a cointegration analysis, are, however, sensitive to model specification. The

long-run effects of both types of wealth are estimated to be about the same (i.e.,

0.06 for stocks and 0.08 for non-stocks) when the level of variables is used. Using

logarithms, however, the results show an elasticity for non-stock wealth four

times greater than that for stock wealth; this implies that the MPC

out of non-stock wealth is at least twice as large as the MPC out of

stock wealth. Additionally, using aggregate data (though applying a

different method), Carroll, Otsuka, and Slacalek (2011) reported an

immediate MPC out of housing wealth of about 1.5 cents and an immediate

stock wealth MPC of 0.75 cents. This difference, however, is statistically

insignificant.

Levin (1998) appears to be the first study in the U.S. to use household-level

data to estimate the differential effect of housing and stock wealth. Using the

Retirement History Survey, Levin found that housing wealth has essentially no

effect on consumption. Out of eight spending categories, only three reported a

statistically significant difference between the respective coefficients for

liquid and housing wealth. This finding contradicts the studies using

aggregate data summarized above. A possible reason could be the fact

that every interviewee in the survey is at least 65 years old. If elderly

people tend to view housing wealth more as consumption than as an

investment item, their housing wealth effect will be lower than would

otherwise be the case. Using the CEX and SCF, Bostic, Gabriel, and

Painter (2009) find that, while incorporating all households in their sample,

there is no evidence for an important housing wealth effect. Among home

owners, however, the housing wealth elasticity is found to be consistently

significant and larger than the stock wealth elasticity. Their paper also

suggests different consumption behaviors for credit-constrained versus non

credit-constrained samples. Using household-level data in the U.K., Campbell

and Cocco (2007) found the response of household consumption to housing

prices is rather large and significant. They also provide evidence for the

heterogeneity of this response. More specifically, the estimated housing

price elasticity is as large as  for old home-owners but near zero

for young renters. Attanasio, Blow, Hamilton, and Leicester (2009),

however, found a larger relationship between consumption and house

prices for younger households. The authors then suggested that both

consumption and house prices are responding to some common factors.

Using a different British household-level dataset, Disney, Gathergood,

and Henley (2010) found a small housing wealth effect of

for old home-owners but near zero

for young renters. Attanasio, Blow, Hamilton, and Leicester (2009),

however, found a larger relationship between consumption and house

prices for younger households. The authors then suggested that both

consumption and house prices are responding to some common factors.

Using a different British household-level dataset, Disney, Gathergood,

and Henley (2010) found a small housing wealth effect of  after

controlling for financial expectations, without which the estimated housing

wealth effect would be significantly biased up. If simultaneity of this kind

can be found even in micro data, where it should be harder to find, it

appears to justify the concern with simultaneity problems using aggregate

data.

after

controlling for financial expectations, without which the estimated housing

wealth effect would be significantly biased up. If simultaneity of this kind

can be found even in micro data, where it should be harder to find, it

appears to justify the concern with simultaneity problems using aggregate

data.

The best known paper using geographical data is Case, Quigley, and

Shiller (2005). Using quarterly U.S. state-level data for 1982 through 1999,

the authors found a significant housing wealth elasticity of about  percent, but an economically negligible stock wealth elasticity under most

model specifications. When using a panel of annual data for 14 developed

countries, they found an even larger housing wealth elasticity, in the range of

percent, but an economically negligible stock wealth elasticity under most

model specifications. When using a panel of annual data for 14 developed

countries, they found an even larger housing wealth elasticity, in the range of

percent. Nonetheless, under all cases, they found no evidence

for an important stock wealth effect. Case, Quigley, and Shiller (2011)

extended their state-level data up to 2009 and applied the same technique

to address the wealth effect question. Similar to their previous study,

the authors found significant and rather large housing wealth effect on

consumption and consistently found larger housing wealth effect than

stock wealth effect. However, after including data during

percent. Nonetheless, under all cases, they found no evidence

for an important stock wealth effect. Case, Quigley, and Shiller (2011)

extended their state-level data up to 2009 and applied the same technique

to address the wealth effect question. Similar to their previous study,

the authors found significant and rather large housing wealth effect on

consumption and consistently found larger housing wealth effect than

stock wealth effect. However, after including data during  ,

the recent housing market meltdown, the authors found that increases

and declines in the housing market have equally important effects on

consumer spending, which contradicts their previous findings. Bayoumi and

Edison (2003) used data for 16 industrial countries and found significant

wealth effects for most samples and periods. Their estimated housing

wealth effect was consistently larger than their estimated equity wealth

effect. Ludwig and Sløk (2002) found evidence contrary to the studies

cited above. Using annual data from 16 OECD countries, and taking

housing prices and stock market prices as proxies for their respective

wealth components, the authors reported an estimated stock wealth

elasticity twice the estimated housing wealth elasticity. Additionally, both

estimates were found to be positive and statistically significant. On the other

hand, Girouard and Blöndal (2001) also used OECD data, but were

unable to arrive at consistent results when comparing housing wealth

with financial wealth. Dvornak and Kohler (2003), using Australian

state-level data, found a larger stock wealth effect than housing wealth

effect.

,

the recent housing market meltdown, the authors found that increases

and declines in the housing market have equally important effects on

consumer spending, which contradicts their previous findings. Bayoumi and

Edison (2003) used data for 16 industrial countries and found significant

wealth effects for most samples and periods. Their estimated housing

wealth effect was consistently larger than their estimated equity wealth

effect. Ludwig and Sløk (2002) found evidence contrary to the studies

cited above. Using annual data from 16 OECD countries, and taking

housing prices and stock market prices as proxies for their respective

wealth components, the authors reported an estimated stock wealth

elasticity twice the estimated housing wealth elasticity. Additionally, both

estimates were found to be positive and statistically significant. On the other

hand, Girouard and Blöndal (2001) also used OECD data, but were

unable to arrive at consistent results when comparing housing wealth

with financial wealth. Dvornak and Kohler (2003), using Australian

state-level data, found a larger stock wealth effect than housing wealth

effect.

3 Limitations of existing state-level consumption and stock wealth

data

Case, Quigley, and Shiller (2005) relate state-level quarterly spending growth to

measures of quarterly state-level stock wealth and housing wealth for the

U.S. for the period 1982 through 1999, and Case, Quigley, and Shiller (2011)

extend that estimation to 2009. But serious problems afflict their measures of

both financial wealth and consumption.

3.1 Financial Wealth

No direct measures of state-level financial wealth data exist, so CQS had to

construct their own estimates. The best data they were able to find was

occasional information about state-level holdings of mutual funds. In order to

produce a measure of state-level stock wealth, CQS assumed that the ratio of

mutual funds holdings to holdings of other financial assets was identical across

states (and equal to the aggregate value of that ratio), which implies that the

distribution of financial wealth across states can be constructed using

the pattern of mutual fund holdings (for years in which mutual fund

holdings are available). CQS obtained the mutual fund data for the years

1986, 1987, 1989, 1991, 1993, 2008, and 2009. In the absence of data

for other years, they assumed a constant distribution of mutual fund

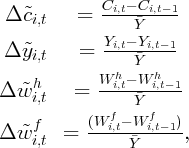

holdings across states for the period  and

and  .

During those years, then, movements in the stock wealth of each state

is assumed to mimic the movement of aggregate stock wealth. From

1999 to 2008, they assume that the ratio of mutual fund assets to total

assets increases linearly so that it matches the aggregate figure in 1999

and 2008. (2008-2009 is the only pair of adjacent years in which the

relevant data are available in both years to construct their measure without

interpolation).

.

During those years, then, movements in the stock wealth of each state

is assumed to mimic the movement of aggregate stock wealth. From

1999 to 2008, they assume that the ratio of mutual fund assets to total

assets increases linearly so that it matches the aggregate figure in 1999

and 2008. (2008-2009 is the only pair of adjacent years in which the

relevant data are available in both years to construct their measure without

interpolation).

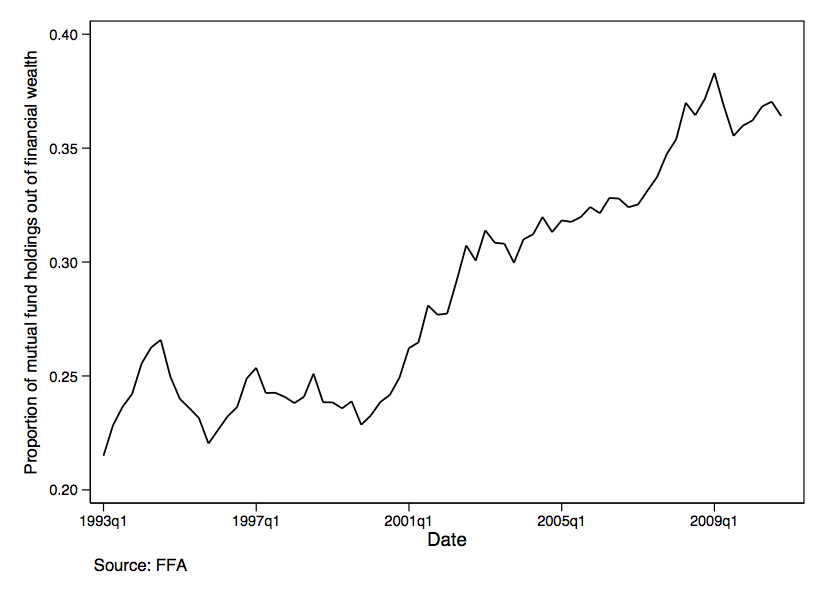

One aspect of their methodology, at least, is subject to test: Their assumptions

about the movements in the ratio of mutual fund holdings to total financial

wealth. Figure 2 plots mutual fund holdings from FFA over the same

period, and shows strong deviations from a linear increase in the ratio of

mutual fund holdings to total financial assets at the aggregate level.

Since aggregate data is the sum of state data, the CQS method must

be producing mismeasurements of the state-level financial wealth data

even if their assumption is correct that the ratio of mutual fund to total

financial assets is identical across states. In principle, mismeasurement of

a regressor tends to bias its coefficient toward zero; so an unfriendly

interpretation of the CQS finding that the ‘financial wealth effect’ is small

might be that this is because their measure of financial wealth changes is

noisy.

3.2 Consumption

To the best of our knowledge, there exist three distinct state-level sources of

consumption data – those used by Asdrubali, Sorensen, and Yosha (1996); Case,

Quigley, and Shiller (2005) and Case, Quigley, and Shiller (2011); and Garrett,

Hernàndez-Murillo, and Owyang (2004). Of these, only CQS utilized the data

to examine wealth effects. The consumption data used by Asdrubali,

Sorensen, and Yosha (1996), and CQS used estimates of retail sales

obtained from private sector sources. However, in both cases, the quality of

these data derived from the private sources is questionable. First, the

methodology used in the data construction is never explicitly revealed by

either private source. Second, retail sales are presented for states that

do not implement sales tax, which constitutes perhaps the single most

important source for calculating state retail sales after the Census Bureau

ceased reporting monthly retail sales by state, in 1997. Last but not

least, both sources vaguely note that important state-level variables

like wage and employment data are incorporated into the estimation of

retail sales. As a result, use of these data is likely to generate unreliable

estimations of the relationship between consumption and any variable

that is correlated with wages or employment. (For example, a finding

that ‘consumption growth is related to the predictable component of

wage growth,’ a classic test of the permanent income hypothesis, would

obviously be spurious if the measure of consumption was generated by

imputation from wage growth data; the vague descriptions of the private firms’

data construction methods suggest that this is more than a hypothetical

problem.)

Given these problems, we are skeptical of the empirical results of any study

that uses data from these private sources. (For considerably more discussion of

these sources and their doubtful properties, see Zhou (2010)).

More promising is the method of Garrett, Hernàndez-Murillo, and

Owyang (2004), who computed quarterly retail sales by dividing sales tax

revenue by the sales tax rate. In principle this could potentially yield a good

measure of state retail sales, and this method therefore provides the basis of the

measure of spending growth measure we use in this paper. One problem,

however, is that the sales tax revenues are occasionally measured with serious

errors; this results in observations with unreasonably large consumption

variations and apparent outliers. We carefully examined these events and found

that many of them could be explained, and many of those that could not be

explained were nevertheless obviously errors. Thus, our dataset “cleans up”

these outliers and thereby improves upon the data used in Garrett et. al.

(2004).

4 Data Description

This paper uses a panel dataset for  U.S. states as well as Washington,

D.C., at a semiannual frequency for the period 2001 through 2005. The

newly constructed datasets are for stock wealth and consumption at the

state level. Other important variables include after-tax labor income

and housing wealth. All are expressed in real per capita terms. There is

evidence that the new data are more comprehensive and accurate than

other existing alternatives. Some important findings will be discussed

in the rest of this section. More detailed discussions can be found in

Zhou (2010).

U.S. states as well as Washington,

D.C., at a semiannual frequency for the period 2001 through 2005. The

newly constructed datasets are for stock wealth and consumption at the

state level. Other important variables include after-tax labor income

and housing wealth. All are expressed in real per capita terms. There is

evidence that the new data are more comprehensive and accurate than

other existing alternatives. Some important findings will be discussed

in the rest of this section. More detailed discussions can be found in

Zhou (2010).

4.1 Stock wealth data

We obtained anonymous account-level records on financial wealth holdings at the

ZIP+4 Code level from a private company. At the end of each semiannual cycle,

that company collects data from more than  leading financial institutions in

its network. Reporting institutions include major banks, brokerage firms,

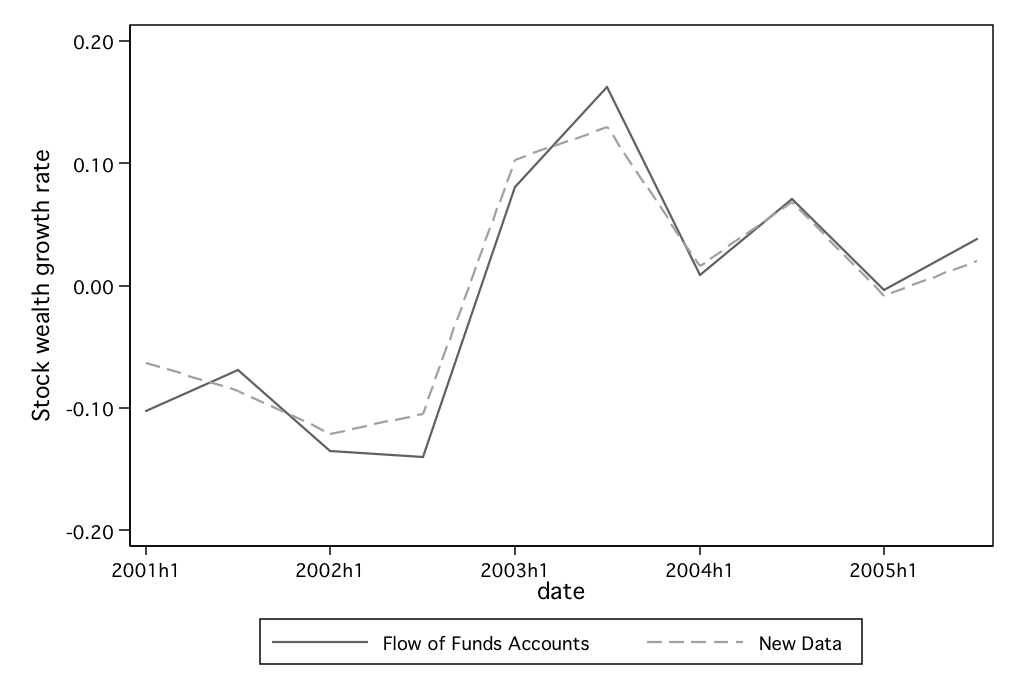

insurance companies and mutual fund dealers. Aggregate stock wealth growth

rates, as measured by both the Flow of Funds Accounts (FFA) and the new

dataset between 2000h1 and 2005h2, are presented in Figure 3. Despite using

completely different data sources, Figure 3 shows that the two series move

similarly to one another, suggesting that the new data is representative of the

nation as a whole.

leading financial institutions in

its network. Reporting institutions include major banks, brokerage firms,

insurance companies and mutual fund dealers. Aggregate stock wealth growth

rates, as measured by both the Flow of Funds Accounts (FFA) and the new

dataset between 2000h1 and 2005h2, are presented in Figure 3. Despite using

completely different data sources, Figure 3 shows that the two series move

similarly to one another, suggesting that the new data is representative of the

nation as a whole.

Stock market wealth is defined as the sum of directly and indirectly

held stocks and equity mutual funds (‘indirectly’ held assets are,

e.g., IRA and Keogh accounts). Stock wealth growth is constructed

using a consistent method for all 50 states plus the District of

Columbia.

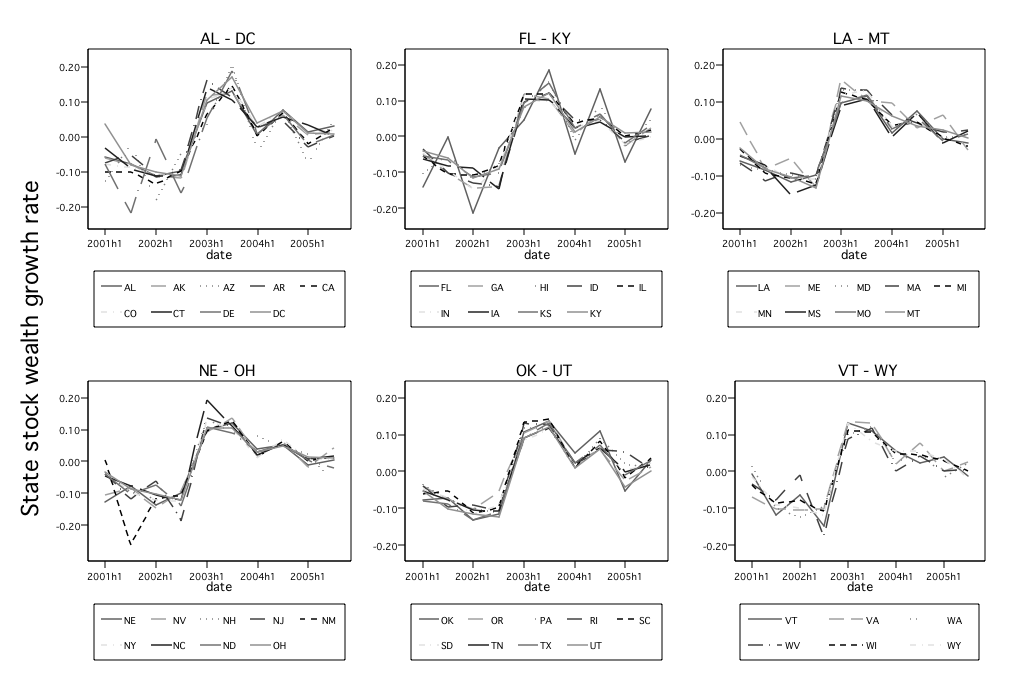

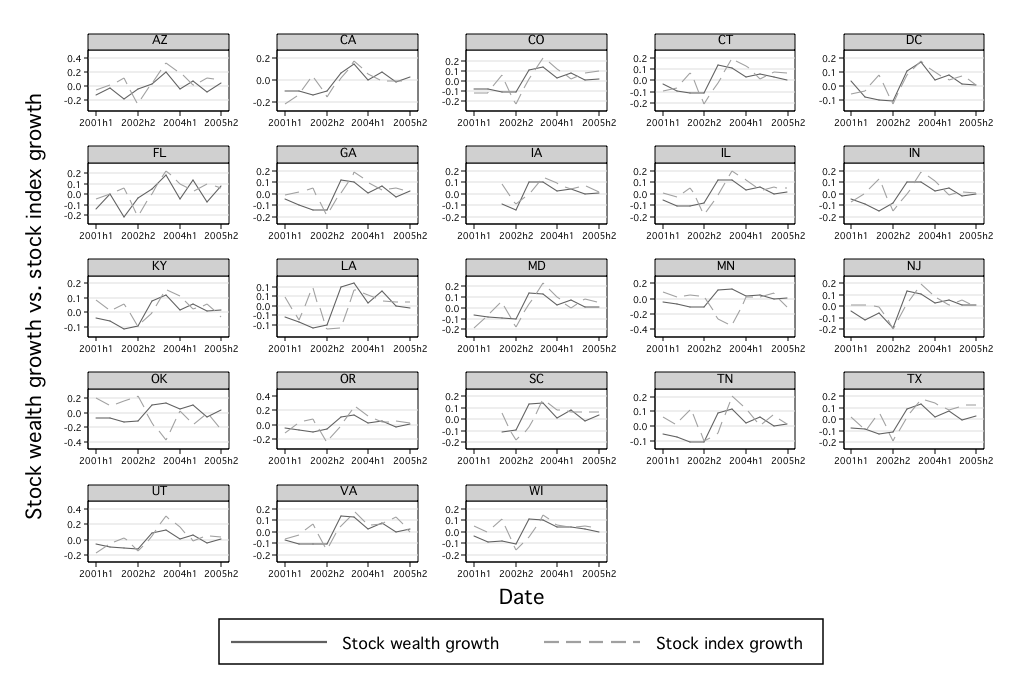

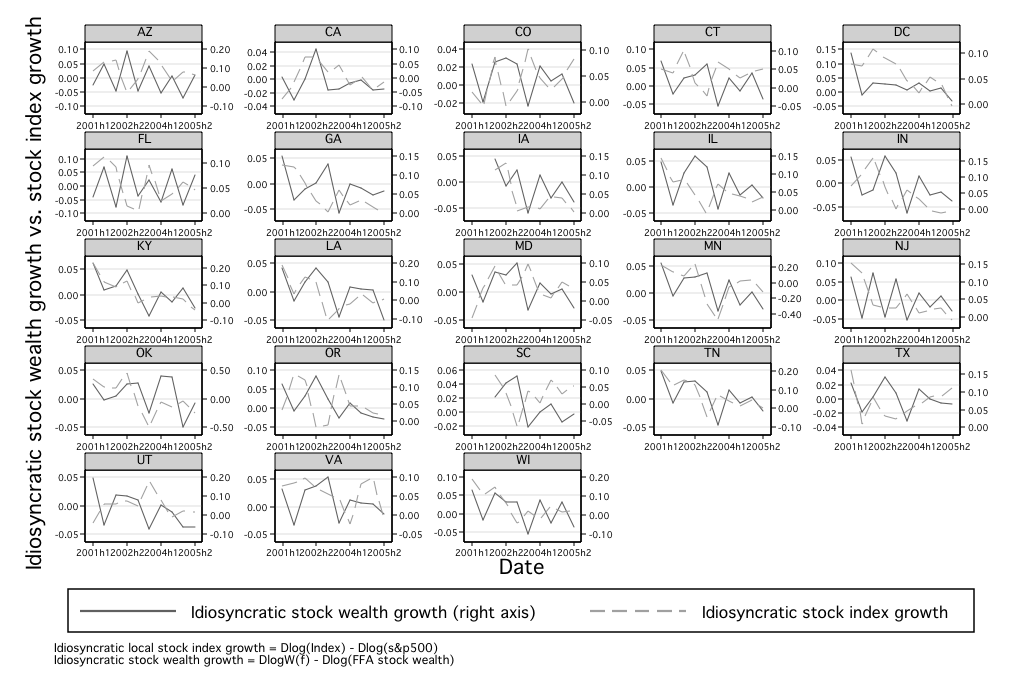

The geographic distribution of stock wealth growth is plotted in Figure 4. We

find similar patterns across states, something to be expected given the fact that

the U.S. stock market is so well integrated. Since there exists no alternative

state-level wealth data for comparisons, we use stylized facts about the U.S. to

understand if the state heterogeneity manifested in the figure reflects

reality.

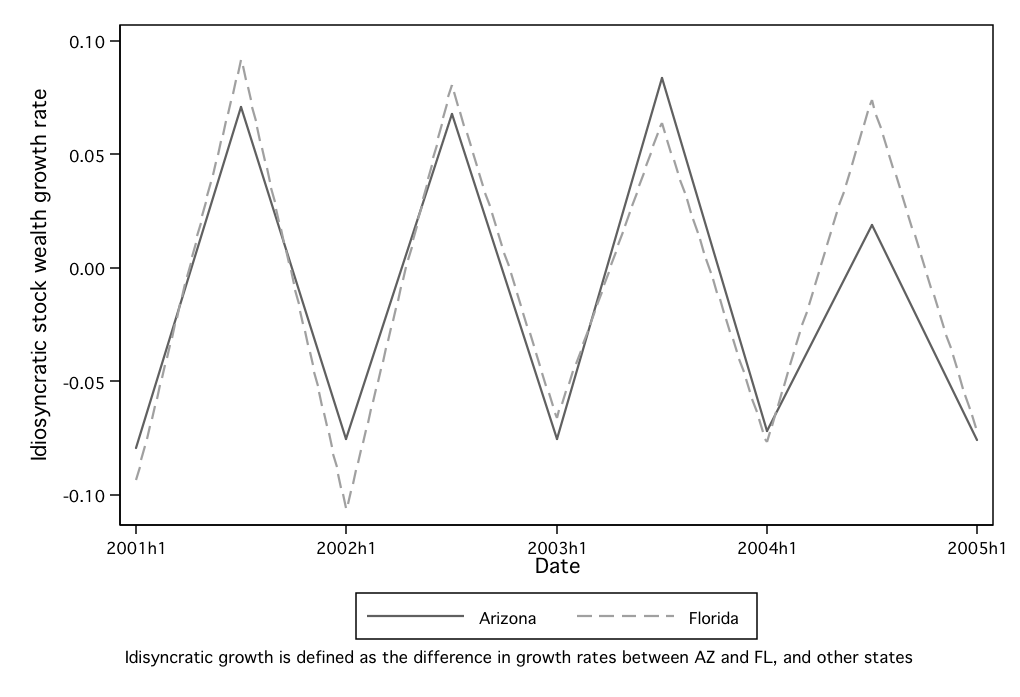

Florida and Arizona are the two states that have the highest percentage of

retired people. As reflected in Figure 4, their seasonal patterns also distinguish

them from other states. In order to better illustrate the differences, Figure 5

compares the stock wealth growth of Florida and Arizona with the average stock

wealth growth of the other states. It indicates that Florida and Arizona have a

much higher stock wealth growth rate than the other states during the second

half of each year, and a much lower stock wealth growth rate during the first half

of each year. This phenomenon might seem strange at first glance, but is actually

an outcome of the “snow-bird effect.” In the U.S., many retired people

tend to move to Florida and Arizona during the winter and then move

back to their permanent residences once the winter is over. If some such

individuals update their physical mailing addresses with their financial

institutions when they relocate, they effectively bring their assets along with

them.

Figures 5 therefore provide evidence that the data are indeed capable of

capturing state-level variations that are both meaningful and independent of

aggregate movements. (The patterns here also motivate our use of year-over-year

growth averages in our empirical work, to avoid seasonal patterns of the kind

identified here).

We exerted substantial effort to find any other measure of state-level financial

resources with which the new data could be compared, without great success.

The most plausible indicator is from Bloomberg, which reports local stock

indices for 23 states; the literature on the “home bias” of investments would lead

us to expect that the growth of this variable to be positively but not

perfectly correlated with local stock wealth growth. Figure 6 presents the

correlation between the local stock index and local stock wealth, broken

down graphically. Out of the 23 calculated correlations, we find only 2

negative numbers. At the state-specific growth level, defined as state

growth minus the U.S. national component, there are still 15 positive

correlations. These facts further provide supporting evidence that the data

is correlated with the true distribution of stock market wealth across

states.

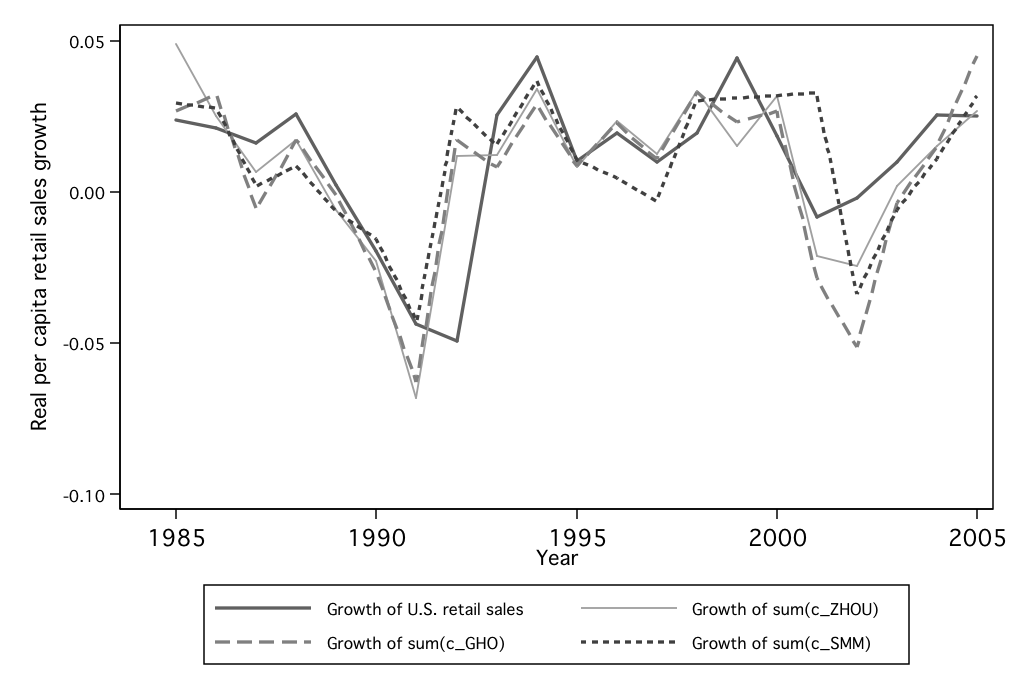

4.2 Consumption data

Since measures of personal consumption expenditure (PCE) at the state level are

not available in the U.S., retail sales are used as a proxy for consumption. In the

U.S., national retail sales account for roughly half of PCE, and The Retail Trade

Survey is probably the single most important source for the national

PCE estimation carried out by the Bureau of Economic Analysis (BEA).

Actually, for nonbenchmark-year estimates for most categories of PCE,

the retail sales series are used in the interpolation and extrapolation

process, as well as the “control total” calculation for each retail control

group.

These considerations provide us with a rationale for using retail sales in place of

consumption.

However, retail sales data are not directly available in the U.S. at the state

level. Following Garrett, Hernàndez-Murillo, and Owyang (2004), quarterly

state-level general sales tax revenues can be obtained from the Quarterly

Summary of State and Local Government Tax Revenue, published by the U.S.

Census Bureau. Together with general sales tax rates collected from various

sources,

state-level retail sales are computed by dividing the state general sales tax

revenue by the general sales tax rate. One limitation of this method is that

since 5 states do not have retail sales taxes, it can be applied only to 45

states and the District of Columbia. Nevada, however, is dropped in this

study because of its discontinued data report and obvious poor data

quality.

Strictly speaking, the computed retail sales are only one component of true

retail sales, as they exclude items that are either not subject to sales tax or are

part of special tax programs, i.e., liquor and cigarettes. Furthermore, there is

unquestionably serious measurement error in the computed retail sales from a

host of sources (including, for example, imperfect measurement of changes in

retail sales tax rates and the distribution of tax rates across categories of goods).

However, we discovered that 12 states actually directly report (taxable) retail

sales for the same period during which state-level stock wealth data is

available.

These measures are more comprehensive than our computed measure of retail sales,

as they either include all consumption items (such as when government-reported

gross retail sales are used) or at least include those items that are part of special tax

programs.

Furthermore, these government-reported measures should be

more accurate and reliable than the computed ones, since local

governments have access to more information regarding their own

sales tax system and tax collection practices than other people

do.

Ideally, government-reported (taxable) retail sales should be used as a measure

of consumption. However, since they are only available for a limited

number of states, this paper compiles three sets of consumption data

according to the quality of the retail sales data. The first one includes those

12 states that have government-reported retail sales or taxable retail

sales; it is categorized as “Best Data.” The second set is called “Good

Data,” which is the computed retail sales with outliers taken care of. The

third set is called “Combined Data,” and is “Best Data” combined with

“Good Data” whenever the former is not available. Table 1 presents the

summary statistics of each set of consumption data. Please refer to the third

chapter of Zhou (2010) for a more detailed discussion of the consumption

data.

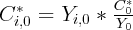

4.3 Data from other sources

Other important variables used in this paper include quarterly after-tax labor

income and housing wealth. After-tax labor income is calculated following

Lettau and Ludvigson (2001). The formula used to construct state-level

housing wealth is similar to the one adopted by CQS, and is given as

follows:

where

where  is the value of the owner occupied housing wealth for state

is the value of the owner occupied housing wealth for state  ;

;  is the home ownership rate, taken from the Census Bureau;

is the home ownership rate, taken from the Census Bureau;  is the

weighted repeat sales housing price index, taken from the Federal Housing

Finance Agency (FHFA); and

is the

weighted repeat sales housing price index, taken from the Federal Housing

Finance Agency (FHFA); and  is the average home price for 1999, taken

from the 2000 Census. Summary statistics of all newly constructed data series

are presented in Table 1.

is the average home price for 1999, taken

from the 2000 Census. Summary statistics of all newly constructed data series

are presented in Table 1.

4.4 Data issues

One important data issue arises here. As mentioned above, all variables except

the stock market wealth are available at quarterly frequencies. To make them

analogous to the stock market wealth, this paper takes their means over

the quarters for each half-year, thus converting them into semiannual

frequencies.

The dataset, however, features evident and sizable seasonal patterns at the

semiannual frequency, especially for the constructed consumption data. We made

a considerable effort at removing these seasonal patterns in a consistent fashion,

but were unable to do so at the semiannual frequency. This is largely because of

the heterogeneity of seasonal patterns across states and the relatively short time

horizon. (Many state governments recommend using longer time spans for more

reliable trends.) It should be recognized that measures of taxable sales (or

revenue) at higher frequencies could be unrepresentative for the purpose of

comparison. This is because of timing errors over the year-long period. The

above consideration persuaded us to use annual growth rates so as to eliminate

seasonal effects, at the cost of fewer observations and thus a reduced regression

power.

Additionally, to avoid a time aggregation problem, annual averages are not

used to calculate growth rates. Instead,  is computed as the log difference

between consumption for the first half of year

is computed as the log difference

between consumption for the first half of year  and for year

and for year  . The first

half was chosen in consideration of the fact that the state fiscal year ends

on June 30th. It is arguable that data collected towards the end of a

fiscal year is more accurate than data collected at any other time of

year.

. The first

half was chosen in consideration of the fact that the state fiscal year ends

on June 30th. It is arguable that data collected towards the end of a

fiscal year is more accurate than data collected at any other time of

year.

4.5 Another look at the new data

Since this paper relies heavily on the two newly constructed datasets, before

examining wealth effects, we report a simple regression of the form

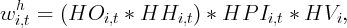

where  denotes the growth rate of a variable, i.e., the log difference of the

variable in real per capita terms. Equation 1 is a simple description of the data

without taking into consideration simultaneity and aggregation problems. Table

3 reports the results for all three datasets. It shows that income growth is

the one variable that consistently has the largest and most significant

coefficient. Perhaps the most interesting finding is that there is evidence

that consumption positively correlates with the growth rates of both

housing wealth and stock wealth when they are regressed separately.

Conversely, whenever income growth is included, their respective coefficients

become much less significant, in connection with the reduced sizes. The

data archive that can produce all results in this study is available from

http://www.econ2.jhu.edu/people/ccarroll/papers/zcWandCdynByState.zip.

denotes the growth rate of a variable, i.e., the log difference of the

variable in real per capita terms. Equation 1 is a simple description of the data

without taking into consideration simultaneity and aggregation problems. Table

3 reports the results for all three datasets. It shows that income growth is

the one variable that consistently has the largest and most significant

coefficient. Perhaps the most interesting finding is that there is evidence

that consumption positively correlates with the growth rates of both

housing wealth and stock wealth when they are regressed separately.

Conversely, whenever income growth is included, their respective coefficients

become much less significant, in connection with the reduced sizes. The

data archive that can produce all results in this study is available from

http://www.econ2.jhu.edu/people/ccarroll/papers/zcWandCdynByState.zip.

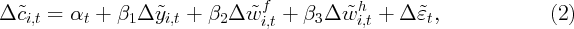

5 Regressions

5.1 Wealth effect estimation

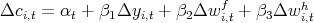

Many studies in the current literature, particularly those that focus on the immediate

response of consumption to wealth, adopt regressions similar to those used in

Equation 1.

However, even if simultaneity problems did not exist, such regressions would not

yield straightforward measures of wealth effects, since they only report the

contemporaneous growth correlation between consumption and wealth.

Worse, in this specification it is not straightforward to test the interesting

hypothesis that stock and housing wealth effects are of equal size (which is

assumed whenever an overall “wealth effect” is estimated, but may not be

true).

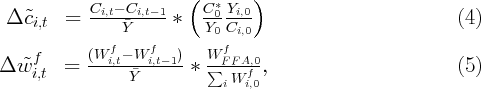

In order to solve this problem, this paper adopts an approach similar to that

employed by Carroll, Otsuka, and Slacalek (2011); those authors use

the ratio of the change in each variable relative to an initial level of

consumption spending. Here, we use average aggregate labor income between

and

and  as the denominator instead. Specifically, if we define

as the denominator instead. Specifically, if we define

where  is the state after-tax labor income at 2000h1, then the following

regression would (in the absence of simultaneity problems) produce direct measures of the

MPC out of the changes in housing wealth and stock wealth.

is the state after-tax labor income at 2000h1, then the following

regression would (in the absence of simultaneity problems) produce direct measures of the

MPC out of the changes in housing wealth and stock wealth.

As with Equation 1, Equation 2 is subject to serious endogeneity problems,

and thus must be considered as simply another description of the data. Table 4

indicates that under this model specification, income change is still the most

correlated variable with respect to consumption.

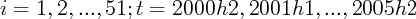

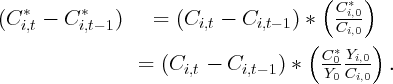

In order to address the endogeneity and simultaneity problems that Equation 2

is subject to, we briefly revisit classic consumption theory. The relationship

between consumption and wealth and income can be described by the

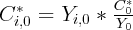

Life-Cycle/Permanent Income Hypothesis. Specifically, a consumer wants to

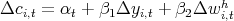

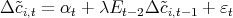

subject to the budget constraint, where  is the time preference, and

is the time preference, and  is

the utility function. If the utility function takes a quadratic form as assumed in

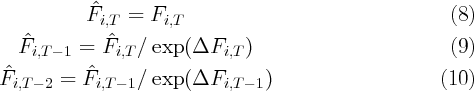

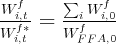

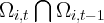

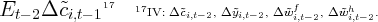

Hall (1978), it can be easily shown that, under certain conditions, consumption

will follow a random walk, i.e., Thus, the theory implies that consumption responds to unexpected shocks only.

In other words, information known to consumers at the time when consumption

choices are made cannot have any predictive power for consumption changes in

any future periods.

is

the utility function. If the utility function takes a quadratic form as assumed in

Hall (1978), it can be easily shown that, under certain conditions, consumption

will follow a random walk, i.e., Thus, the theory implies that consumption responds to unexpected shocks only.

In other words, information known to consumers at the time when consumption

choices are made cannot have any predictive power for consumption changes in

any future periods.

The random walk proposition, therefore, can help us address the endogeneity

and simultaneity problem, as it suggests that current consumption growth would

not be correlated with any lagged wealth growth. Nevertheless, time aggregation

and measurement error could cause current consumption changes to correlate

with once lagged income and wealth changes, even if the PIH holds true.

Aggregation also matters when the PIH holds in continuous time, and

the measures of consumption are based on time averages. Under this

situation, changes in time-averaged consumption will have nonzero first

order serial correlations; this will lead to nonzero correlations between

changes in consumption and once-lagged variables. It is also easy to

prove that measurement errors in the consumption level could cause

measured consumption changes that correlate with once-lagged explanatory

variables.

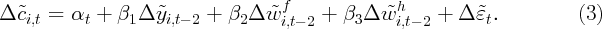

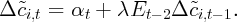

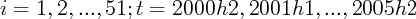

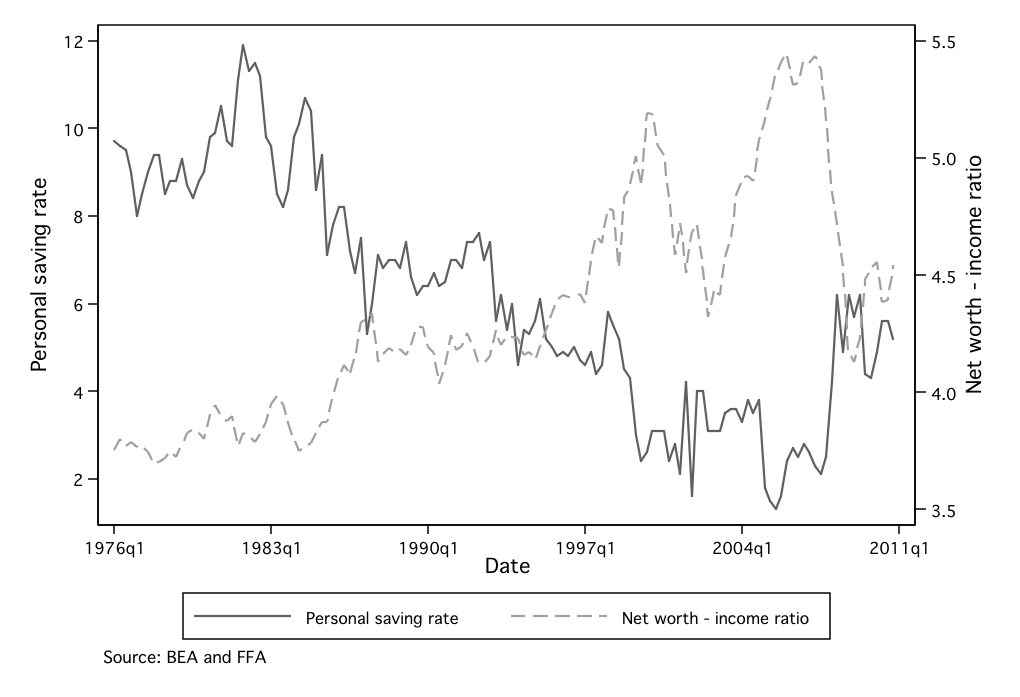

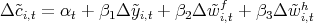

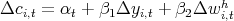

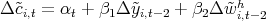

Given the above considerations, the following equation is

employed to see if we can detect delayed effects of wealth

changes:

Equation 3 employs twice-lagged independent variables, and thus gives a

rudimentary estimate of current MPCs out of changes in housing wealth and

stock wealth that occurred two periods prior, which would be zero in the random

walk model.

There are, however, two minor modifications that need to be made. First, what

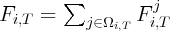

captures here is not the real personal consumption for state

captures here is not the real personal consumption for state  , but the

state’s taxable retail sales. Thus, using

, but the

state’s taxable retail sales. Thus, using  , the estimation of Equation 3

actually yields the effect of changes in wealth on taxable retail sales. To gauge

the approximate change in real consumption, it is assumed that initial

state consumption can be determined by

, the estimation of Equation 3

actually yields the effect of changes in wealth on taxable retail sales. To gauge

the approximate change in real consumption, it is assumed that initial

state consumption can be determined by  , where

, where  and

and  are aggregate personal consumption expenditure and after-tax

labor income, respectively. In addition, we assume that the ratio of retail

sales to real consumption holds constant over time, i.e.,

are aggregate personal consumption expenditure and after-tax

labor income, respectively. In addition, we assume that the ratio of retail

sales to real consumption holds constant over time, i.e.,  .

Therefore, changes in state consumption can be measured roughly by

.

Therefore, changes in state consumption can be measured roughly by

The

same problem arises when measuring stock wealth. Thus, it is assumed for all

states and time periods that  , where

, where  denotes the real state

stock wealth at time

denotes the real state

stock wealth at time  .

.

Therefore, if we redefine

the

regression of Equation 3 ends up reporting approximate estimates of the MPC

out of changes in housing wealth and stock wealth.

Table 5 summarizes the results of our estimations using Equation 3. It

indicates that all three datasets report similar results, with the exception that

none of the estimations from “Best Data” is statistically significant. Given the

small sample size of the “Best Data” sample, this is perhaps not too

surprising.

Table 5 shows that the coefficients of income changes are all positive and large.

It therefore implies that income changes have a fairly big impact on

consumption, despite the two-year lag. This, however, contradicts the random

walk theory as predicted by the Permanent Income Hypothesis.

The wealth effect from lagged changes in financial wealth, on the other hand, is

found to be both statistically insignificant and economically negligible. This

finding is consistent with Dynan and Maki (2001), who found that the impact of

stock wealth on consumption very quickly becomes apparent, and any lagged

change in stock wealth beyond 9 months does not have any significant effect on

consumption.

However, we observe highly significant and large coefficients for housing wealth

in two out of the three datasets. Additionally, all three datasets indicate an MPC

out of housing wealth changes that occurred two years prior around the

neighborhood of  cents.

cents.

There are several reasons why the response to housing wealth shocks may be

slower than the response to financial wealth shocks. Unlike stock prices

that can be easily tracked daily online or in newspapers, house prices

might be difficult to observe accurately or regularly. Homeowners might

be less aware of short-run changes in house prices and it might take

a homeowner a while to realize that his/her house price has changed.

Additionally, the cost of realizing capital gains on housing wealth is lumpy. As a

result, the response to housing wealth growth is not likely to be entirely

contemporaneous.

What is more interesting is that the difference between the housing wealth

effect and the stock wealth effect is found to be statistically significant

for “Good Data,” and on the verge of being significant for “Combined

Data.”

5.2 A habit formation test

A method for formalizing the sluggishness of the response of consumption to

changes in wealth was proposed by Carroll, Otsuka, and Slacalek (2011)

(henceforth ‘COS’), who show how to derive “eventual” wealth effects implied by

serial correlation in consumption growth. The basic idea is, if there is evidence of

habit formation, consumption growth will be serially correlated. Thus, any

impact that wealth changes have on consumption could be delivered

through the serial correlation of consumption growth. The eventual wealth

effect then can be derived by dividing the short run wealth effect by one

minus the habit formation coefficient. We attempt to test this method

of describing the consumption process using the equation derived by

COS:

| (6) |

where the coefficient  is expected to indicate the strength of habit

formation.

is expected to indicate the strength of habit

formation.

Table 6 reports the estimations using Equation 6. Using currently

available state-level instruments, the results provide no evidence of habit

formation.

This could be because of the short time horizon of the data, and the

corresponding weakness of IV techniques like the one employed for this

test.

5.3 Post 2005

The U.S. economy entered a serious downturn in 2007 and is currently going

through a weak recovery. Therefore, it would be illuminating if we can conduct a

wealth-effect analysis using state-level data post 2005. State-level financial

wealth data, however, is currently only available through 2005. As a result, our

analysis in this section is performed without financial wealth growth. This is

arguably valid since financial wealth growth was found insignificant in previous

sections.

Similar to Table 3 and 4, Table 7 and 8 describe the data between 2001 and

2009, and present the test of structural break after 2005. It shows that both

income and housing wealth growth are positively and significantly correlated

with concurrent consumption growth. The null hypothesis of equal correlation

between consumption and income and/or housing wealth before and after

2005, however, is rejected under most scenarios. More interestingly, new

data tends to present a higher correlation between consumption and

income/housing wealth after 2005. Liquidity constraints might be a possible

reason that income and wealth are more correlated with consumption during a

recession.

Employing Equation 3, Table 9 repeats the wealth effect analysis without

financial wealth growth. Neither income nor housing wealth effect is found to be

significant. Furthermore, all three datasets show a negative coefficient for

housing wealth growth, indicating that consumption will decline in reaction to

increases in housing wealth two years ago. An obvious explanation is that the

two-year lag is too long if there is a bubble that inflates and then bursts, and if

there are immediate and once-lagged effects of housing wealth changes on

consumption that are larger than the twice-lagged effects. Housing price bubbles

and thus rapid increases in housing wealth occurred before the housing market

breakdown is the exact reason why the economy took a sharp turn in

2007.

The rest of this section is inspired by the work of Mian and Sufi (2011), who

study the patterns of household debt at the county level from 2002 to 2007, and

investigate how they are correlated with the following economic recession and

recovery. They find that not only did high household debt counties experience

larger declines in prices during the recession, but they also recover more slowly

after the recession. Employing their methodology, we take the 6 states that had

the highest house price growth during 2001-2006, then show the subsequent

behavior of house prices and consumption for 2007-2009. We do the same

thing for the 6 states having the lowest housing wealth growth between

2001-2006.

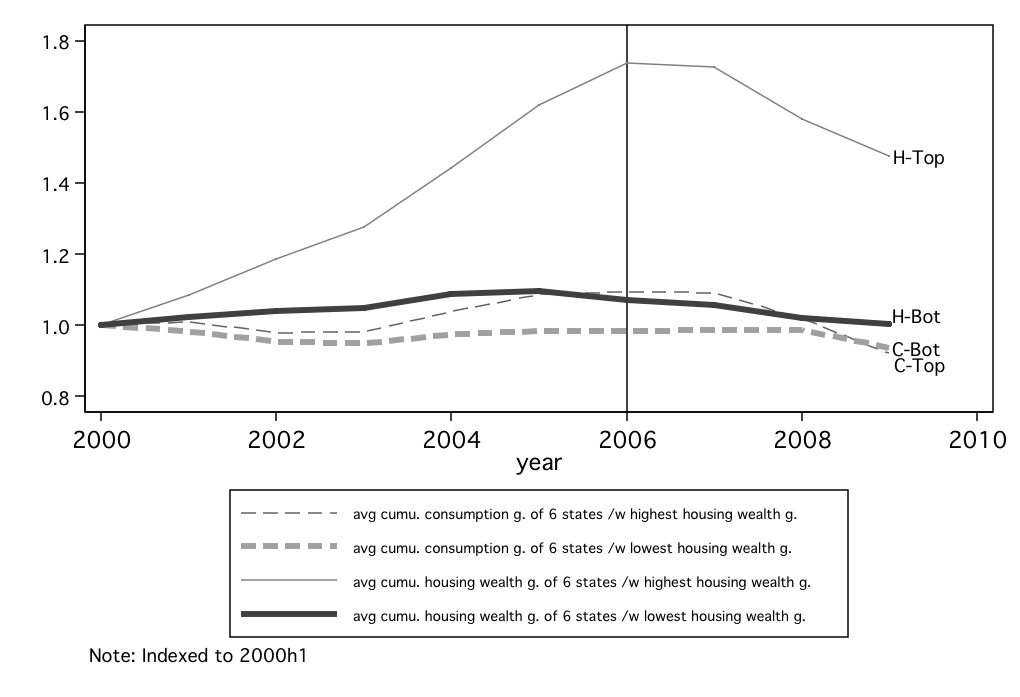

Figure 9 compares consumption and housing wealth, both indexed to 2000h1,

for the top and bottom 6 states during 2001-2006. The figure reflects the

well-known fact that housing wealth growth was highly heterogeneous across

states. The top 6 states experienced a sharp increase in housing wealth up to

2006 and experienced an equally sharp decline in housing wealth starting 2007.

On the other hand, the bottom 6 states show a much smoother housing wealth

growth path through the whole period. Figure 9 further shows that consumption

of both high and low housing wealth growth states contracted in 2001-2003,

likely due to the recession that started in 2001. Nevertheless, consumption of the

top 6 states with high housing wealth growth was rapidly increasing

as the real estate bubble was forming. In contrast, consumption of the

bottom 6 states only grew slightly as the housing market was booming

nationwide. By the time when national housing price peaked, consumption

of the top 6 states has been about  percent higher than its level

in 2000. But the bottom 6 states were still inching toward their 2000

level.

percent higher than its level

in 2000. But the bottom 6 states were still inching toward their 2000

level.

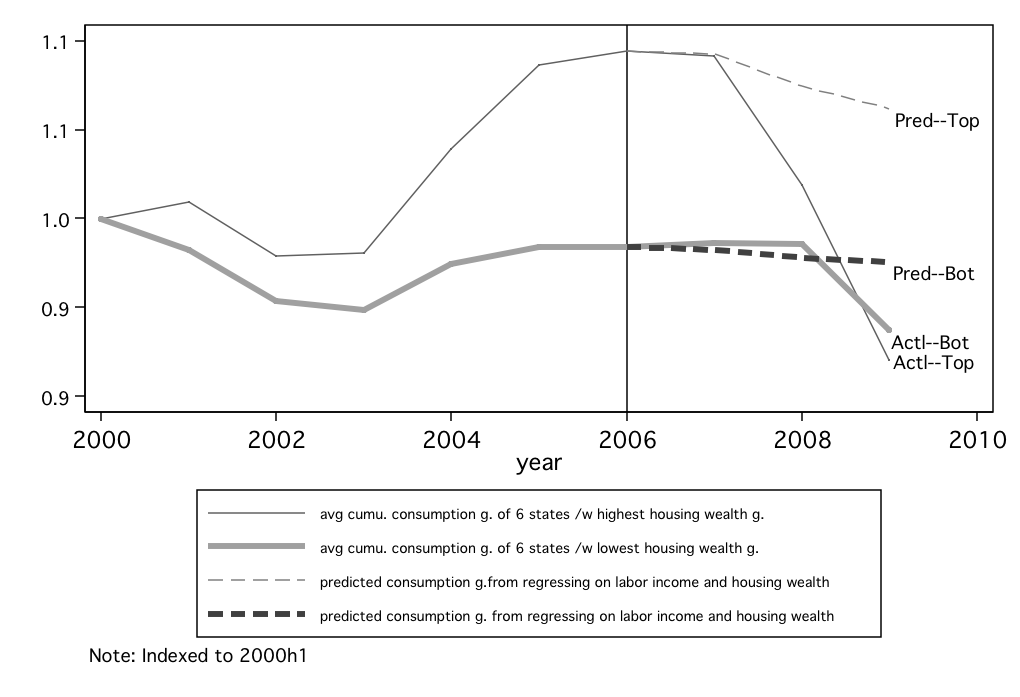

The observations above lead to an interesting question: Given what we knew

from the 2001-2006 estimates, how well would we have been able to predict

consumption declines after 2006 in the two groups of states had we known the

housing wealth and income changes they would experience over 2007-2009? In

other words, what fraction of the consumption declines after 2006 can be

associated with the concurrent housing wealth and income changes? (We freely

admit that this association cannot properly be interpreted as causal, for all the

reasons articulated in the introduction).

To address this question, we start by regressing consumption growth,  ,

on a time dummy, income growth, and housing wealth growth,

,

on a time dummy, income growth, and housing wealth growth,  , using

data between 2001-2006. We then predict consumption growth for 2007-2009 by

setting the intercept term to be zero. Figure 10 compares the actual and

predicted consumption growth for the top and bottom 6 states. It shows that the

top 6 states experienced an immediate drop in consumption as soon as the

housing market turned south in 2007, and continued with a sharp decline in

2008 as the subprime crisis intensified. Table 10 further shows, however,

that of the cumulative decline in consumption from 2006 to 2009, only

about

, using

data between 2001-2006. We then predict consumption growth for 2007-2009 by

setting the intercept term to be zero. Figure 10 compares the actual and

predicted consumption growth for the top and bottom 6 states. It shows that the

top 6 states experienced an immediate drop in consumption as soon as the

housing market turned south in 2007, and continued with a sharp decline in

2008 as the subprime crisis intensified. Table 10 further shows, however,

that of the cumulative decline in consumption from 2006 to 2009, only

about  percent can be ‘explained’ by the declines in income and

housing wealth. On the other hand, Figure 10 shows that states with the

bottom housing wealth growth hardly experienced any major consumption

contraction until 2009, when the subprime crisis had spread to non-subprime

areas and other industries. This nicely matches findings by Mian and

Sufi (2010) who find that spending on motor vehicles in non-housing-boom

states did not collapse until 2009, while motor vehicle purchases began

declining considerably earlier in the states that had a housing bubble then

bust. Together, these points suggest that, while problems in the housing

market may have been an important trigger for the 2008-2009 crisis, the

precipitous drop in consumption spending in that period went well beyond

what would have been expected just from the loss of housing wealth and

income.

percent can be ‘explained’ by the declines in income and

housing wealth. On the other hand, Figure 10 shows that states with the

bottom housing wealth growth hardly experienced any major consumption

contraction until 2009, when the subprime crisis had spread to non-subprime

areas and other industries. This nicely matches findings by Mian and

Sufi (2010) who find that spending on motor vehicles in non-housing-boom

states did not collapse until 2009, while motor vehicle purchases began

declining considerably earlier in the states that had a housing bubble then

bust. Together, these points suggest that, while problems in the housing

market may have been an important trigger for the 2008-2009 crisis, the

precipitous drop in consumption spending in that period went well beyond

what would have been expected just from the loss of housing wealth and

income.

6 Conclusion

This paper’s main contribution is to construct and describe two panel datasets:

One for financial wealth for U.S. states for 2000-2005, constructed from

anonymous proprietary account-level records of geographic wealth holdings, and

one for state-level consumption data, constructed using data on retail sales tax

revenues from the Census of State Governments (and, for some states, from

state-level estimates of retail sales); and to argue that these datasets are

substantially better than those that have been used by previous authors. We

then combine these datasets to provide new estimates of the relationship

between spending growth and current and lagged changes in stock wealth

and housing wealth. Consistent evidence is found for large but sluggish

housing wealth effects. Based on the results from our new approach,

two out of the three datasets indicate that the MPC out of a one dollar

change in two-year lagged housing wealth is about  cents. In addition,

the twice-lagged income change is also found to be strongly related to

the current consumption change. Both findings lead to the rejection of

the random walk model of consumption. Furthermore, a statistically

insignificant and economically small stock wealth effect is found for almost all

specifications, although large standard errors mean that the differences of

the financial wealth effect from housing wealth effects are statistically

insignificant.

cents. In addition,

the twice-lagged income change is also found to be strongly related to

the current consumption change. Both findings lead to the rejection of

the random walk model of consumption. Furthermore, a statistically

insignificant and economically small stock wealth effect is found for almost all

specifications, although large standard errors mean that the differences of

the financial wealth effect from housing wealth effects are statistically

insignificant.

In addition, the paper finds evidence for a strong association between

consumption and housing wealth declines in the period after the real estate

bubble burst; the states with the biggest housing wealth decline experienced

substantially larger declines in consumption spending. Our results also lend

tentative further support to the proposition asserted in CQS, in Carroll, Otsuka,

and Slacalek (2011), and elsewhere that movements in housing wealth and

financial wealth have different effects, with housing wealth changes apparently

exerting a large influence on household spending even two years after the

impulse. In addition to their salience for explaining recent events, these results

might also help explain the strength of consumption following the bursting of the

stock market bubble at the end of the  s: at the same time the

stock bubble was bursting, housing wealth had shown substantial gains,

and with a larger and more sluggish MPC might have been sufficient to

explain the strength of household spending in that era (in addition to its

weakness recently); see Figure 11 in the appendix for a breakdown of the

movements in wealth between financial and nonfinancial that supports this

story.

s: at the same time the

stock bubble was bursting, housing wealth had shown substantial gains,

and with a larger and more sluggish MPC might have been sufficient to

explain the strength of household spending in that era (in addition to its

weakness recently); see Figure 11 in the appendix for a breakdown of the

movements in wealth between financial and nonfinancial that supports this

story.

Figure 1: The saving rate versus the net worth - income ratio

Figure 2: Mutual fund holdings at the aggregate level

Figure 3: New data versus the Flow of Funds Accounts

Figure 4: Stock wealth growth rates across states:

Figure 5: Snow bird effect

Note: The sharp seasonal fluctuations in wealth in Florida and Arizona likely reflect a “snow bird” effect, as wealthy

retirees move in and out of these states on a seasonal basis.

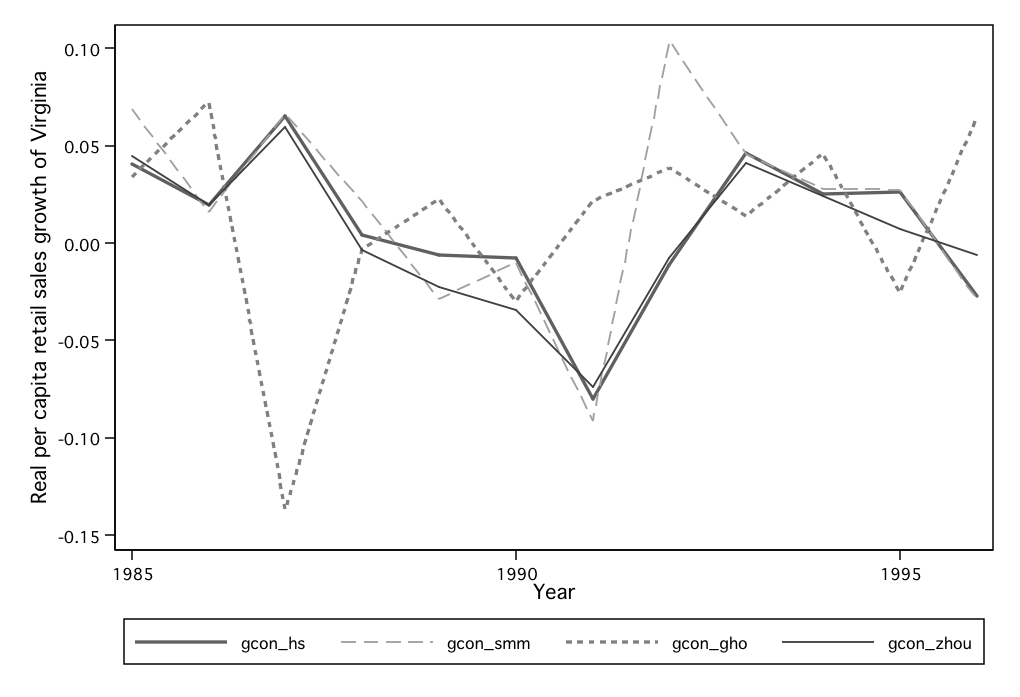

Figure 7: The sum of state retail sales measures versus U.S. aggregate retail sales

Figure 8: Virginia:  versus

versus  ,

,  , and

, and

Figure 9: Housing wealth growth vs. consumption growth: 6 states with the

highest/lowest housing wealth growth during 2001-2006

Figure 10: Actual vs. predicted consumption growth: 6 states with the highest/lowest

housing wealth growth

Table 3: Data description:

| Good Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | (1) | (2) | (3) | (4) | (5) | (6) | (7)

|

| 1.009 | | | 0.989 | 0.971 | | 0.956 |

| | (0.246) | | | (0.251) | (0.254) | | (0.258) |

| | 0.112 | | 0.059 | | 0.095 | 0.053 |

| | | (0.086) | | (0.085) | | (0.086) | (0.085) |

| | | 0.093 | | 0.039 | 0.086 | 0.036 |

| | | | (0.055) | | (0.053) | (0.055) | (0.054) |

| Obs. | 180 | 180 | 180 | 180 | 180 | 180 | 180 |

| 0.261 | 0.188 | 0.194 | 0.258 | 0.259 | 0.194 | 0.256 |

Partial  | 0.091 | 0.002 | 0.009 | 0.088 | 0.088 | 0.009 | 0.085 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Combined Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | (1) | (2) | (3) | (4) | (5) | (6) | (7)

|

| 1.054 | | | 1.028 | 0.983 | | 0.964 |

| | (0.21) | | | (0.21) | (0.216) | | (0.217) |

| | 0.131 | | 0.076 | | 0.107 | 0.065 |

| | | (0.083) | | (0.078) | | (0.082) | (0.078) |

| | | 0.128 | | 0.074 | 0.121 | 0.07 |

| | | | (0.05) | | (0.049) | (0.05) | (0.049) |

| Obs. | 180 | 180 | 180 | 180 | 180 | 180 | 180 |

| 0.368 | 0.287 | 0.301 | 0.368 | 0.372 | 0.303 | 0.371 |

Partial  | 0.12 | 0.007 | 0.027 | 0.12 | 0.126 | 0.03 | 0.124 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

a. Partial  refers to the proportion of variance explained by all variables other than the year dummies.

refers to the proportion of variance explained by all variables other than the year dummies.

b. Standard errors in parenthesis. {*, **, ***} = significant at the {10%, 5%, 1%} level.

Table 7: Data description using data up to 2009:

a. Partial  refers to the proportion of variance explained by all variables other than the year dummies.

refers to the proportion of variance explained by all variables other than the year dummies.

b. Standard errors in parenthesis. {*, **, ***} = significant at the {10%, 5%, 1%} level.

c. F-Test and P-val is for the test of equal income and house wealth effect for the periods before and after 2005.

Table 10: Actual  vs. predicted

vs. predicted  for top and bottom states

for top and bottom states

A Stock Wealth Data

The data used in this paper were constructed during the author’s part-time

employment at a private company over two years. All financial data feeds are

provided as anonymous, ZIP Code data by product type. Absolutely no

non-public, personally identifiable information on U.S. households have been

used in this study.

Code data by product type. Absolutely no

non-public, personally identifiable information on U.S. households have been

used in this study.

Once the ZIP+4 Code level data is received by the private company, for ZIP+4

codes with fewer than  households, the data are joined and averaged with

other ZIP+4 Codes to ensure a minimum household count of

households, the data are joined and averaged with

other ZIP+4 Codes to ensure a minimum household count of  per ZIP+4

code. The average value is then imputed identically back down to the

affected ZIP+4 Codes. The rules utilized to perform the joining and

averaging are complex and based on geographical proximity and other

factors.

per ZIP+4

code. The average value is then imputed identically back down to the

affected ZIP+4 Codes. The rules utilized to perform the joining and

averaging are complex and based on geographical proximity and other

factors.

The names of the financial institutions reporting to the private company are

suppressed and cannot be revealed. However, it should be noted that the number

of reporting institutions changes over time. Hence, the biggest concern with

constructing the stock wealth data is the possibility that the variations in wealth

are caused by reasons other than the wealth holding variations of the

state residents. To minimize this problem, we expended a great deal of

effort keeping track of all mergers and institutions’ membership in the

network.

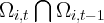

The formation of a consistent source of financial data over time was

performed at the state level. Thus, I could construct a common group of

reporting institutions for every TWO ADJACENT CYCLES. So the growth

rates could be calculated as the log difference of two adjacent values on

a rolling basis. Specifically speaking, for growth rate of stock wealth

for state  at time

at time  , we summed up the assets by those institutions

reporting at both

, we summed up the assets by those institutions

reporting at both  and

and  for state

for state  , and then I took the log

difference.

, and then I took the log

difference.

Specifically, suppose  is the total amount of stock wealth reported at time

is the total amount of stock wealth reported at time

for state

for state  by institution

by institution  .

.  is the set of all institutions reporting at

time

is the set of all institutions reporting at

time  for state

for state  . So

. So  is the set of all the institutions

reporting for state

is the set of all the institutions

reporting for state  at both time

at both time  and

and  . Therefore,

. Therefore,  ,

the growth rate of stock wealth of state

,

the growth rate of stock wealth of state  at time

at time  is defined as:

is defined as:

where  .

.

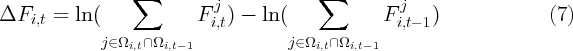

After obtaining the correct growth rates, total stock market wealth for each

state were imputed backward as

where  and

and  .

.

Real stock wealth per capita is defined as

where  is the consumer price index at time

is the consumer price index at time  and

and  is the

population of state

is the

population of state  at time

at time  . Therefore, growth rate of real stock wealth per

capita is calculated as:

. Therefore, growth rate of real stock wealth per

capita is calculated as:

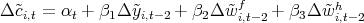

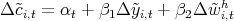

B Results using the elasticity method

Many papers in the literature have estimated wealth effects by adopting the

elasticity method. Consequently, we then investigate the respective housing

wealth and stock wealth effects by estimating the following equation, as with

most related studies:

Table 11 reports the regression results from Equation 13 for all three sets of

consumption data. The findings are roughly consistent across the three

datasets.

The most outstanding and robust finding is the large coefficient for lagged

housing wealth. The stock wealth effects reported in Table 11 are all statistically

insignificant. Furthermore, in 2 of the 3 estimations, the size of the stock

wealth effect is economically small. The hypotheses of equal housing

wealth and stock wealth coefficients are, however, accepted in 2 out of 3

estimations.

Table 11: Results for the elasticity method

Figure 11: The saving rate versus the wealth - income ratio

References

ANTONIEWICZ, ROCHELLE L. (2000): “A Comparison of the

Household Sector from the Flow of Funds Accounts and the Survey of,”

Discussion paper, Federal Reserve Board.

ARON, JANIE, JOHN V. DUCA, JOHN MUELLBAUER, KEIKO

MURATA, AND ANTHONY MURPHY (2010): “Credit, Housing Collateral

and Consumption: Evidence from the UK, Japan and the US,” Working

Paper 1002, Federal Reserve Bank of Dallas.

ARON, JANINE, AND JOHN MUELLBAUER (2006): “Housing Wealth,

Credit Conditions and Consumption,” Centre for the Study of African

Economies Series WPS 2006-08, University of Oxford.

ASDRUBALI, PIERFEDERICO, BENT SORENSEN, AND OVED YOSHA

(1996): “Channels of interstate risksharing: United States 1963-1990,”

Quarterly Journal of Economics, 111, 1081–1110.

ATTANASIO, ORAZIO P., LAURA BLOW, ROBERT HAMILTON, AND

ANDREW LEICESTER (2009): “Booms and Busts: Consumption, House

Prices and Expectations,” Economica, 76(301), 20–50.

BAYOUMI, TAMIM, AND HALI EDISON (2003): “Is Wealth Increasingly

Driving Consumption,” DNB Staff Reports (discontinued) 101,

Netherlands Central Bank.

BERTAUT, CAROL (2002): “Equity Prices, Household Wealth, and

Consumption Growth in Foreign Industrial Countries: Wealth Effects

in the 1990s,” International Finance Discussion Papers 724, Board of

Governors of the Federal Reserve System.

BOSTIC, RAPHAEL, STUART GABRIEL, AND GARY PAINTER (2009):

“Housing Wealth, Financial Wealth, and Consumption: New Evidence

from Micro Data,” Regional Science and Urban Economics, 39, 79–89.

BYRNE, JOSEPH P., AND E. PHILIP DAVIS (2003): “Disaggregate

Wealth and Aggregate Consumption: an Investigation of Empirical

Relationships for the G7,” Oxford Bulletin of Economics and Statistics,

65(2), 197–220.

CAMPBELL, JOHN Y., AND JOAO F. COCCO (2007): “How Do House

Prices Affect Consumption? Evidence From Micro Data,” Journal of

Monetary Economics, 54(3), 591–621.

CAMPBELL, JOHN Y., AND N. GREGORY MANKIW (1989):

“Consumption, Income and Interest Rates: Reinterpreting the Time

Series Evidence,” in NBER Macroeconomics Annual, ed. by Olivier J.

Blanchard, and Stanley Fischer, Cambridge, MA. MIT Press.

CARDARELLI, ROBERTO, DENIZ IGAN, AND ALESSANDRO REBUCCI

(2008): “The Changing Housing Cycle and the Implications for Monetary

Policy,” in World Economic Outlook, chap. 3. Washington: International

Monetary Fund.

CARROLL, CHRISTOPHER D., MISUZU OTSUKA,

AND JIRI SLACALEK (2011): “How Large Are Housing

and Financial Wealth Effects? A New Approach,”

Journal of Money, Credit and Banking, 43(1), 55–79,

http://www.econ2.jhu.edu/people/ccarroll/papers/cosWealthEffects/.

CASE, KARL E., JOHN M. QUIGLEY, AND ROBERT J. SHILLER

(2005): “Comparing Wealth Effects: The Stock Market versus The Housing

Market,” Advances in Macroeconomics, 5(1), 1–34.

__________ (2011): “Wealth Effects Revisited 1978-2009,” Cowles

foudation discussion paper, Cowles Foundaion for Reserch in Economics,

Yale University.

CICCONE, ANTONIO (2002): “Agglomeration effects in Europe,”

European Economic Review, 46(2), 213–227.

CICCONE, ANTONIO, AND ROBERT E. HALL (1996): “Productivity

and the Density of Economic Activity,” The American Economic Review,

86(1), 54–70.

DAVIS, MORRIS, AND MICHAEL PALUMBO (2001a): “A Primer on

the Economics and Time Series Econometrics of Wealth Effects,” Federal

Reserve Board Finance and Economics Discussion Papers 2001-09.

DAVIS, MORRIS, AND MICHAEL G. PALUMBO (2001b): “Does Stock

Market Wealth Matter for Consumption?,” Finance and Economics

Discussion Series 2001-23. Washington: Board of Governors of the Federal

Reserve System.

DEL NEGRO, MARCO (1998): “Aggregate Risk Sharing Across US

States and Across European Countries,” Ph.D. thesis, Yale University.

DISNEY, RICHARD, JOHN GATHERGOOD, AND ANDREW HENLEY

(2010): “House Price Shocks, Negative Equity, and Household

Consumption in the United Kingdom,” Journal of the European Economic

Association, 8(6), 1179–1207.

DISNEY, RICHARD, ANDREW HENLEY, AND DAVID JEVONS (2003):

“House Price Shocks, Negative Equity and Household Consumption in the

UK in the 1990s,” memo, University of Nottingham.

DVORNAK, NIKOLA, AND MARION KOHLER (2003): “Housing Wealth

Stock Market Wealth and Consumption: A Panel Analysis for Australia,”

RBA Research Discussion Papers rdp2003-07, Reserve Bank of Australia.

DYNAN, KAREN E., AND DEAN M. MAKI (2001): “A Primer on the

Economics and Time Series Econometrics of Wealth Effects,” Finance and

Economics Discussion Series 2001-9. Washington: Board of Governors of

the Federal Reserve System.

EDELSTEIN, ROBERT H., AND SAU KIM LUM (2004): “House prices,

wealth effects, and the Singapore macroeconomy,” Journal of Housing

Economics, 13, 342–367.

GARRETT, THOMAS A., RUBèN HERNàNDEZ-MURILLO, AND

MICHAEL T. OWYANG (2004): “Does Consumer Sentiment Predict

Regional Consumption?,” Federal Reserve Bank of St. Louis Review,

87(2), 123–35.

GIROUARD, NATHALIE, AND SVEINBJöRN BLöNDAL (2001): “House

Prices and Economic Activity,” OECD Economics Department Working

Papers 279, OECD Economics Department.

GLAESER, EDWARD L, HEDI D. KALLAL, JOSE A. SCHEINKMAN,

AND ANDREI SHLEIFER (1992): “Growth in Cities,” Journal of Political

Economy, 100(6), 1126–52.

HALL, ROBERT E (1978): “Stochastic Implications of the Life

Cycle-Permanent Income Hypothesis: Theory and Evidence,” Journal of

Political Economy, 86(6), 971–87.

KENNICKELL, ARTHUR B. (2003): “A Rolling Tide:

Changes in the Distribution of Wealth in the U.S.,

1989-2001,” Discussion paper, Federal Reserve Board,

http://www.federalreserve.gov/pubs/oss/oss2/papers/concentration.2004.5.pdf.

LETTAU, MARTIN, AND SYDNEY LUDVIGSON (2001): “Consumption,

Aggregate Wealth and Expected Stock Returns,” Journal of Finance,

LVI(3), 815–849.

__________ (2004): “Understanding Trend and Cycle in Asset Values:

Reevaluating the Wealth Effect on Consumption,” American Economic

Review, 94(1), 279–299.

LEVIN, LAURENCE (1998): “Are assets fungible? Testing the behavioral

theory of life-cycle savings,” Journal of Economic Organization and

Behavior,, 36, 59–83.

LOPEZ, MIGUEL ANGEL GARCIA, AND IVAN MUNIZ OLIVERA

(2005): “The Spatial Effect of Intra-Metropolitan Agglomeration

Economies,” Working Papers 0513, Department of Applied Economics at

Universitat Autonoma of Barcelona.

LUDWIG, ALEXANDER, AND TORSTEN SLØK (2002): “The Impact of

Changes in Stock Prices and House Prices on Consumption in OECD

Countries,” Working Paper 02/1 International Monetary Fund.

MIAN, ATIF, AND AMIR SUFI (2010): “The Effects of Fiscal Stimulus:

Evidence from the 2009 ‘Cash for Clunkers’ Program,” Discussion paper,

National Bureau of Economic Research.

__________ (2011): “Consumers and the Economy, Part II: Household Debt

and the Weak U.S. Recovery,” FRBSF Economic Letter, 4.

SHILLER, ROBERT J. (2004): “Household Reaction to Chagnes in

Housing Wealth,” Discussion paper, Cowles Foundation for Research in

Economics, Yale University, Discussion Paper NO. 1459.

THALER, RICHARD H. (1990): “Anomalies: Saving, Fungibility, and

Mental Accounts,” Journal of Economic Perspectives, 4(1), 193–205.

WILCOX, DAVID W. (1992): “The Construction of U.S. Consumption

Data: Some Facts and Their Implications for Empirical Work,” The

American Economic Review, 82(4), 922–941.

ZHOU, XIA (2010): “Essays On U.S. State-Level Financial Wealth

Data and Consumption Data,” Ph.D. thesis, Johns Hopkins University,

http://jhir.library.jhu.edu/handle/1774.2/34267.

is measured with error. By construction, the personal saving

rate,

is measured with error. By construction, the personal saving

rate,  , will also be mismeasured in the same direction

as

, will also be mismeasured in the same direction

as  . At the same time, the measured wealth-income ratio

. At the same time, the measured wealth-income ratio  will be biased in the opposite direction, generating a spurious negative

relationship.

will be biased in the opposite direction, generating a spurious negative

relationship.

![[ ]

∑∞

s- t

max Et β u(cs )

s=t](zcWandCdynByState35x.png)

![Δct+1 = ϵt+1,

Et [ϵt+n ] = 0 ∀ n > 0.](zcWandCdynByState38x.png)

versus

versus  ,

,  , and

, and

vs. predicted

vs. predicted  for top and bottom states

for top and bottom states