cssUSSaving, May 1,

2019

Dissecting Saving Dynamics: Measuring

Wealth, Precautionary, and Credit Effects

May 1, 2019

Christopher Carroll 1

JHU

Jiri Slacalek 2

ECB

Martin Sommer 3

IMF

_____________________________________________________________________________________

Abstract

We show that an estimated tractable ‘buffer stock saving’ model can match the 30-year decline in

the U.S. saving rate leading up to 2007, the sharp increase during the Great Recession, and

much of the intervening business cycle variation. In the model, saving depends on the

gap between ‘target’ and actual wealth, with the target determined by measured credit

availability and measured unemployment expectations. Following financial deregulation starting

in the late 1970s, expanding credit supply explains the trend decline in saving, while

fluctuations in wealth and consumer-survey-measured unemployment expectations capture much

of the business-cycle variation, including the sharp rise during the Great Recession.

-

Keywords

-

Consumption, Saving, Wealth, Credit, Uncertainty

-

JEL codes

-

E21, E32

| | | (Contains data and estimation software producing paper’s results) |

1Carroll: ccarroll@jhu.edu, Department of Economics, Johns Hopkins University,

http://econ.jhu.edu/people/ccarroll/, and National Bureau of Economic Research.

2Slacalek: jiri.slacalek@ecb.europa.eu, European Central Bank, Frankfurt am Main, Germany,

http://www.slacalek.com/. 3Sommer: msommer@imf.org, International Monetary Fund, Washington,

DC, http://martinsommeronline.googlepages.com/.

1 Introduction

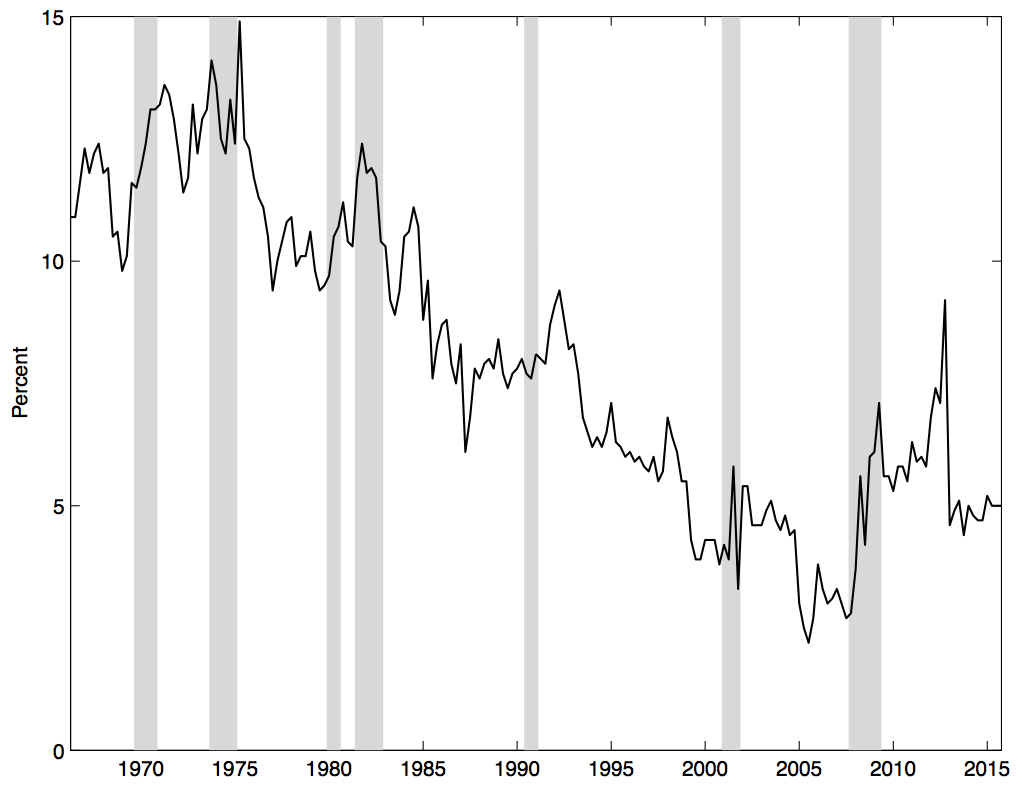

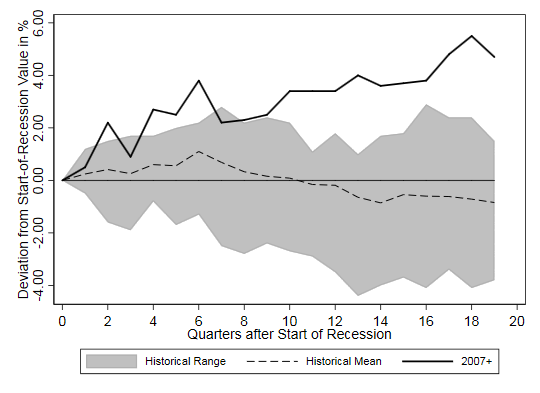

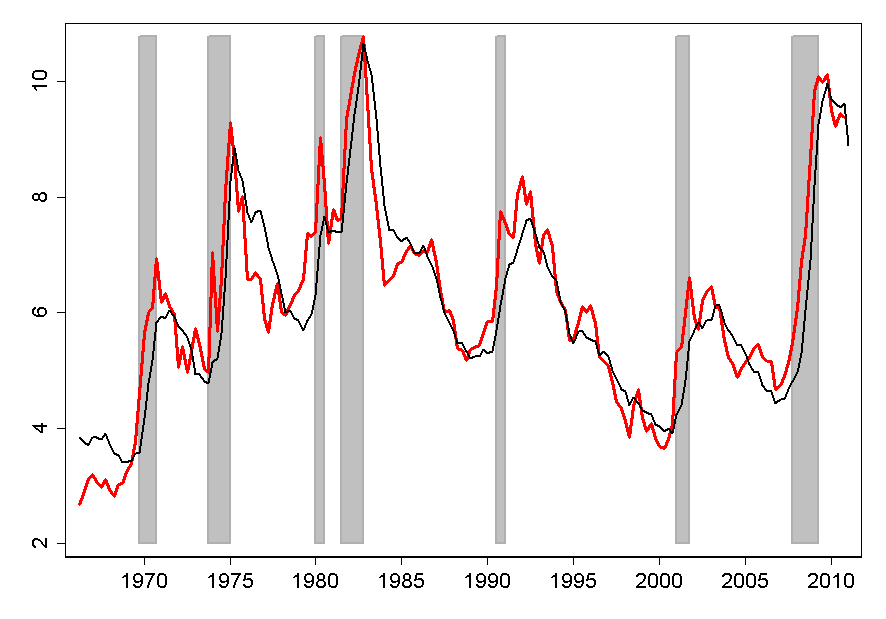

The start of the Great Recession marked a striking break in the behavior of the US

personal saving rate. After gradually declining over the previous 30 years, the saving

rate doubled during the recession (Figure 1(a)), and even 5 years later, exceeded

its pre-crisis level by 4 percentage points (Figure 1(b)). Surprising weakness of

consumption growth (relative to income growth) was a key element in explanations

of why, year after year, the recovery was weaker than forecasters expected. The

“secular stagnation” hypothesis of Summers (2013, 2015), Krugman (2013, 2014),

Gordon (2015), and others is the most provocative interpretation of these facts,

but even skeptics of secular stagnation have acknowledged that surprisingly weak

consumption growth played a role in the anemic recovery (Hamilton, Harris, Hatzius, and

West (2016)).

Standard consumption models incorporate several mechanisms that interact with

income dynamics to generate the saving rate; the channels that have received the

most attention include ‘wealth effects,’ the availability of credit, and precautionary

motives.

But we are not aware of any work that has attempted to quantify the relative importance of

these channels using the full (secular and cyclical) variation in the available historical data.

Our contribution is to use a simple structural model of saving to construct such a quantitative

decomposition. Specifically, we estimate a tractable ‘buffer stock saving’ model (an extended

version of Carroll and Toche (2009)) with explicit and transparent roles for the

three factors emphasized above (the wealth, credit, and precautionary channels).

The model’s key intuition is that, in the presence of income uncertainty, optimizing

households have a target ratio of wealth to permanent income that depends on the usual

theoretical considerations (the coefficient of relative prudence, see Kimball (1993);

time preference; etc.) and on two features that have been harder to incorporate into

analytical models: The degree of labor income uncertainty and the availability of

credit.

Over the historical period for which the necessary data are available, the structural model is

able to capture the bulk of the variation in the saving rate—with a fit better than 0.90 in the R2

sense.

We find a statistically significant and economically important role for all three explanatory

variables. The trend decline in saving between the mid-1970s and 2007 is explained by the

continual easing of credit availability during the period of gradual financial deregulation that

began in the Carter administration (see Woolley (2012) for the history) and extended to the

brink of the Great Recession. Our measure of credit supply (based on the Fed’s

Survey of Senior Loan Officers) shows a substantial tightening during the Great

Recession, the first sustained curtailment since the 1970s. But according to the model’s

estimates, a larger contributor to the sharp increase in the saving rate during the Great

Recession was the collapse in household wealth, with an increased precautionary motive

(proxied by a measure of consumers’ unemployment expectations) playing the next

most important role. We find that, contra Eggertsson and Krugman (2012) and

Guerrieri and Lorenzoni (2017), redit contraction as the least important of the three

factors.

The rest of the paper is organized as follows. Section 2 presents the structural model and its

mechanics. Section 3 briefly describes our data sources; section 4 presents the estimates of the

model and the empirical decomposition of the saving rate. Section 5 compares our

framework to the key competing frameworks for thinking about the saving rate; section 6

concludes.

2 Theory: Target Wealth and Credit Conditions

Here we introduce the model that we will later estimate, a simple representative-consumer

buffer-stock saving model derived from Carroll and Toche (2009) (henceforth CT). We extend

the CT model to incorporate unemployment insurance, which gives the model a mechanism to

capture changes in credit availability (because borrowing is assumed to be limited by the

minimum possible income available to repay it).

2.1 Essentials of the Tractable Model

Under most specifications of uncertainty, Constant Relative Risk Aversion utility interacts

with uncertainty in ways that rule out any transparent analytical formulation of the forces at

work. The assumption that makes the CT model tractable despite its use of CRRA utility is

that unemployment risk takes a particularly stark form: Employed consumers face a constant

probability ℧ of becoming unemployed, and, once unemployed, can never become employed

again. The sense in which the model is tractable is that there is a closed form solution for the

level of target wealth, and the full consumption function (though numerical) can

be constructed from the target almost instantaneously using a simple difference

equation.

CT show that for the special case of logarithmic utility, the target ‘market resources’ ratio

for an employed consumer (roughly, spendable wealth) is:

where γ is the growth rate of labor income, r is the interest rate and 𝜗 = − log β is the time

preference rate.

A “Growth Impatience Condition” guarantees that the expression (γ + 𝜗 −r) in the

denominator is strictly positive. Using this fact, the equation has intuitive implications: Target

wealth is higher (the consumer saves more) when

- The consumer is more patient (the time preference rate 𝜗 is lower)

- Unemployment risk ℧ is higher (inducing a stronger precautionary motive)

- Expected future income is lower (that is, γ −r is smaller)

2.2 Determinants of Target Wealth

We modify the CT model by adding an ‘unemployment insurance’ (UI) system that

relaxes the natural borrowing constraint. In the CT model, households accumulate

positive wealth to prevent zero consumption when they become unemployed. But,

in the model in this paper, employed households are willing to borrow, because

they know they will not starve even if they become unemployed; their consumption

function shifts to the left. However, such consumers will limit their indebtedness to an

amount small enough to guarantee that consumption will remain strictly positive

even if they become unemployed (so, it is the ‘natural borrowing constraint’ that

shifts).

The budget constraint depends on the consumer’s employment status. We denote with

lower-case m and c the levels of market resources M (market wealth plus current income) and

consumption C normalized by the corresponding period’s pretax labor income ℓW (the

product of individual labor productivity ℓ and the aggregate wage W); ℓW grows by Γ = 1 + γ

per period. Next period’s market resources ratio mt+1 is the sum of current market resources

mt net of consumption ct, augmented by the (growth-adjusted) interest factor R∕Γ and

income. For the employed consumer (normalized) after-tax labor income is 1 −τ, while for the

unemployed consumer the unemployment benefit is ς (both expressed as a fraction labor

income). The unemployment benefit ς is financed on a pay-as-you-go basis by a lump

sum tax τ. Under these assumptions the (normalized) dynamic budget constraint

is:

| (2) |

Generalizing formula (1) for relative risk aversion ρ > 1 and allowing for UI benefits ς, the

employed consumer’s target market resources ratio me can be written as a function characterized

by:

| (3) |

The target wealth me increases with unemployment risk ℧, as consumers build up a larger

precautionary buffer of savings. An easing of credit conditions (which we denote as

‘CEA’)—an increase in the CEA index (modelled as an increase in ς)—allows households to

borrow more and thus reduces the need to accumulate wealth for consumption smoothing. A

higher interest rate R increases the rewards to holding wealth and thus increases

the amount held. Faster expected growth of labor income Γ translates into a lower

wealth target because optimists consume more now in anticipation of their future

prosperity (the ‘human wealth effect’). Increasing risk aversion ρ raises target wealth

in a way that is qualitatively similar to the effects of an increase in uncertainty.

And of course, making the consumer more patient (increasing β) increases target

wealth.

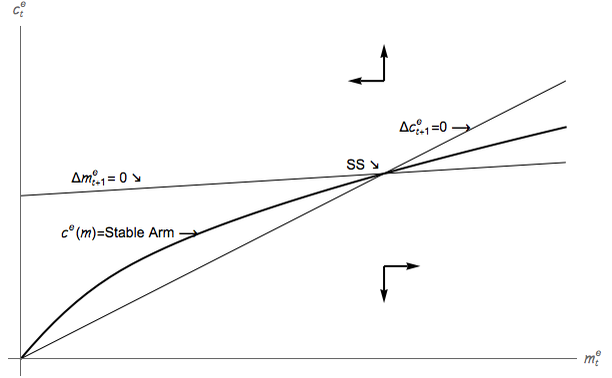

2.3 The Three Channels: A Graphical Exposition

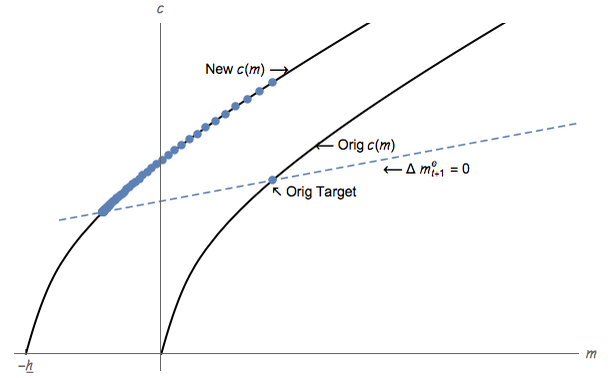

Figure 3a shows the phase diagram for the CT model. The (concave) consumption function

is indicated by the thick solid locus, which is the saddle path that leads to the steady

state (at which both consumption and market resources, c and m, are constant).

Because the precautionary motive diminishes as wealth rises, the model says the

saving rate is a declining function of market resources, an implication of consumption

concavity.

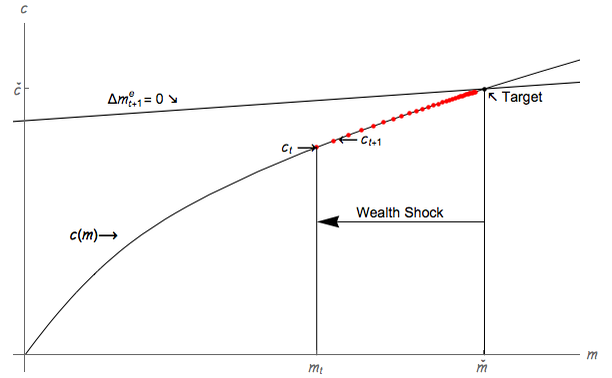

This consumption function can be used directly to analyze the effects of the three channels

affecting the saving rate. For a consumer who starts with market resources equal to the target,

mt = me, the consequences of a pure negative shock to wealth, depicted in Figure 3b, are

straightforward: Consumption declines upon impact, to a level below the value that would

leave m constant (the leftmost red dot); because consumption is below permanent income,

m (and thus c) rises over time back toward the original target (the sequence of

dots).

From an initial borrowing limit of 0 that requires wealth to be positive (m must be strictly

greater than c), an expansion of unemployment benefits results in a more generous natural

borrowing limit h (implying minimum net worth of −h < 0) and causes an immediate

increase in consumption for a given level of resources (Figure 3c). But over time, the

higher spending makes the consumer’s level of wealth decline, forcing a corresponding

gradual decline in consumption until wealth eventually settles at its new, lower target

level.

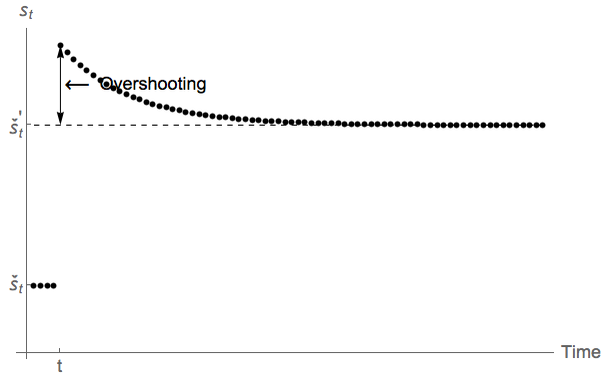

Figure 3d shows the consequences of a permanent increase in unemployment risk ℧ for the

dynamics of the personal saving rate (‘PSR’ henceforth), rather than the level of consumption

shown before. Qualitatively, the effects of a human-wealth-preserving spread in risk are

essentially the opposite of a credit loosening: On impact, the PSR jumps upward,

‘overshooting’ (cf. Dornbusch (1976)) the new target š′, followed by a gradual decline

toward š′ (which is higher than the original š). This nonmonotonic adjustment of saving to

shocks reflects the fact that, when target wealth rises, not only is a higher level of steady-state

saving needed to maintain higher target wealth, an immediate further boost to saving is

necessary to move from the current (inadequate) level of wealth up toward the new (higher)

target.

2.4 Comparison to Alternative ‘Structural’ Models

We use this simple, partial-equilibrium framework (instead of a richer but less tractable

HA-GE model) because our goal is to estimate a unified structural saving model whose “deep”

parameters are jointly identified using both business-cycle-frequency fluctuations AND

long-term trends. Both cyclical and secular changes in the saving rate have been large,

and a model that matched one set of facts (secular, or cyclical) but had strongly

counterfactual implications for the other would not be a satisfying description of

history.

We are not aware of prior papers that attempt this. Essentially all of the “structural”

literature has focused on cyclical dynamics, using one of two frameworks:

- Complex Heterogeneous Agent New Keynesian models (HANK) with serious

treatments of uncertainty

- Simple spender–saver Two-Agent New Keynesian models (TANK)

For the first class of models, the last decade or so has seen impressive progress in the

degree of realism achievable in the treatment of uncertainty, liquidity constraints, household

structure, and other first-order elements of households’ microeconomic environment. A

flourishing literature today explores the implications of these complexities for many questions;

see Krueger, Mitman, and Perri (2016) for a survey. However, at the current state of the art,

estimating such a model would be a considerable challenge, as estimation is generally

several orders of magnitude more computationally demanding than simulating a

calibrated version (which is what the existing literature has done). Furthermore, rich

microfounded models have usually been optimized for the specialized purposes of

examining in great depth a single question (such as the mechanisms of transmission of

monetary policy, Kaplan, Moll, and Violante (2016)) rather than, as we are attempting,

to address a number of different causal mechanisms, over different time horizons,

simultaneously. Finally, even if such a rich HA-GE model could be estimated, it is not clear

that the extra microeconomic realism would be worth the cost in transparency and

tractability.

Indeed, in advocating the use of TANK models, Debortoli and Galí (2017) argue that the

simplicity and transparency of models with only two agents more than make up for their lack

of fidelity to microeconomic facts. This point is reflected in the fact that, at present, central

banks and other entities that require a workhorse model for current analysis, have (to our

knowledge) not gone further than TANK models in their incorporation of heterogeneity.

Nonetheless, a major drawback of the TANK models is that they allow no role for

uncertainty either as an impulse or a propagation mechanism, despite the large

literature in recent years that has argued the uncertainty is a core element of business

cycle dynamics (see, e.g., cf. Bloom, Floetotto, Jaimovich, Saporta-Eksten, and

Terry (2018)).

Our model occupies a middle ground. We have only a single agent (making our model

simpler in one respect even than the TANK models), but that agent’s consumption function is

nonlinear (making it harder to analyze analytically). This nonlinearity brings a major benefit,

though, in providing a way to accommodate two mechanisms that do not meaningfully exist in

TANK models: Uncertainty and credit constraints. Furthermore, like a TANK model, its

parameters can be straightforwardly estimated to match targeted macroeconomic facts (in our

case, the saving rate).

Likely because of its tractability and simplicity, our model (as introduced in a draft version

of this paper) has been found useful as a tool to understand saving dynamics in a number of

countries in addition to the US. The model has been used explicitly to forecast

consumption and the saving rate at the Bank of England (Burgess, Fernandez-Corugedo,

Groth, Harrison, Monti, Theodoridis, and Waldron (2013)). Mody, Ohnsorge, and

Sandri (2012) use a version of it to motivate an empirical exercise which concludes that

labor income uncertainty contributed by at least two fifths to the increase in the

saving rate in advanced economies during the Great Recession (consistent with our

structural estimates below). Trichet (2010) argues (referring to our model) that the

precautionary motive contributed to the high saving rate in advanced economies after

2008.

2.4.1 Why We Do Not Endogenize Asset Prices

Arguably a deeper problem, both with our paper and with the other literature cited above, is

the choice to take as exogenous some of the variation that we would most urgently like to

understand. In particular, our model’s finding that a ‘wealth effect’ explains part of the

increase in saving in the Great Recession begs the question of what caused the asset price

movements that underlie the wealth effect (in stocks, housing and bonds). If, as seems likely,

an important driver of asset prices is the degree of uncertainty (cf. Bekaert, Engstrom, and

Xing (2009), Drechsler (2013)), then our method will substantially underestimate the

cyclical importance of uncertainty, attributing part of uncertainty’s true effect to

developments (asset prices; credit availability) that are themselves consequences of

uncertainty.

A vast literature has attempted to model asset pricing in general equilibrium. While some

progress has been made in understanding the cross-sectional heterogeneity of asset holdings

(cf. Gomes and Michaelides (2007)), for our purposes what is needed is a model that can

capture the cyclical and secular time series of returns. The extent to which no consensus exists

is highlighted by the diversity of the recent literature that has sought to endogenize the

precipitous decline of net worth and house prices during the Great Recession. In

this attempt, different authors have built into their models a number of alternative

mechanisms, including the presence of a exogenous but rare Great-Depression-like

state, exogenous shocks to expectations, or endogenous changes in illiquidity of

housing.

The existence of this literature suggests that no single model of asset pricing is adequate both

for “normal” times and for the Great Recession; more broadly, it seems fair to say that no

single asset pricing model has come to be viewed as robustly applicable to most times and

places, or for both high-frequency cyclical and low-frequency secular movements in asset

prices. If we were to incorporate any non-consensus model of asset pricing (and, at this point,

all asset-pricing models are non-consensus models), our paper would inevitably (and correctly)

judged to be more about the performance of that asset pricing model than anything

else.

The exogeneity assumptions bring us to a final reason for using our tractable model, which

is that a central purpose of this paper has been to bring to light the existence of some

surprisingly simple empirical relationships between the saving rate and our three explanatory

variables. The construction of an elaborate model that required many pages to set up and

explain, and many more pages to estimate, might have drawn attention away from the

simplicity of the empirical foundations of the paper, in which the key results are evident even

in the OLS reduced form estimates. Our penultimate section 5 examines the empirical

performance of our model in comparison with a number of alternatives (including the

reduced form model) and argues that our structural model has advantages over any of

them.

3 Data and Measurement Issues

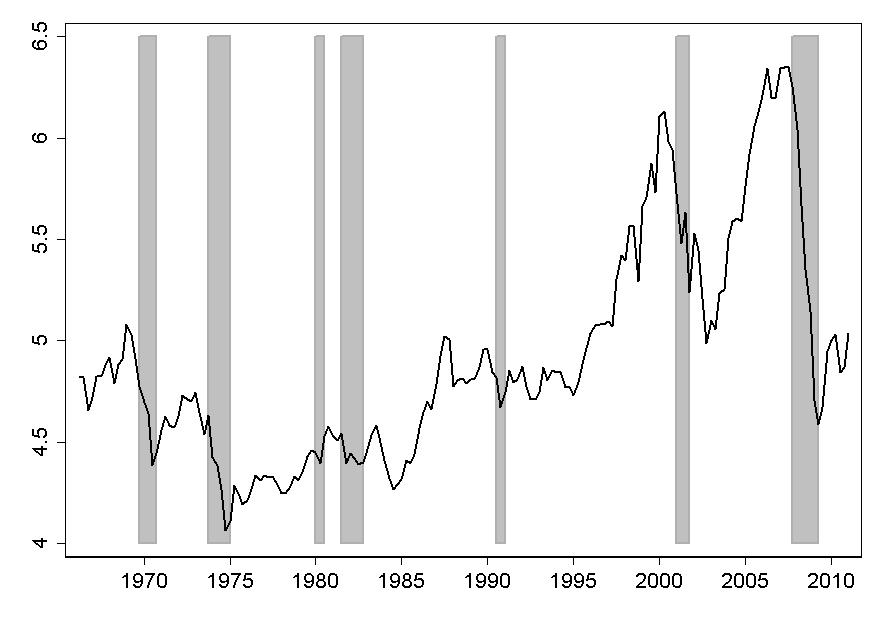

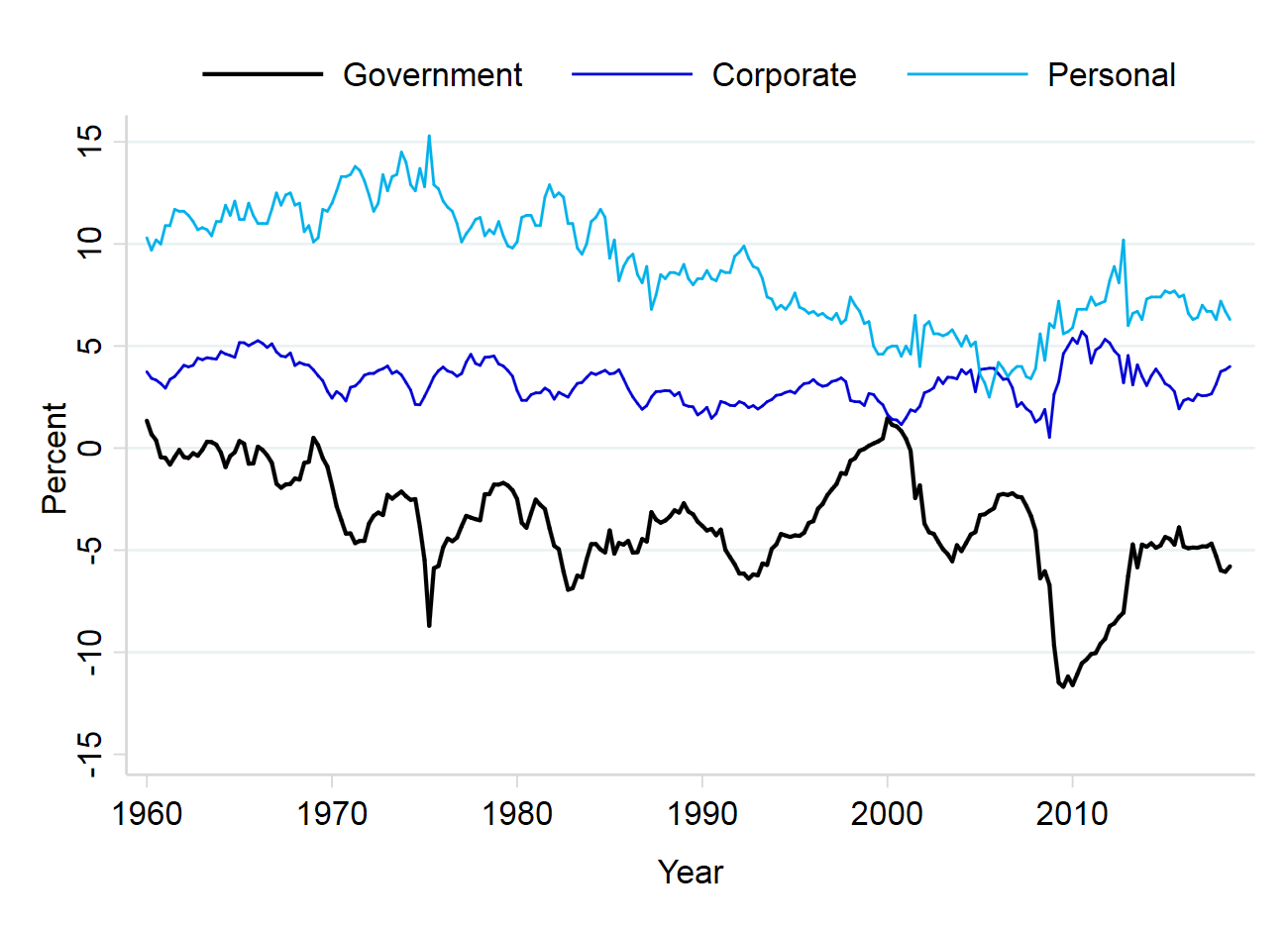

This section describes how we measure our key variables (shown in Figure 4).

The saving rate is from the BEA’s National Income and Product Accounts and is expressed

as a percentage of disposable income.

Motivated by equation (2), we measure household’s normalized market resources mt as 1

plus the ratio of household net worth to disposable income (Figure 5a). For net worth we use

data from the Federal Reserve’s Financial Accounts; this variable is lagged by one quarter

to account for the fact that data on net worth are reported as the end-of-period

values.

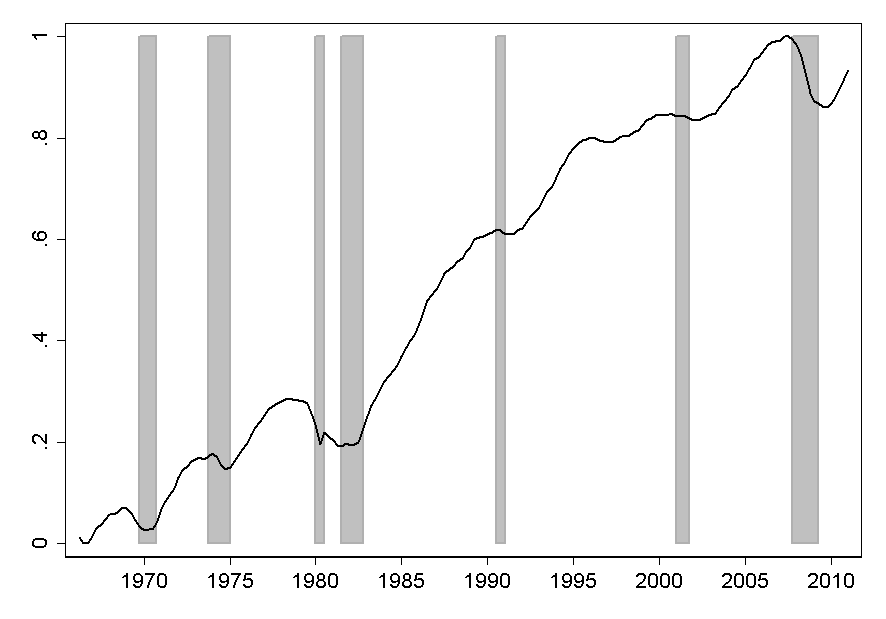

Our measure of credit availability, which we call the ‘Credit Easing Accumulated’ index

(CEA; Figure 5b) is adapted from work by John Muellbauer and various coauthors

(Muellbauer (2007), Duca, Muellbauer, and Murphy (2010) and Aron, Duca, Muellbauer,

Murata, and Murphy (2011); for a related approach, see Hall (2011)). It is constructed using

a question from the Federal Reserve’s Senior Loan Officer Opinion Survey (SLOOS) on Bank

Lending Practices. The question asks about banks’ willingness to make consumer installment

loans now as opposed to three months ago. To calculate a proxy for the level of credit

conditions, the scores from the survey were accumulated, weighting the responses by the

contemporaneous debt-to-income ratio to account for the increasing trend in that variable,

and normalizing the result to range between 0 and 1 to make the interpretation of regression

coefficients straightforward. We use the question on installment loans because it

is available since 1966; other measures of credit availability, such as for mortgage

lending, move closely with the index on consumer installment loans over the sample

period when both are available until 2008. While the two indices diverge in the

Great Recession and afterward, this corresponds to the period when there was a

massive shift of mortgage origination from banks (the respondents to the SLOOS)

to government sponsored entities (Fannie Mae, Freddie Mac, and others). That

shift brings into question the continued relevance of the direct SLOOS index of

mortgage lending conditions. There was no similar profound institutional change

in the market for installment lending, which is one reason it might reasonably be

interpreted as a consistent indicator of the overall credit environment (given its

high correlation with other credit supply indices in the period before the Great

Recession).

The CEA index is taken to measure the availability/supply of credit to a typical household

as it is affected by factors other than the level of interest rates—for example, through

constraints on loan-to-value or loan-to-income ratios, availability of mortgage equity

withdrawal and mortgage refinancing. The broad trends in the CEA index seem to reflect well

the key developments of the US financial market institutions, which we summarize as follows:

Until financial deregulation began in the late 1970s, consumer lending markets were heavily

regulated and segmented. After the phaseout of interest rate controls beginning in the

early 1980s, the markets became more competitive, spurring financial innovations

that led to greater access to credit. Technological progress leading to new financial

instruments and better credit screening methods (Pagano and Jappelli (1993)), a greater

role of nonbanking financial institutions, and the increased use of securitization all

contributed to the dramatic rise in credit availability from the early 1980s until

the onset of the Great Recession in 2007, at which point a substantial drop in the

CEA index was associated with the funding difficulties and de-leveraging of financial

institutions.

We measure a proxy 𝔼 tut+4 for unemployment risk ℧t using re-scaled answers to the

question about the expected change in unemployment in the Thomson Reuters/University of

Michigan Surveys of Consumers. In particular, we estimate 𝔼 tut+4 using fitted values

Δ4ût+4 from the regression of the four-quarter-ahead change in unemployment rate

Δ4ut+4 ≡ ut+4 − ut on the answer in the survey, summarized with the balance statistic

UExptBS:

The coefficient α1 is highly statistically significant, indicating that households do have

substantial information about the direction of future changes in the unemployment rate. As

expected, our 𝔼 tut+4 series is strongly correlated with unemployment rate and predicts its

dynamics (Figure 5c).

Data for our empirical measure of credit conditions are available starting 1966q2, and the data

we use in estimation cover that date to 2011q4.

We do not use data after 2011 for several reasons. First, personal saving rate statistics are

subject to large revisions until some five years after the first data release (after the BEA receives

much higher quality personal income data from the IRS). To quote Nakamura and Stark (2007):

“[M]uch of the initial variation in the personal saving rate across time was meaningless

noise.”

As their paper documents, it is not uncommon for the saving rate to be revised by 3–5 percent

of disposable income after several benchmark revisions.

Second, our index of credit availability is increasingly questionable after 2011 because of the

apparent divergence in credit conditions for installment and mortgage loans: Various sources

(including the Mortgage Credit Availability Index of the Mortgage Bankers’ Association; see

also Bhutta (2015)) document continued tight credit conditions after 2011. If, as this work

suggests, mortgage credit remained tighter than indicated by our installment loans index after

2012, that could explain part of the continued high saving rate in the post-2012 period, which

would be mispredicted by a mismeasured credit conditions index. Alternatively, saving

attitudes may have changed after the Great Recession due to the substantial shock of the

Great Recession, perhaps because of “scarring” effects (see, e.g., Malmendier and Shen (2018),

Jordà, Schularick, and Taylor (2015), Hall (2012)); for evidence that financial crises have

much longer-lasting effects than usual business cycle fluctuations, see Reinhart and

Rogoff (2009). All of these are reasons to worry about data from the post-Great-Recession

period.

4 Structural Estimation

This section estimates the structural model of section 2 by minimizing the distance between

the saving rate implied by the model and its empirical counterpart.

4.1 Estimation Procedure

In more detail, the structural estimation proceeds as follows. We assume that households

observe exogenous movements in unemployment risk ℧ and credit availability

h, and

that there are simple mappings from our credit availability index CEAt to the location of the

consumers’ borrowing constraint ht and from measured unemployment expectations 𝔼 tut+4 to

℧t:

Collecting the parameters Θ = {β,𝜃CEA,𝜃℧,𝜃u}, and the time-t observable variables as

zt = {mt, CEAt, 𝔼 tut+4}, the model implies a “saving rate function” s(zt; Θ) which we aim to

compare to the saving rates observed in the data, stmeas. Our objective is therefore to find the

parameter vector Θ that minimizes the distance between actual saving rates and those implied

by the model:

| (5) |

Minimization of (5) is a non-linear least squares problem for which the standard asymptotic

results apply. The estimates have the asymptotic normal distribution:

where the variance matrix can consistently be estimated with

where the variance matrix can consistently be estimated with

for

σ2 =

for

σ2 =  ∑

t=1T

∑

t=1T  s

tmeas − s(zt; Θ)

s

tmeas − s(zt; Θ) 2 and the T × 4 gradient matrix of the saving rate function

F = ∇Θ′s(zt; Θ) evaluated at Θ (which is calculated numerically).

2 and the T × 4 gradient matrix of the saving rate function

F = ∇Θ′s(zt; Θ) evaluated at Θ (which is calculated numerically).

4.2 Estimates and the Model Fit

Table 1 presents the estimation results. The calibrated parameters—the quarterly real interest

rate r = 0.04∕4, quarterly wage growth ΔW = 0.01∕4 and the coefficient of relative risk

aversion ρ = 2—are conventional and meet (together with the estimated discount factor β) the

conditions sufficient for the problem to have a well-defined solution (see Carroll and

Toche (2009)).

The estimated quarterly discount factor β = 1 − 0.0065 = 0.9935, or 0.974 at an annual

frequency, lies in the standard range. As for the horizontal shift in the consumption function

ht driven by credit availability, the estimates of the scaling factor 𝜃CEA implies that ht varies

between 0 and 8.89∕4 ≈ 2.2, implying that financial deregulation resulted at its peak in an

availability of credit in 2007 that was greater than credit availability at the beginning of

our sample in 1966 by an amount equal to about 220 percent of annual income

(for an average household)—not an unreasonable figure given the now-prevailing

rule of thumb that homebuyers can afford a house costing three times their annual

income.

The estimated intensity of perceived unemployment risk reflects that fact that the risk in

our setup is purely permanent: the estimated risk ℧t ranges between 1.25 × 10−4 and

1.5 × 10−4 per quarter. The peak magnitude of ℧

t (of 1.5 × 10−4) implies that over the life

cycle of 50 years or 200 quarters, the workers face a probability of roughly 3 percent to

become (permanently) unemployed. Given the average aggregate unemployment rate of

roughly 6 percent in our sample and given that much of this risk is in reality transitory, the

estimated scaling of ℧t seems broadly plausible. The estimated risk ℧t is highly

counter-cyclical, reflecting movements in the unemployment rate, further magnified by

unemployment expectations.

The quantitative interpretation of the coefficients in the model can be summarized by

calculating that a 20 percent increase in uncertainty (not out of line for a recession) results in

a roughly 1-percentage-point increase in the saving rate. A way to judge the plausibility of this

prediction is to consider a similar increase in uncertainty in a microeconomically richer model,

such as Carroll, Slacalek, Tokuoka, and White (2017). A 20 percent increase in the variance of

permanent shocks in that model predicts a similar increase in the saving rate, as that implied

by our estimates above.

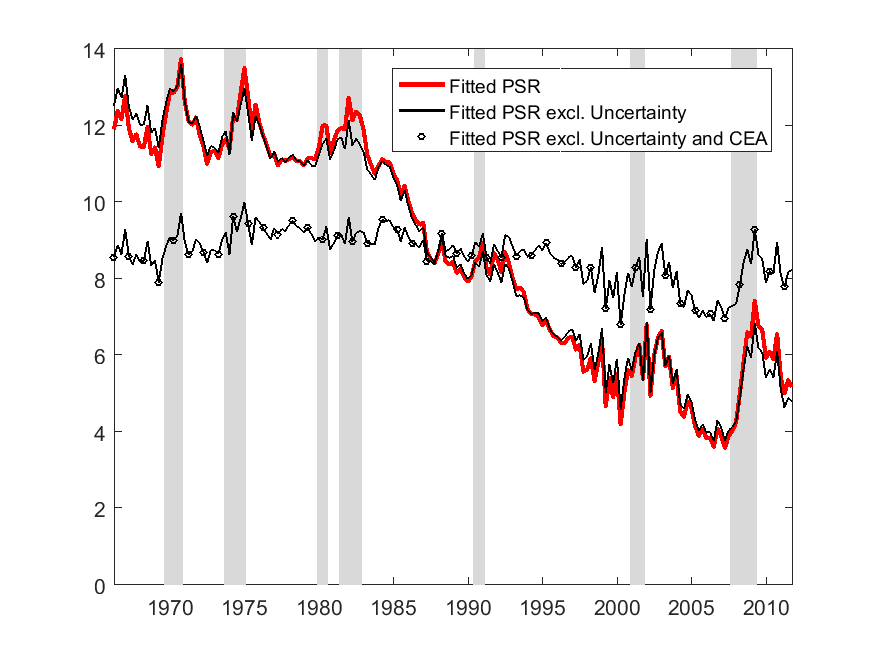

4.3 What Drives the Saving Rate? A Decomposition

Time-variation in the fitted saving rate arises as a result of movements in its three

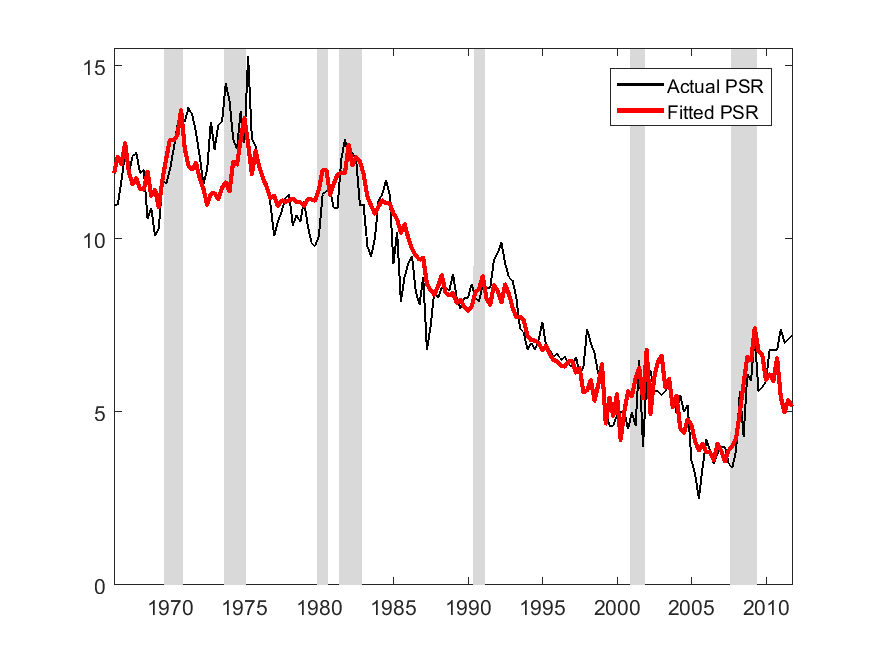

time-varying determinants: wealth, uncertainty and credit conditions; Figure 6.

Overall, the estimated structural model provides a good explanation for both low-frequency

and business-cycle variation in the saving rate (red line in Figure 7a). The model matches

both the 30-year decline in the saving rate before 2007 and the cyclical increases in saving

during recessions. For the Great Recession, Table 2 shows that the model implies an increase

in the saving rate of about 2.6 percentage points between the 2006–2007 period (immediately

before the GR) and the 2009–2010 period (skipping the transitional year of 2008). This

matches exactly the 2.6 point measured change in the saving rate. Of that 2.6 point change,

the drop in wealth accounts for about half, with the increase in uncertainty accounting for a

bit more of the remainder than the decrease in credit. (Recall also our earlier point

that this decomposition understates the full role of uncertainty, if the drop in asset

prices or the tightening of credit were themselves partly the result of increases in

uncertainty).

To gauge the relative importance of the three variables over the full sample, we

sequentially switch off the channels by setting the series equal to their sample

means.

The main takeaway is that the CEA is essential in capturing the trend decline in the PSR

between the 1980s and the early 2000s. The wealth fluctuations contribute to a good

fit of the model at the business-cycle frequencies, and the cyclical fluctuations in

uncertainty magnify the increases in the PSR during recessions, including in the Great

Recession.

The implied estimates of the wealth effect on consumption are on the low end of the range

produced by existing empirical estimates, which lie between 0.02–0.07 (Carroll, Otsuka, and

Slacalek (2011), Mian, Rao, and Sufi (2011), Berger, Guerrieri, Lorenzoni, and

Vavra (2018) and many others). For example, during the Great Recession, of the

5-percentage-point increase in the saving rate the model (black circled line in Figure 7b)

ascribes roughly 3 percentage points to the drop in net worth, which amounted to

roughly 200 percent of disposable income (Figure 5a), implying a marginal propensity

consume out of wealth (MPCW) of 3∕200 = 0.015. The key reason for this contrast is

that our structural estimates attribute a substantial role to uncertainty and credit

conditions. This finding suggests that much of what has been interpreted as pure “wealth

effects” in the prior literature may actually have reflected precautionary or credit

availability effects that are correlated with wealth (a result in line with much of the

household-level evidence, including Hurst and Stafford (2004), Cooper (2013), Aruoba, Elul,

and Kalemli-Ozcan (2019) and others, who stress the role of credit availability and

collateral constraints). (This explanation is supported by our reduced form results in

section 5.3, in which the coefficient on wealth in the saving rate equation is substantially

higher in the univariate regression, than when controlling for uncertainty and credit

conditions.)

Finally, our simple model does not adequately account for household heterogeneity. In a

model like that of Carroll, Slacalek, Tokuoka, and White (2017), wealth shocks mostly hit

wealthy people who have low MPCs, while income shocks (like stimulus checks) hit the whole

population which includes many low-wealth people who have high MPCs. If this is the right

explanation, an RA model (ours included) is by its fundamental nature incapable of

reconciling the conflict. In addition, a substantial proportion of shocks to net worth are

driven by housing wealth, for which evidence suggests that the MPC is likely lower

than for liquid assets (including increases from income tax rebates; for a compelling

quasi-natural experiment on the size of housing wealth effects, see Kessel, Tyrefors, and

Vestman (2019)).

5 Empirical Evaluation of Alternative Models

Here we argue that our model has advantages over the chief alternatives that can be readily

evaluated.

5.1 Quadratic Utility

Since Hall (1978), an optimizing model with quadratic utility has been an influential

benchmark for aggregate consumption dynamics (especially once one understands that

linearized DSGE models are basically indistinguishable from the Hall model). The key

distinction from our theoretical model in section 2 is that, in contrast to CRRA utility, under

quadratic utility uncertainty has no effect on consumption dynamics; quadratic-utility

households do not engage in precautionary saving and do not have a wealth target (other than

the current level of wealth).

The model without uncertainty turns out to be distinctly inferior to our buffer stock saving

model. We have already seen above in Table 1 that the intercept 𝜃℧ and the sensitivity to

uncertainty 𝜃u enter very significantly the unemployment risk equation (4) of the structural

model. This evidence is confirmed in a reduced form linear regression estimation,

where business-cycle variation in labor market uncertainty is strongly related to

the PSR, both on its own and controlling for other variables (columns 1 and 3 of

Table 3, respectively). The results imply that a 1 percentage point increase in

expected unemployment rate increases the saving rate by roughly 0.2–0.6 percentage

points.

These results confirm a large body of complementary evidence on how uncertainty affects

aggregate consumption and saving going back to 1990s. Recently, the evidence based on

household-level data has shown that uncertainty is also important for macroeconomic

outcomes (Bloom, Floetotto, Jaimovich, Saporta-Eksten, and Terry (2018), Kaplan and

Violante (2018) and many others). These findings, mostly based on ‘normal’ (shallow)

recessions, were further strengthened during the Great Recession when (according to Krueger,

Mitman, and Perri (2016) and the references in footnote 8) uncertainty amplified the drop in

house prices, employment and consumption.

5.2 Demographics and Saving

A long tradition of work, stemming from the seminal work of Modigliani and

Brumberg (1954), examines the implications of demographic change for saving using

calibrations and simulations of various life-cycle models (usually in an OLG setup).

Overall, this strand of work has concluded that at the higher frequencies (e.g., annual)

demographic changes do not substantially affect changes in saving because they are both

small and very slow-moving (Summers and Carroll (1987), Parker (2000) and many

others).

If demographic trends could provide a compelling explanation for the long-term decline in

the saving rate leading up to 2007, that might constitute a plausible alternative to our story

based on increased credit availability in the era of financial deregulation. But Auerbach, Cai,

and Kotlikoff (1991) and related papers argued persuasively in the early 1990s that the

first-order implication of demographics was that there should be a sustained rise in the

saving rate for many years until the baby boom generation hit its peak earnings

years around 2000–2005, and a declining saving rate thereafter. This is precisely

the opposite of the actual pattern (the baby boom generation began exiting the

“high-saving” phase of life and entering the supposedly “low-saving” retirement

phase during exactly the interval when the saving rate stopped declining and then

rose).

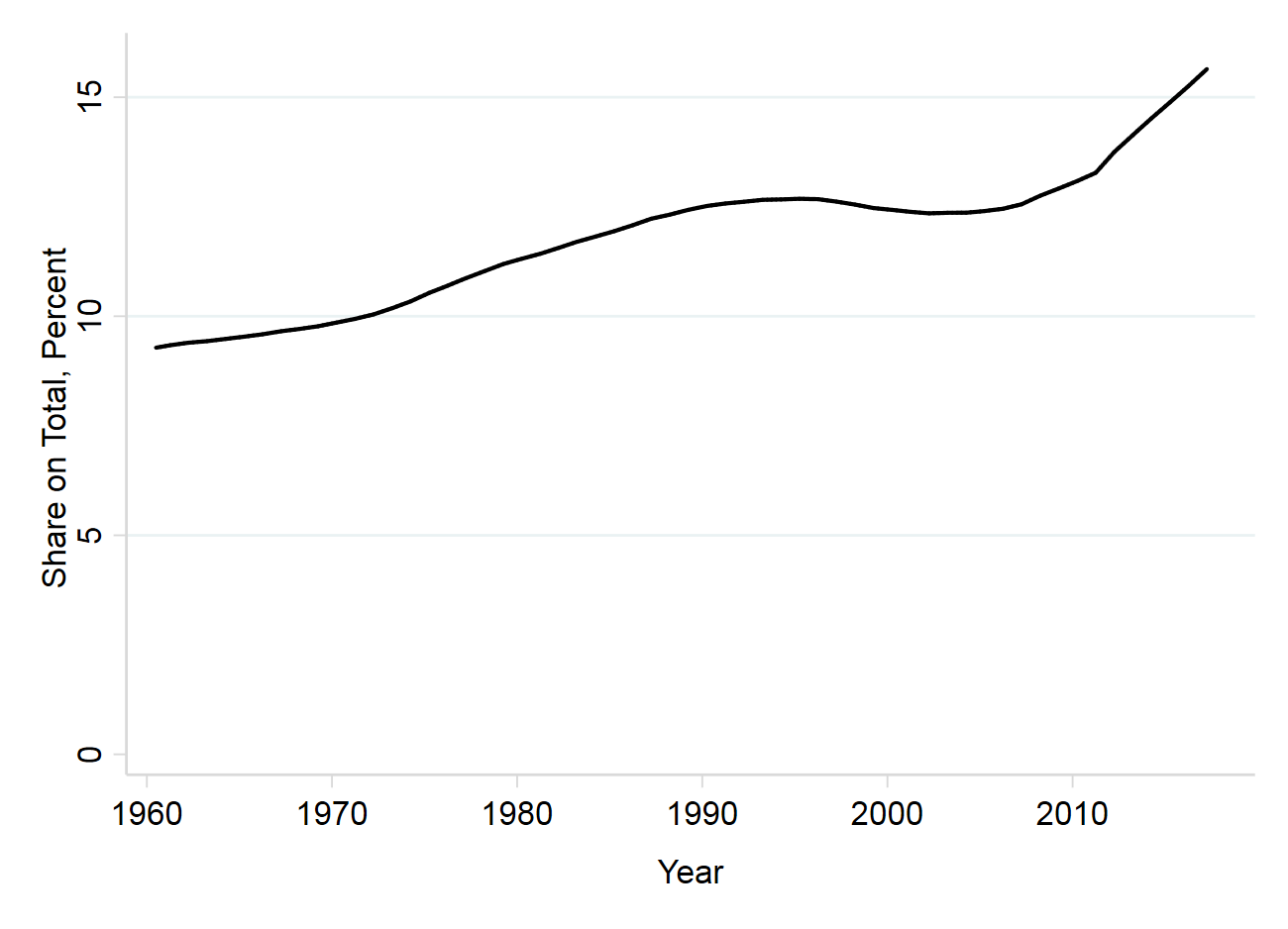

This point is roughly captured in Figure 9a which plots the old-age dependency ratio,

which began rising faster around 2010 when large numbers of baby boomers began reaching

retirement age. In Table 3, column 2 we estimate that the coefficient on the old-age

dependency ratio is negative, which would suggest that the increase in the share of

people older than 65 years should have reduced the saving rate, so the correlations go

the wrong way for a demographic story (confirming the large prior literature after

Auerbach, Cai, and Kotlikoff (1991) that failed to find meaningful demographic

effects).

5.3 Reduced-Form vs Structural Models of Saving

We now ask to what extent the main features of the structural model of section 2 can be

summarized in a simple reduced-form linear regression:

| (6) |

This specification can be readily estimated using OLS estimators (Table 3, column 3) and,

at a minimum, can be interpreted as summarizing basic stylized facts about the

data.

We have mentioned (in section 5.1) that the estimates of the “Baseline” model (6) are

significant and explain more than 90 percent of variation in the saving rate. As expected from

the structural model, the point estimates indicate a strong negative correlation of saving with

net wealth and credit conditions, and a positive correlation with unemployment

risk.

The coefficient on the Credit Easing Accumulated index is highly statistically significant

with a t-statistic of more than 14. (Of course, this t-statistic should be taken with a several

grains of salt given the obvious trends in both variables, and the cautionary literature about

regressions of trends on trends; but aside from demographics (which go the wrong way), there

are no other variables that are core constituents of standard saving models that

have had powerful trends like this, so the case for spurious correlation is weaker

than it sometimes is). The point estimate of γCEA implies that increased access to

credit over the sample period until the Great Recession reduced the PSR by about

8 percentage points of disposable income. In the aftermath of the Recession, the

CEA index declined between 2007 and 2010 by roughly 0.11 as credit supply tightened,

contributing roughly 0.64 percentage point to the increase in the saving rate. Finally,

once the three variables are included jointly, the time trend ceases to be significant

(column 4).

Given how well the baseline linear reduced-form model captures the saving rate, one might

wonder what value is added by construction of the structural model we proposed earlier. A

first point to make here is that when we simulate the estimated version of our model

and perform linear regressions on the corresponding generated data, the result is

very close to being linear (the R2 is 0.975). Essentially, therefore, the difference

between the two approaches is that the OLS regression puts no restrictions at all

on the linear relationships between the variables, while the structural estimation

puts stringent requirements that those linear relationships be tightly constrained to

the small subset of nearly linear relationships that is a good approximation to the

structural theory. The fact that the R2 from the structural estimation is essentially the

same as for the unrestricted model (both of them round to 0.91) was by no means

inevitable and indicates that the structure imposed by the model does no violence to the

data.

5.3.1 Why Estimate a Structural Model When OLS Works Fine?

Because structural estimation restricts empirical relationships to those that are compatible

with a theory, structural models by their intrinsic nature fit the data worse than an

unrestricted data-fitting exercise; the advantages of structural modeling (articulated below)

can nevertheless make such estimation worth the sacrifice in data-fitting ability. In

the case at hand, however, the structural model fits the data nearly as well as an

unrestricted OLS regression. Thus, in our context, the case for structural modeling is

stronger than in the usual case where there is a significant penalty in data-fitting

ability.

Some of the advantages of having a structural model are:

- If the structure imposed is one that has considerable backing from other contexts

or kinds of data, it is less likely that the fit of the model to the data is spurious

(in the sense of failing to capture any reliable or causal economic relationship).

- The structural model can provide insights that could not be obtained from

the reduced form model. For example, the “overshooting” result implied by the

structural model might have important consequences for business cycle dynamics

even if the fit of the structure that embodies those dynamics is statistically inferior

to the reduced form fit.

- The structural model has implications for ways to test the ideas using data other

than those on which it was estimated. In this case, for example, the structural

model would suggest that it would be useful to look at regional or local data in

which the endogeneity of aggregate asset prices and credit conditions could be

controlled for by looking at differences in unemployment expectations and saving

responses across regions in an aggregate economy where most of the movements

in the other explanatory variables are not region-specific.

5.4 Further Robustness Checks

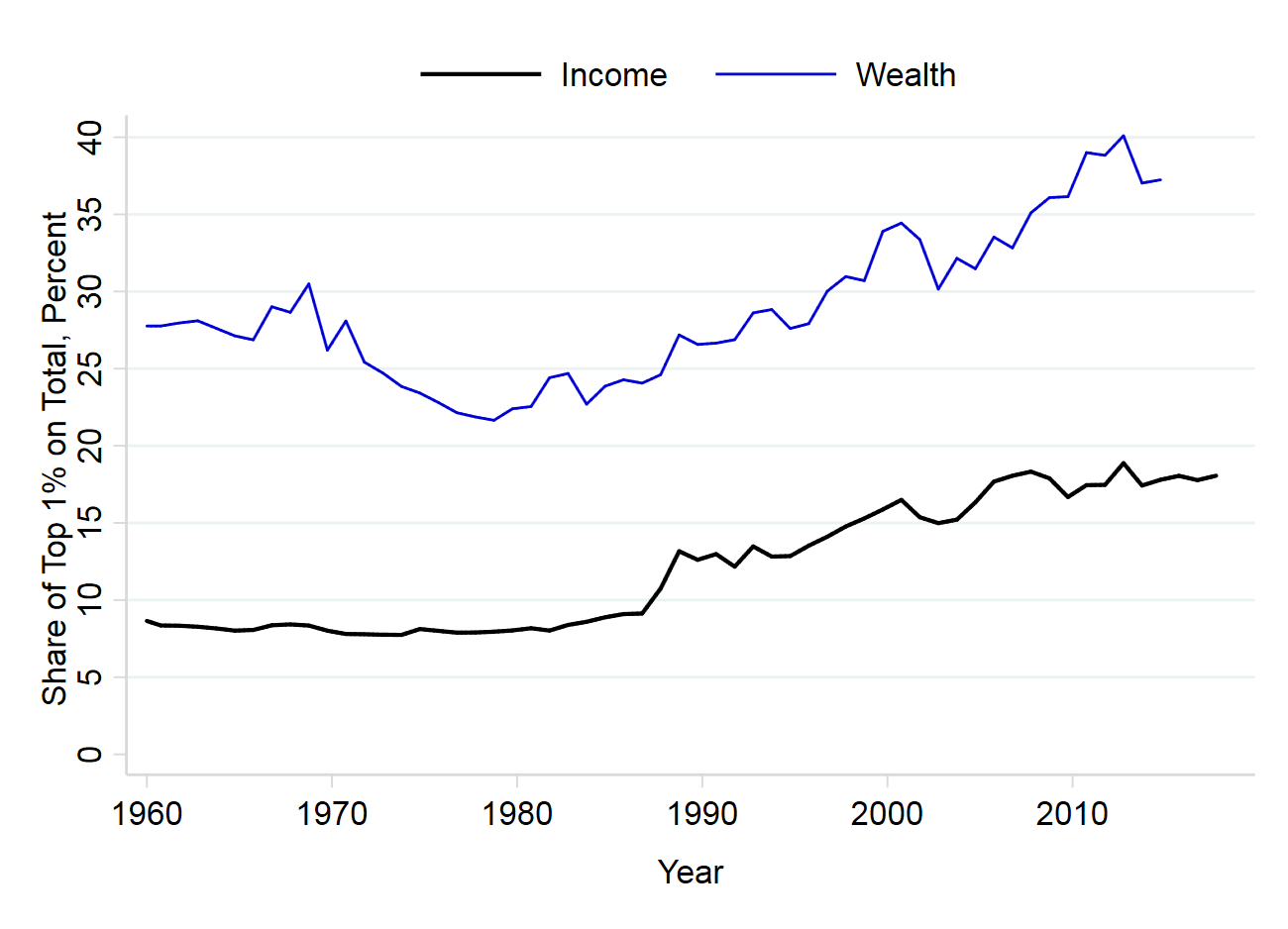

Columns 5 and 6 of Table 3 summarize the correlations of the personal saving rate with two

variables that some theories suggest might be related to it: government saving (Figure 9b)

and income inequality (Figure 9c).

Column 5 reports that there is indeed a negative correlation between government and

personal saving, though the size of the coefficient, −0.15, implies only a modest crowding out.

More than a support for the Ricardian equivalence—the hypothesis that households

observing higher government saving should save less themselves (as they should expect

lower taxes in the future)—the finding seems to reflect reverse causality between

private and public saving, the fact that during recessions government saving falls

(e.g., due to higher outlays on unemployment insurance), while personal saving rises

for precautionary reasons (see work of Elmendorf and Mankiw (1999) and many

others).

Finally, in column 6 we evaluate whether growing income inequality (shown in Figure 9c)

has resulted in an increase in the aggregate saving rate: Microeconomic evidence points to

high personal saving rates among the higher-permanent-income households (Carroll (2000);

Dynan, Skinner, and Zeldes (2004)), whose share on total income has been rising. Having

experimented with numerous measures of the top shares of Piketty and Saez (2003), we find

little evidence of a substantial and statistically significant correlation between saving and

income inequality.

6 Conclusions

We show that a simple representative-consumer model of buffer stock saving can match most

of the time-series variation in the aggregate US personal saving rate over the past 50 years. In

the model, saving depends on the gap between the ‘target’ and actual wealth, with the target

determined by credit availability and uncertainty.

We estimate that these three factors—credit availability, shocks to household wealth, and

movements in income uncertainty proxied by unemployment risk—have all been important in

driving the saving rate. In particular, the relentless expansion of credit supply between the

early-1980s and 2007 (likely largely reflecting financial innovation and liberalization), along

with higher asset values and consequent increases in net wealth (possibly also partly

attributable to the credit boom) encouraged households to save less out of their disposable

income. At the same time, the fluctuations in wealth and labor income uncertainty, for

instance during and after the burst of the information technology and credit bubbles

of 2001 and 2007, can explain the bulk of business cycle fluctuations in personal

saving.

The model we estimate could be extended to analyze the implications of the ‘overshooting’

of saving in response to business-cycle shocks. For example, the model suggests that in a

recession an optimizing government might want to counteract the part of the consumption

decline that reflects overshooting. In an economy rendered non-Ricardian by liquidity

constraints and/or uncertainty, the existence of precautionary saving thus provides a potential

rationale for counter-cyclical fiscal policy.

More generally, the simple buffer stock saving model we estimate could provide insights into

the current debate about the role household heterogeneity for macroeconomic outcomes. The

model is both easy to solve and provides a setup to meaningfully analyze the effects on

uncertainty on the macro-economy. Consequently, the model could be a useful middle ground

between a setup with a realistic but complex description of household heterogeneity (HANK)

and a simple two-agent spender–saver setup (TANK) that cannot accommodate roles for

credit availability or uncertainty.

References

Abiad, Abdul, Enrica Detragiache, and Thierry Tressel (2010): “A New

Database of Financial Reforms,” IMF Staff Papers, 57(2), 281–302.

Aron, Janine, John V. Duca, John Muellbauer, Keiko Murata, and Anthony

Murphy (2011): “Credit, Housing Collateral, and Consumption: Evidence from Japan, the

U.K., and the U.S.,” Review of Income and Wealth.

Aruoba, S Boragan, Ronel Elul, and Sebnem Kalemli-Ozcan (2019): “How Big

is the Wealth Effect? Decomposing the Response of Consumption to House Prices,” FRB of

Philadelphia Working Paper.

Auerbach, Alan J., Jinyong Cai, and Laurence J. Kotlikoff (1991): “U.S.

Demographics and Saving: Predictions of Three Saving Models,” Carnegie–Rochester

Conference Series on Public Policy, 34(1), 135–156.

Baker, Scott R, Nicholas Bloom, and Steven J Davis (2016): “Measuring

economic policy uncertainty,” The Quarterly Journal of Economics, 131(4), 1593–1636.

Bekaert, Geert, Eric Engstrom, and Yuhang Xing (2009): “Risk, uncertainty, and

asset prices,” Journal of Financial Economics, 91(1), 59–82.

Berger, David, Veronica Guerrieri, Guido Lorenzoni, and Joseph Vavra

(2018): “House Prices and Consumer Spending,” Review of Economic Studies, 85(3),

1502–1542.

Bhutta, Neil (2015): “The Ins and Outs of Mortgage Debt During the Housing Boom

and Bust,” Journal of Monetary Economics, 76(C), 284–298.

Bloom, David E., David Canning, Richard K. Mansfield, and Michael Moore

(2007): “Demographic Change, Social Security Systems and Savings,” Journal of Monetary

Economics, 54, 92–114.

Bloom, Nicholas, Max Floetotto, Nir Jaimovich, Itay Saporta-Eksten, and

Stephen J. Terry (2018): “Really Uncertain Business Cycles,” Econometrica, 86(3),

1031–1065.

Bosworth, Barry, and Gabriel Chodorow-Reich (2007): “Saving and Demographic

Change: The Global Dimension,” working paper 2, Center for Retirement Research, Boston

College.

Burgess, Stephen, Emilio Fernandez-Corugedo, Charlotta Groth, Richard

Harrison, Francesca Monti, Konstantinos Theodoridis, and Matt Waldron

(2013): “The Bank of England’s Forecasting Platform: COMPASS, MAPS, EASE and the

Suite of Models,” working paper 471, Bank of England.

Carroll, Christopher D. (1992): “The Buffer-Stock Theory of Saving: Some

Macroeconomic Evidence,” Brookings Papers on Economic Activity, 1992(2), 61–156,

http://econ.jhu.edu/people/ccarroll/BufferStockBPEA.pdf.

__________ (2000): “Why Do the Rich Save So Much?,” in Does Atlas Shrug? The Economic

Consequences of Taxing the Rich, ed. by Joel B. Slemrod. Harvard University Press,

http://econ.jhu.edu/people/ccarroll/Why.pdf.

__________ (2001): “A Theory of the Consumption Function,

With and Without Liquidity Constraints,” Journal of Economic Perspectives, 15(3), 23–46,

http://econ.jhu.edu/people/ccarroll/ATheoryv3JEP.pdf.

Carroll, Christopher D., and Olivier Jeanne (2009): “A Tractable Model of

Precautionary Reserves, Net Foreign Assets, or Sovereign Wealth Funds,” NBER Working

Paper Number 15228, http://econ.jhu.edu/people/ccarroll/papers/cjSOE.

Carroll, Christopher D., Misuzu Otsuka, and Jiri Slacalek (2011): “How Large

Are Financial and

Housing Wealth Effects? A New Approach,” Journal of Money, Credit, and Banking, 43(1),

55–79, http://econ.jhu.edu/people/ccarroll/papers/cosWealthEffects/.

Carroll, Christopher D.,

Jiri Slacalek, Kiichi Tokuoka, and Matthew N. White (2017): “The Distribution

of Wealth and the Marginal Propensity to Consume,” Quantitative Economics, 8, 977–1020,

At http://econ.jhu.edu/people/ccarroll/papers/cstwMPC.

Carroll, Christopher D., and Patrick Toche

(2009): “A Tractable Model of Buffer Stock Saving,” NBER Working Paper Number 15265,

http://econ.jhu.edu/people/ccarroll/papers/ctDiscrete.

Cooper, Daniel (2013): “House Price Fluctuations: The Role of Housing Wealth as

Borrowing Collateral,” The Review of Economics and Statistics, 95(4), 1183–1197.

Curtis, Chadwick C., Steven Lugauer, and Nelson C. Mark (2015):

“Demographic Patterns and Household Saving in China,” American Economic Journal:

Macroeconomics, 7(2), 58–94.

Debortoli, Davide, and Jordi Galí (2017): “Monetary policy with heterogeneous

agents: Insights from TANK models,” Manuscript.

Demyanyk, Yuliya, Charlotte Ostergaard, and Bent E. Sørensen (2007): “U.S.

Banking Deregulation, Small Businesses, and Interstate Insurance of Personal Income,”

Journal of Finance, 62(6), 2763–2801.

Dornbusch, Rudiger (1976): “Expectations and Exchange Rate Dynamics,” Journal of

Political Economy, 84(6), 1161–1176.

Drechsler, Itamar (2013): “Uncertainty, time-varying fear, and asset prices,” The

Journal of Finance, 68(5), 1843–1889.

Duca, John V., John Muellbauer, and Anthony Murphy (2010): “Credit Market

Architecture and the Boom and Bust in the U.S. Consumption,” mimeo, University of

Oxford.

Dynan, Karen E., Jonathan Skinner, and Stephen P. Zeldes (2004): “Do the

Rich Save More?,” Journal of Political Economy, 112(2), 397–444.

Eggertsson, Gauti B., and Paul Krugman (2012): “Debt, Deleveraging, and the

Liquidity Trap: A Fisher–Minsky–Koo Approach,” The Quarterly Journal of Economics,

127(3), 1469–1513.

Elmendorf, Douglas, and N. Gregory Mankiw (1999): “Government Debt,” in

Handbook of Macroeconomics, ed. by J. B. Taylor, and M. Woodford, vol. 1, Part C,

chap. 25, pp. 1615–1669. Elsevier, 1 edn.

Favilukis, Jack, Sydney C. Ludvigson, and Stijn Van Nieuwerburgh (2017):

“The Macroeconomic Effects of Housing Wealth, Housing Finance, and Limited Risk Sharing

in General Equilibrium,” Journal of Political Economy, 125(1), 140–223.

Garriga, Carlos, and Aaron Hedlund (2018): “Housing Finance, Boom–Bust

Episodes, and Macroeconomic Fragility,” mimeo, University of Missouri.

Glover, Andrew, Jonathan Heathcote, Dirk Krueger, and José-Víctor

Ríos-Rull (2017): “Intergenerational Redistribution in the Great Recession,”

updated version of working paper 16924, National Bureau of Economic Research,

https://www.sas.upenn.edu/~dkrueger/research/RecessionNew.pdf.

Gomes, Francisco, and Alexander Michaelides (2007): “Asset pricing with limited

risk sharing and heterogeneous agents,” The Review of Financial Studies, 21(1), 415–448.

Gordon, Robert J (2015): “Secular stagnation: A supply-side view,” American

Economic Review, 105(5), 54–59.

Gorea, Denis, and Virgiliu Midrigan (2018): “Liquidity Constraints in the U.S.

Housing Market,” mimeo, New York University.

Guerrieri, Veronica, and Guido Lorenzoni (2017): “Credit crises, precautionary

savings, and the liquidity trap,” The Quarterly Journal of Economics, 132(3), 1427–1467.

Hall, Robert E. (1978): “Stochastic Implications of the Life-Cycle/Permanent Income

Hypothesis: Theory and Evidence,” Journal of Political Economy, 96, 971–87, Available at

http://www.stanford.edu/~rehall/Stochastic-JPE-Dec-1978.pdf.

__________ (2011): “The Long Slump,” AEA Presidential Address, ASSA Meetings, Denver.

__________ (2012): “Quantifying the Forces Leading to the Collapse of GDP after the

Financial Crisis,” Manuscript, Stanford University.

Hamilton, James D, Ethan S Harris, Jan Hatzius, and Kenneth D West

(2016): “The equilibrium real funds rate: Past, present, and future,” IMF Economic Review,

64(4), 660–707.

Hubmer, Joachim, Per Krusell, and Anthony A. Smith, Jr. (2018): “A

Comprehensive Quantitative Theory of the U.S. Wealth Distribution,” mimeo, Yale

University.

Huo, Zhen, and José-Víctor Ríos-Rull (2016): “Financial Frictions, Asset

Prices, and the Great Recession,” Staff Report 526, Federal Reserve Bank of Minneapolis.

Hurst, Erik, and Frank Stafford (2004): “Home Is Where the Equity Is: Mortgage

Refinancing and Household Consumption,” Journal of Money, Credit and Banking, 36(6),

985–1014.

Imrohoroglu, Ayse, and Kai Zhao (2018): “The Chinese Saving Rate: Long-Term

Care Risks, Family Insurance, and Demographics,” Journal of Monetary Economics, 96(C),

33–52.

Jordà, Òscar, Moritz Schularick, and Alan M. Taylor (2015): “Leveraged

Bubbles,” Journal of Monetary Economics, 76(S), 1–20.

Justiniano, Alejandro, Giorgio Primiceri, and

Andrea Tambalotti (forthcoming): “Credit Supply and the Housing Boom,” Journal of

Political Economy.

Kaplan, Greg, Kurt Mitman, and Giovanni L. Violante (2017): “The Housing

Boom and Bust: Model Meets Evidence,” working paper 23694, National Bureau of Economic

Research.

Kaplan, Greg, Benjamin Moll, and Giovanni L. Violante (2016): “Monetary

Policy According to HANK,” Working Paper 21897, National Bureau of Economic Research.

Kaplan, Greg, and Giovanni L. Violante (2018): “Microeconomic Heterogeneity and

Macroeconomic Shocks,” Journal of Economic Perspectives, 32(3), 167–194.

Kessel, Dany, Björn Tyrefors, and Roine Vestman (2019): “The Housing Wealth

Effect: Quasi-Experimental Evidence,” Available at SSRN.

Kimball, Miles S. (1993): “Standard Risk Aversion,” Econometrica, 61(3), 589–611.

Krueger, Dirk, Kurt Mitman, and Fabrizio Perri (2016): “Macroeconomics and

Household Heterogeneity,” Handbook of Macroeconomics, 2, 843–921.

Krugman, Paul (2013): “Secular stagnation, coalmines, bubbles, and Larry Summers,”

New York Times, 16, 2013.

__________ (2014): “Four observations on secular stagnation,” Secular stagnation: Facts,

causes and cures, pp. 61–68.

Landvoigt, Tim (2017): “Housing Demand During the Boom: The Role of Expectations

and Credit Constraints,” The Review of Financial Studies, 30(6), 1865–1902.

Malmendier, Ulrike, and Leslie Sheng Shen (2018): “Scarred Consumption,”

working paper 24696, National Bureau of Economic Research.

Mian, Atif, Kamalesh Rao, and Amir Sufi (2011): “Household Balance Sheets,

Consumption, and the Economic Slump,” Manuscript, University of California at Berkeley.

Modigliani, Franco, and Richard Brumberg (1954): “Utility Analysis and the

Consumption Function: An Interpretation of Cross-Section Data,” in Post-Keynesian

Economics, ed. by Kenneth K. Kurihara, New Brunswick, NJ. Rutgers University Press.

Mody, Ashoka, Franziska Ohnsorge, and Damiano Sandri (2012): “Precautionary

Savings in the Great Recession,” IMF Economic Review, 60(1), 114–138.

Muellbauer, John N. (2007): “Housing, Credit and Consumer Expenditure,” in

Housing, Housing Finance and Monetary Policy, pp. 267–334. Jackson Hole Symposium,

Federal Reserve Bank of Kansas City.

Nakamura, Leonard I., and Thomas Stark (2007): “Mismeasured

Personal Saving and the Permanent Income Hypothesis,” Working Papers,

http://philadelphiafed.org/research-and-data/publications/working-papers/2007/wp07-8.pdf.

Pagano, Marco, and Tullio Jappelli (1993): “Information sharing in credit markets,”

The Journal of Finance, 48(5), 1693–1718.

Parker, Jonathan A. (2000): “Spendthrift in America? On Two Decades of Decline

in the U.S. Saving Rate,” in NBER Macroeconomics Annual 1999, Volume 14, NBER

Chapters, pp. 317–387. National Bureau of Economic Research, Inc.

Piketty, Thomas, and Emmanuel Saez (2003): “Income Inequality in the United

States, 1913–1998,” Quarterly Journal of Economics, 118(1), 1–39.

Reinhart, Carmen M., and Kenneth S. Rogoff (2009): “The Aftermath of

Financial Crises,” American Economic Review, 99(2), 466–72.

Summers, Lawrence (2013): “On secular stagnation,” Reuters Analysis & Opinion, 16.

Summers, Lawrence H (2015): “Demand side secular stagnation,” American Economic

Review, 105(5), 60–65.

Summers, Lawrence H., and Christopher D. Carroll (1987): “Why is

U.S. National Saving So Low?,” Brookings Papers on Economic Activity, 1987(2), 607–636,

http://econ.jhu.edu/people/ccarroll/NatSavSoLow.pdf.

Trichet, Jean-Claude (2010): “Luncheon Address: Central Banking in Uncertain Times:

Conviction and Responsibility,” Proceedings, Economic Policy Symposium, Jackson Hole,

pp. 243–266.

Woolley, John T. (2012): “Persistent Leadership: Presidents and the Evolution of U.S.

Financial Reform, 1970-2007,” Presidential Studies Quarterly, 42(1), 60–80.

Table 1: Calibration and Structural Estimates

s t = s  {mt, {mt, CEA t, 𝔼 tut+4}; Θ , |

| ht = 𝜃CEACEAt,

|

| ℧t = 𝜃℧ + 𝜃u 𝔼 tut+4.

|

| Parameter | Description | Value

|

| Calibrated Parameters

|

| r | Interest Rate | 0.04/4

|

| ΔW | Wage Growth | 0.01/4

|

| ρ | Relative Risk Aversion | 2

|

| Estimated Parameters Θ = {β,𝜃CEA,𝜃℧,𝜃u}

|

| β | Discount Factor | 1 − 0.0065∗∗∗ |

| | | (0.0005) |

| 𝜃CEA | Scaling of CEAt to ht | 8.8943∗∗∗ |

| | | (0.8403) |

| 𝜃℧ | Scaling of 𝔼 tut+4 to ℧t | 1.2079×10−4∗∗∗ |

| | | (0.2757 × 10−4) |

| 𝜃u | Scaling of 𝔼 tut+4 to ℧t | 2.6764×10−4∗∗∗ |

| | | (0.6490 × 10−4) |

| R2 | | 0.906 |

| DW stat | | 0.780 |

| | Sample average of CEAt | 0.4289 |

| | Sample average of 𝔼 tut+4 | 0.0620 |

| |

Notes: Quarterly calibration. Estimation sample: 1966q2–2011q4. {∗,∗∗,∗∗∗} = Statistical significance at

{10,5,1} percent. Standard errors (in parentheses) were calculated with the delta method. Parameter

estimates imply sample averages of 3.82 and 0.000137 for ht and ℧t, respectively.

Table 2: Actual and Explained Change of the Saving Rate: Structural and Reduced

Form Models, 2006/07–2009/10

| |

| | Model Decomposition | |

| |

|

| Variable | Structural | Reduced Form | Actual Δst

|

| mt | 1.3 | −0.89 ×−1.19 = 1.1 | |

| CEAt | 0.6 | −7.91 ×−0.12 = 1.0 | |

| 𝔼 tut+4 | 0.7 | 0.20 × 4.6 = 0.9 | |

| Explained/Actual Δst | 2.6 | 3.0 | 2.6 |

| |

Notes: The table shows the change of the personal saving rate between the two-year averages of years

2006–2007 and 2009–2010 (in percentage points) implied by the structural model, the baseline reduced form

model of Table 3 and in actual data.

Table 3: Reduced-Form Regressions

| st = γ0 + γmmt + γCEACEAt + γEu 𝔼 tut+4 + γ′Xt + 𝜀t

| | | | Reduced-Form | Additional Variables

|

| | |

| |

|

| Model | Uncertainty | Demographics | Baseline | Time Trend | Gov Sav | Ineq

|

| γ0 | 11.750∗∗∗ | 29.504∗∗∗ | 17.157∗∗∗ | 15.535∗∗∗ | 17.588∗∗∗ | 18.553∗∗∗ |

| | (0.462) | (5.257) | (1.589) | (2.004) | (1.589) | (1.804) |

| γm | | −1.596∗∗∗ | −0.894∗∗∗ | −0.618∗ | −0.862∗∗∗ | −1.321∗∗∗ |

| | | (0.362) | (0.261) | (0.341) | (0.269) | (0.410) |

| γCEA | | −4.444∗∗∗ | −7.909∗∗∗ | −4.156∗∗ | −8.149∗∗∗ | −9.545∗∗∗ |

| | | (1.451) | (0.556) | (2.098) | (0.565) | (1.249) |

| γEu | 0.551∗∗∗ | 0.264∗∗∗ | 0.202∗∗∗ | 0.347∗∗∗ | 0.028 | 0.181∗∗∗ |

| | (0.059) | (0.068) | (0.064) | (0.105) | (0.074) | (0.065) |

| γt | −0.055∗∗∗ | | | −0.025 | | |

| | (0.002) | | | (0.015) | | |

| γold | | −0.861∗∗ | | | | |

| | | (0.365) | | | | |

| γgov sav | | | | | −0.152∗∗ | |

| | | | | | (0.063) | |

| γinc share | | | | | | 0.190 |

| | | | | | | (0.144) |

| R2 | 0.910 | 0.918 | 0.911 | 0.914 | 0.916 | 0.913 |

| F stat p val | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| DW stat | 0.761 | 0.848 | 0.732 | 0.769 | 0.682 | 0.771 |

| |

Notes: Estimation sample: 1966q2–2011q4. {∗,∗∗,∗∗∗} = Statistical significance at {10,5,1} percent.

Newey–West standard errors, 4 lags.

Supplemental Materials—Not for Publication

A Extension of Derivation of Target Wealth to Include Unemployment Insurance

This appendix introduces an unemployment insurance system into the model of Carroll and

Toche (2009) (which assumes that income for unemployed/retired households is zero). The UI system

guarantees a minimum (positive) level of income to the unemployed. For ease of modelling we assume

that the unemployment insurance benefit is a constant proportion of the labor income that the

unemployed would counterfactually earn in the first year of unemployment if they had not become

unemployed.

In the perfect foresight context, receiving a constant payment with perfect certainty is equivalent

to receiving a lump sum “severance” payment whose value is equal to the PDV of the stream of

future UI payments. Thus, for simplicity, we assume S = ς ⋅ℓW, which means individuals will receive

one-period severance payment S in the amount of a certain ratio ς to labor income of the period

when they first lose their jobs. After that, they will not receive any unemployment insurance

benefit.

The only modifications of the decision problem are to add the severance payment and a

corresponding lump-sum tax into the dynamic budget constraint (DBC) of employed consumers in

Carroll and Toche (2009),

where we denote with lower-case m and c the levels of market resources (market wealth plus

current income) and consumption normalized by the corresponding period’s pretax labor

income ℓW. We let τ = ℧ ×S to ensure a balanced budget for the unemployment insurance

system.

Following Carroll and Toche (2009), we have the following condition derived from the Euler

equation,

Superscripts e and u represent the two possible employment states.

To find the Δce = 0 and Δme = 0 loci, we let ct+1e = cte ≡ce and mt+1e = mte ≡me. Given

ct+1u = mt+1uκu (κu is the MPC of an unemployed consumer), combined with the modified DBC

above, we have (for R≡R∕Γ):

Rearranging terms, the Δce = 0 locus can be characterized as:

Given the modified DBC of employed consumers, the Δme = 0 locus becomes:

Given the last two equations, we are able to obtain the exact formula for target wealth me, which is

the steady state value of me. Defining η ≡RκuΠ, following Carroll and Toche (2009), we have:

Clearly, target wealth decreases when the severance payment becomes more generous and it can even

be negative if we make the severance ratio ς large enough.

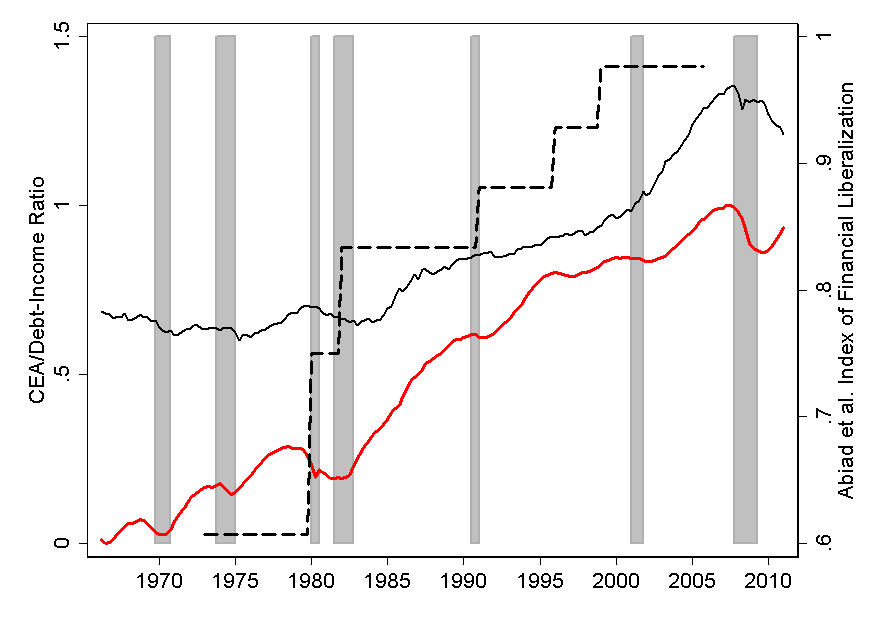

B Comparison of Alternative Measures of Credit Availability

Figure 10 compares three measures of credit availability: our baseline CEA index, the Index of

Financial Liberalization constructed by Abiad, Detragiache, and Tressel (2010) for a number of

countries including the United States, and the ratio of household liabilities to disposable

income.

The Abiad, Detragiache, and Tressel index is a mixture of indicators of financial development:

credit controls and reserve requirements, aggregate credit ceilings, interest rate liberalization,

banking sector entry, capital account transactions, development of securities markets and banking

sector supervision. The correlation coefficient between this measure and CEA is about 90

percent.

For comparison, the figure also includes the ratio of liabilities to disposable income (from the Flow

of Funds), which is however determined influenced by the interaction between credit supply and

demand.

C Reduced Form Regressions with Saving Rate Generated by the Structural Model

Table 4: Reduced-Form Regressions with Saving Rate Estimated by the Structural

Model

| st = γ0 + γmmt + γCEACEAt + γEu 𝔼 tut+4 + γ′Xt + 𝜀t

| | | | Reduced-Form | Additional Variables

|

| | |

| |

|

| Model | Uncertainty | Demographics | Baseline | Time Trend | Gov Sav | Ineq

|

| γ0 | 11.689∗∗∗ | 18.994∗∗∗ | 16.254∗∗∗ | 16.093∗∗∗ | 16.215∗∗∗ | 16.330∗∗∗ |

| | (0.182) | (1.126) | (0.636) | (0.710) | (0.633) | (0.646) |

| γm | | −0.912∗∗∗ | −0.756∗∗∗ | −0.729∗∗∗ | −0.759∗∗∗ | −0.780∗∗∗ |

| | | (0.110) | (0.099) | (0.113) | (0.099) | (0.117) |

| γCEA | | −7.316∗∗∗ | −8.085∗∗∗ | −7.713∗∗∗ | −8.064∗∗∗ | −8.174∗∗∗ |

| | | (0.292) | (0.112) | (0.621) | (0.114) | (0.309) |

| γEu | 0.555∗∗∗ | 0.237∗∗∗ | 0.223∗∗∗ | 0.238∗∗∗ | 0.239∗∗∗ | 0.222∗∗∗ |

| | (0.025) | (0.018) | (0.017) | (0.030) | (0.021) | (0.016) |

| γt | −0.055∗∗∗ | | | −0.002 | | |

| | (0.001) | | | (0.004) | | |

| γold | | −0.191∗∗∗ | | | | |

| | | (0.071) | | | | |

| γgov sav | | | | | 0.014 | |

| | | | | | (0.014) | |

| γinc share | | | | | | 0.010 |

| | | | | | | (0.033) |

| R2 | 0.975 | 0.989 | 0.988 | 0.988 | 0.988 | 0.988 |

| F stat p val | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| DW stat | 1.167 | 2.331 | 2.213 | 2.219 | 2.237 | 2.217 |

| |

Notes: Estimation sample: 1966q2–2011q4. {∗,∗∗,∗∗∗} = Statistical significance at {10,5,1} percent.

Newey–West standard errors, 4 lags.