The American Consumer:

Reforming, Or Just Resting?

June 20, 2009

Christopher D. Carroll1

Johns Hopkins University

Jiri Slacalek2

European Central Bank

_____________________________________________________________________________________

Abstract

American households have received a triple dose of bad news since the beginning of the current

recession: The greatest collapse in asset values since the Great Depression, a sharp tightening in credit

availability, and a large increase in unemployment risk. We present measures of the size of these

shocks and discuss what a benchmark theory says about their immediate and ultimate consequences.

We then provide a forecast based on a simple empirical model that captures the effects of wealth

shocks and unemployment fears. Our short-term forecast calls for somewhat weaker spending, and

somewhat higher saving rates, than the Consensus survey of macroeconomic forecasters. Over

the longer term, our best guess is that the personal saving rate will eventually approach

the levels that preceded period of financial liberalization that began in the late 1970s.

-

Keywords

-

Consumption/Saving Forecast, Credit Crunch, Financial

Crisis

-

JEL codes

-

C61, D11, E24

1Carroll: ccarroll@jhu.edu, Department of Economics, Johns Hopkins University, Baltimore

Maryland 21218, USA; and National Bureau of Economic Research.

2Slacalek: jiri.slacalek@ecb.int, Monetary Policy Research Division, European Central Bank,

Frankfurt Germany. The views contained in this paper do not necessarily reflect the views of the

European Central Bank or other members of its staff.

1 Introduction

Economists and pundits have complained for years that Americans do not save

enough. Economists, in keeping with our reputation, have tended to use bland

words like “unsustainable” or “problematic”; pundits, preferring more

colorful language, have called the American saving rate “dismal” and

“pathetic.”

As economists, we lean toward the bland terminology. But, to quote former

Council of Economic Advisors chair Herbert Stein, “Unsustainable trends, sooner

or later, come to an end.”

That end appears now to be coming, much more suddenly than anyone

expected. Indeed, the collapse in household spending over the past six months is

a principal source of the gloom currently emanating from macroeconomic

forecasters.

After so much lamentation about low saving, it may be a bit hard for the

public to stomach economists’ new worries about a drop in spending. But the

contradiction can be understood by analogy to the prayer of Saint Augustine,

who after a youth spent in debauchery decided to convert to Christianity to

preserve his mortal soul. He was still enjoying his sinful ways when he made that

fateful decision, so his first prayer was “Lord, make me chaste – but not quite

yet.”

Saint Augustine may not have had a good excuse for gradualism, but

economists do: The costs of adjustment to a permanently higher saving rate

would likely be substantially smaller if that increase were spread out over the

course of several years than if it happens all at once. (This is part of the

motivation behind several items in the recently passed stimulus bill that aimed

to revive near-term consumer spending, especially on durable goods like

automobiles.)

Optimal or not, our best guess (illustrated below by forecasts from a simple

model) is that the drop in overall consumption spending will not be speedily

reversed; indeed, we project that the saving rate will rise a bit further from

current levels before stabilizing somewhere not far below the saving rates that

prevailed before the era of financial liberalization that started in the late 1970s.

But we would not be greatly surprised if the saving rate ultimately rises even

more than in our most extreme projection. In answer to the question in our title,

our view is that American consumers are not merely resting from their

former role as the world’s champion consumers, they are permanently

reforming their spending patterns, in response to the end of the period of

ever-more-available credit that fueled the unsustainably high spending of recent

years.

2 Theory and Data

2.1 A Simple Model

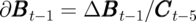

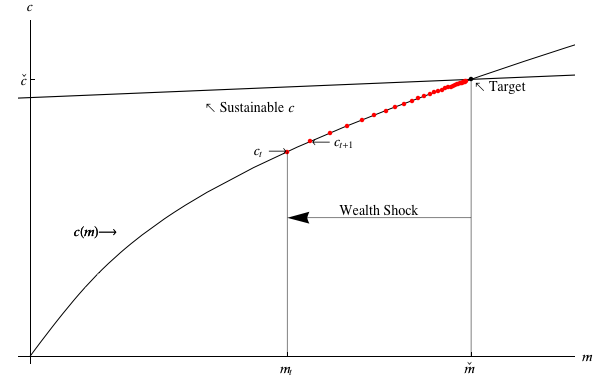

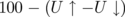

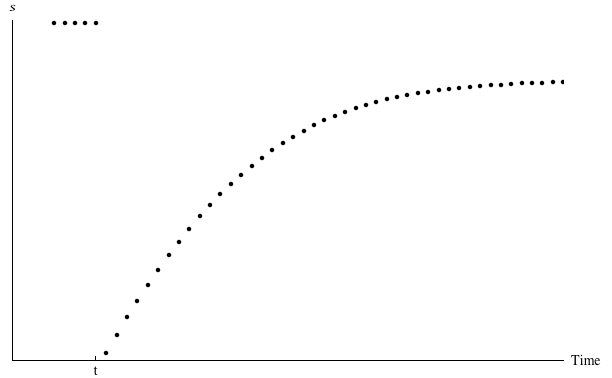

Figure 1 depicts a consumption function  that relates a stylized consumer’s

optimal spending-to-labor-income ratio

that relates a stylized consumer’s

optimal spending-to-labor-income ratio  to the monetary-resources-to-labor-income

ratio

to the monetary-resources-to-labor-income

ratio  ; the consumer is assumed to be behaving according to a simple

buffer-stock saving model like that of Carroll (2009). This consumer is

impatient: In the absence of uncertainty, spending would exceed the amount

consistent with wealth maintenance. For such a consumer, precautionary motives

are the only reason to hold any positive wealth. (The consumption function is

concave because at lower and lower levels of wealth the consumer’s precautionary

motive gets stronger and stronger).

; the consumer is assumed to be behaving according to a simple

buffer-stock saving model like that of Carroll (2009). This consumer is

impatient: In the absence of uncertainty, spending would exceed the amount

consistent with wealth maintenance. For such a consumer, precautionary motives

are the only reason to hold any positive wealth. (The consumption function is

concave because at lower and lower levels of wealth the consumer’s precautionary

motive gets stronger and stronger).

The shallowly sloped line plots, for each level of wealth, the level of spending

that is “sustainable” in the sense that, at that level of spending, expected  in the next period will be unchanged from the current level of

in the next period will be unchanged from the current level of  . (Sustainable

spending is simply the sum of expected labor income and expected interest

income; it is upward sloping because with more assets, the consumer expects to

earn more interest income).

. (Sustainable

spending is simply the sum of expected labor income and expected interest

income; it is upward sloping because with more assets, the consumer expects to

earn more interest income).

The target  is the level of

is the level of  at which the consumer will choose the

sustainable level of consumption.

at which the consumer will choose the

sustainable level of consumption.

2.2 A Wealth Shock

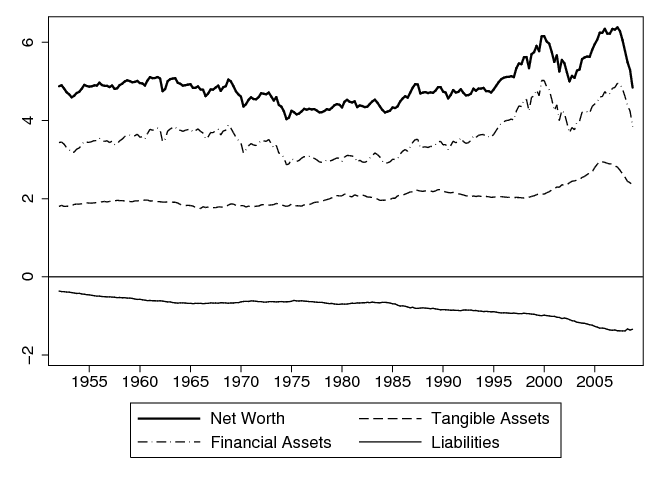

Our first experiment with the model is motivated by the historic shock to

household wealth depicted in figure 2. Estimates of the magnitude of the wealth

shock range as high as $13 trillion (Baily, Lund, and Atkins (2009)); this is

certainly the largest collapse in asset values since the Great Depression.

Leading up to the period  when the wealth shock occurs, our consumer is

assumed to have been holding the target amount of wealth

when the wealth shock occurs, our consumer is

assumed to have been holding the target amount of wealth  ; the consumer’s

pre-shock position is indicated by the black dot at the point

; the consumer’s

pre-shock position is indicated by the black dot at the point  . In period

. In period

, wealth drops to

, wealth drops to  , inducing a corresponding drop in consumption to

, inducing a corresponding drop in consumption to  ,

indicated by the red dot at

,

indicated by the red dot at  . The subsequent evolution of consumption

and wealth are represented by the series of red dots leading back toward

. The subsequent evolution of consumption

and wealth are represented by the series of red dots leading back toward

.

.

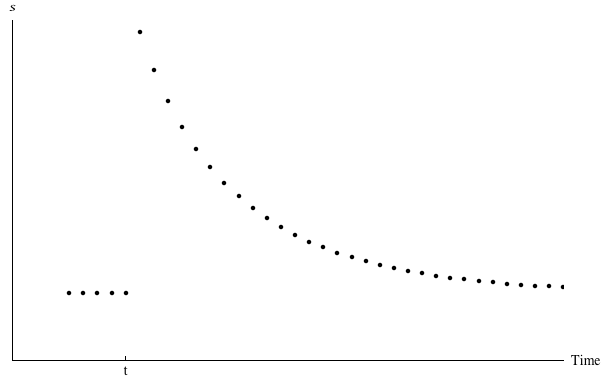

The next figure shows the path of the consumer’s saving rate. Before

the shock, saving was constant at the level necessary to maintain the

wealth-to-income ratio at its target. When the wealth shock hits, the saving rate

jumps up substantially (this is the ‘wealth effect’ in this model). Subsequently, as

wealth builds back up toward its target, the saving rate subsides toward its

equilibrium value.

2.3 A Rise In Unemployment Expectations

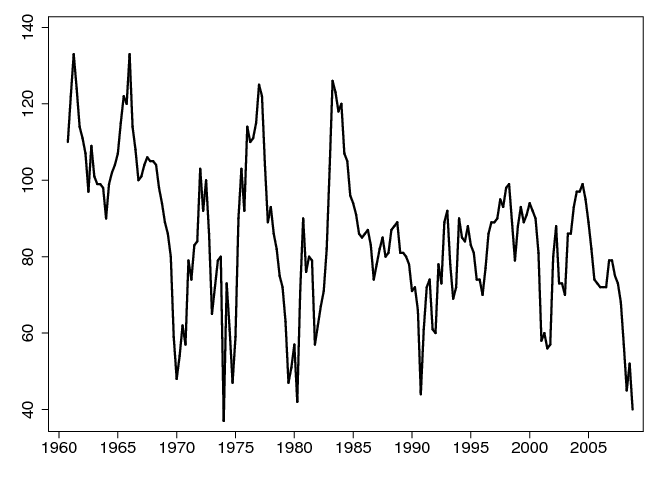

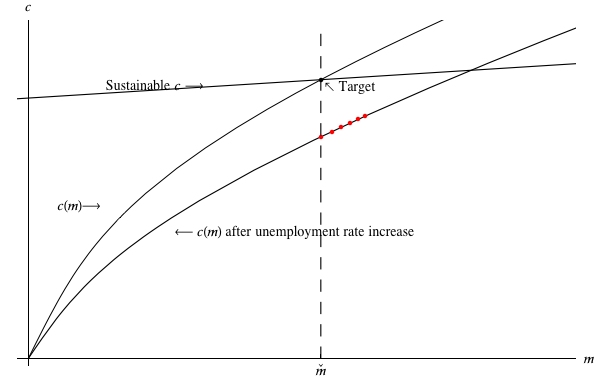

Figure 5 shows the history of our favorite measure of consumer sentiment: The

University of Michigan’s index of unemployment expectations. In prior work,

we have found that this indicator has substantial predictive power for

consumption spending. And, as the figure shows, the recent survey results show

consumers exhibiting near-record pessimism about future job market

conditions.

Our next experiment, in figure 6, examines the consequences of an increase in

unemployment expectations in the model.

Beginning from the same original consumption function as before,

the new consumption function corresponding to the state of heightened

fear is labelled “ after unemployment rate increase.” Starting,

again, from the original steady state, consumption drops sharply, then as

precautionary wealth builds up spending gradually recovers. The saving path

follows the same pattern as in figure 4: A sudden rise followed by a

gradual subsidence. (The pattern of consumption after the shock is again

indicated by dots. We show only 5 periods of evolution because presumably

unemployment expectations will not remain elevated longer than five years;

when unemployment expectations return to normal, consumption would

jump back to the original consumption function. Of course, real-world

changes in expectations are not likely to be one-off events like those we

simulate, so the changes in spending would not be expected to be so

sharp).

after unemployment rate increase.” Starting,

again, from the original steady state, consumption drops sharply, then as

precautionary wealth builds up spending gradually recovers. The saving path

follows the same pattern as in figure 4: A sudden rise followed by a

gradual subsidence. (The pattern of consumption after the shock is again

indicated by dots. We show only 5 periods of evolution because presumably

unemployment expectations will not remain elevated longer than five years;

when unemployment expectations return to normal, consumption would

jump back to the original consumption function. Of course, real-world

changes in expectations are not likely to be one-off events like those we

simulate, so the changes in spending would not be expected to be so

sharp).

While unemployment expectations will likely return to more normal levels

within a few years, it is possible that the crisis will have a long-lasting

residual effect on consumers’ generalized degree of uncertainty. After the

“Great Moderation” period of relative macroeconomic stability of the

prior twenty years, households’ perceptions of the degree of economic

risk that they were subject to may have fallen substantially. Lingering

memories of the current crisis could therefore have a very long-lasting

effect in boosting the saving rate (and reducing consumers’ appetite for

borrowing).

This leads us to a discussion of the final element of the crisis: Developments in

the credit market.

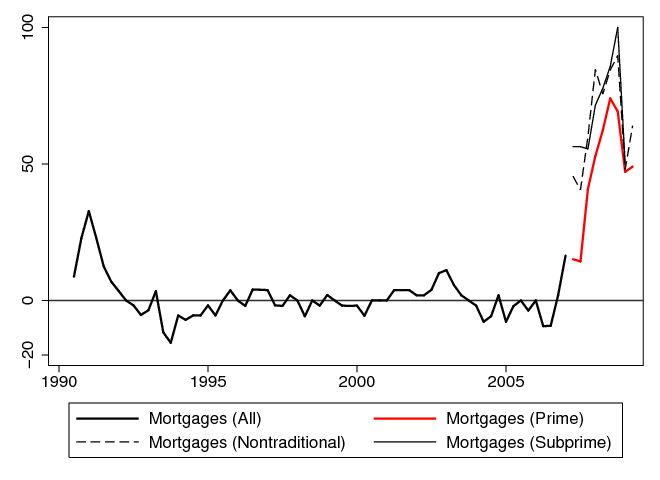

2.4 A Relaxation of Borrowing Constraints

Our final experiment with the model is motivated by the literature that

attributes the runup in consumer debt depicted as the bottom line in figure 2 to

a relaxation of borrowing constraints. The rapid pace of credit expansion,

especially over the past few years, is evident in figure 7. Since the borrowing

outcome depends on both credit demand and credit supply, the rapid pace of

debt growth over this period is not prima facie proof of relaxing credit

conditions; but plenty of evidence suggests that increasing credit availability was

the main driver of credit growth (cf., for example, Mian and Sufi (2008) and the

references therein; see also Dynan and Kohn (2007), who argue that

the increase in house prices was partly responsible for the relaxation of

credit).

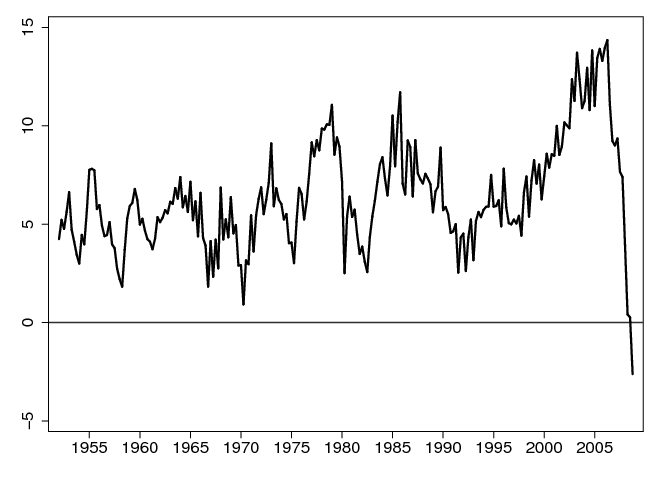

The function labelled “Orig  ” in figure 8 reflects an assumed initial

situation in which borrowing is prohibited. The function “New

” in figure 8 reflects an assumed initial

situation in which borrowing is prohibited. The function “New  ” shows

how the consumption function changes if a financial liberalization suddenly

makes borrowing easier. The effect is intuitive: For any given level of monetary

assets

” shows

how the consumption function changes if a financial liberalization suddenly

makes borrowing easier. The effect is intuitive: For any given level of monetary

assets  , the consumer with greater access to credit spends more. Rather than

needing to rely on personal saving as a buffer against uncertainty, the consumer

plans to use his credit line in case of emergencies, so there is less need for direct

wealth holding.

, the consumer with greater access to credit spends more. Rather than

needing to rely on personal saving as a buffer against uncertainty, the consumer

plans to use his credit line in case of emergencies, so there is less need for direct

wealth holding.

Before the relaxation of borrowing constraints, we assume that the

consumer was at the target level of  , as signalized by the black dot at the

intersection of the ‘sustainable

, as signalized by the black dot at the

intersection of the ‘sustainable  ’ line and the consumption function. The

rightmost (highest) red dot on the “New

’ line and the consumption function. The

rightmost (highest) red dot on the “New  ” function shows the

point to which consumption jumps when easier borrowing is allowed; the

remaining dots on the new consumption function show the path by which

consumption evolves downward as wealth falls toward its new, lower

target.

” function shows the

point to which consumption jumps when easier borrowing is allowed; the

remaining dots on the new consumption function show the path by which

consumption evolves downward as wealth falls toward its new, lower

target.

The consumer in our example is so impatient, and the availability of credit

(post liberalization) is so generous, that the new target level of wealth is

negative; in the new equilibrium, the consumer relies upon his borrowing ability

to provide the buffering capacity that was previously provided by his wealth

stock.

The path of the saving rate following the liberalization is shown in figure 9.

The initial upward leap in spending corresponds to a sharp decline in the saving

rate. Subsequently, the saving rate gradually increases, but never fully recovers

to its pre-liberalization level (the lower level of target wealth permitted by

increased borrowing does not require as high a saving rate in order to be

sustained).

This figure underpins our interpretation of the effects of the credit boom of the

past few decades. We view that history as an ongoing sequence of modest

relaxations of borrowing constraints, rather than a giant one-time event. Every

year, credit conditions got slightly easier (with only a few backward

steps). Each particular increase in credit availability would, by itself,

have resulted in a saving response like the one implicit in our figure

(sharp decline followed by gradual recovery); but in each case borrowing

constraints were subsequently further relaxed before the saving rate could

recover. Since credit availability cannot get easier forever (that would be

unsustainable!), the saving rate should stop being depressed whenever

credit-easing ends.

The period of ever-looser credit has certainly now come to an end. Perhaps the

best way to measure changes in the supply of credit is through the Federal

Reserve’s ongoing Senior Loan Officer Opinion Survey, which reports the fraction

of loan officers who say conditions are tightening minus the proportion who say

they are easing. (This only measures conditions at banks, and since much of the

increase in credit supply in the last decade came from nonbank lenders, the

survey is an imperfect measure).

Figure 10, which shows the results of that survey, should remove any doubt

that in the period since the crisis began, credit conditions have tightened

sharply.

The effects of a credit cutback, in the model, are simply the inverse of the

effects of an expansion: Consumption drops, the saving rate rises, and there is

gradual adjustment toward a new equilibrium in which even impatient

consumers find it prudent to hold a larger buffer stock of wealth than

before.

Everyone agrees that much of the credit tightening is necessary and permanent

(the days of No Income, No Job, No Assets (NINJA) mortgage loans will

not return). But the demand for credit has surely fallen also, as fearful

consumers refrain from borrowing even when credit is available to them. Some

combination of reduced demand and tightening supply accounts for the

impressive collapse in net borrowing (‘deleveraging’) shown at the end of

figure 7.

A key question for the longer-term outlook is how long this period of

deleveraging will last, and how much lower the ‘target’ level of leverage is than

its current (still-elevated) level. These are difficult questions with no clear

answer; but we are in the camp that believes that the long-run equilibrium level

of household debt will be substantially lower than the levels of the past few

years, as a result both of consumers’ newfound fears of overindebtedness and as a

result of financial markets’ presumably greater prudence in offering credit going

forward.

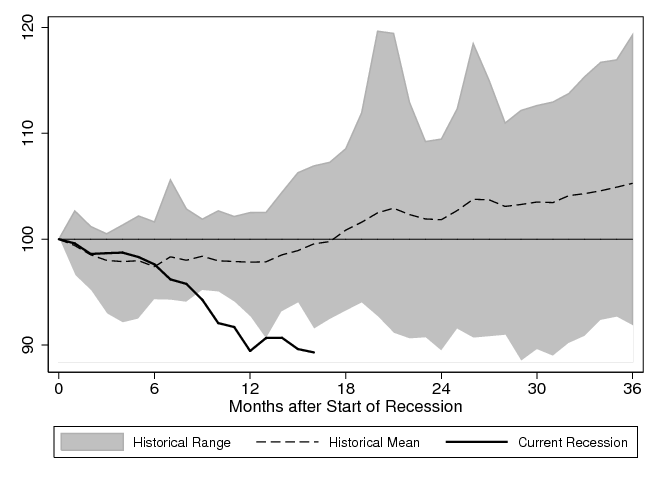

3 Consumption So Far

Wealth has cratered; credit availability has tightened sharply; and consumer

confidence has collapsed.

The effect of these events on household spending is best measured using the

BEA’s index of retail sales, which is more timely and less subject to

revision than more comprehensive measures of spending like Personal

Consumption Expenditures (PCE). Figure 11 shows the level of retail

sales over the period since the beginning of the recession (in December

2007, according to the National Bureau of Economic Research), along

with the pattern of retail sales spending following the other business

cycle peaks in the postwar period. (The level of sales is indexed to 100

at the beginning of each business cycle peak). The gray interval in the

diagram shows, for each month after the recession peak, the minimum

and maximum levels of relative retail sales across all previous postwar

recessions.

Given the magnitude of the shocks, it is no surprise that the figure shows that

the decline in retail sales in the current recession is considerably larger than in

any previous postwar recession. In the latest data available at this writing,

retail sales in April 2009 were estimated to be about 10 percent lower

than when the recession began. In contrast, by this time after previous

recessions peaks, retail sales had on average fully recovered to their peak

level.

Other indicators yield similar conclusions; for example, the decline in

consumption spending in the fourth quarter of 2008 was the sharpest

drop in the past 50 years; a Rockefeller Institute report by Boyd and

Dadayan (2009) finds that state-level data for sales taxes (presumably, an

indicator of sales) showed the sharpest drop in 50 years in the fourth quarter of

2008. Automobile sales have dropped by around 50 percent. And so

on.

4 Our Forecast

The path of consumer spending is famously difficult to forecast. Conveniently,

Robert Hall (1978) provided economists with a good excuse for our forecasting

failures by proving that standard consumption theory implies that forecasting

changes in consumption should be mathematically impossible.

A subsequent literature has nevertheless found some reasonably predictable

patterns in consumption growth. For example, Carroll, Sommer, and

Slacalek (2008) (henceforth, CSS) find that, across a set of 13 developed

economies for which sufficient time series data are available, behavior deviates

from the random walk theory in a simple way: After correcting for measurement

error, consumption growth has a substantial degree of serial correlation, or

‘momentum.’

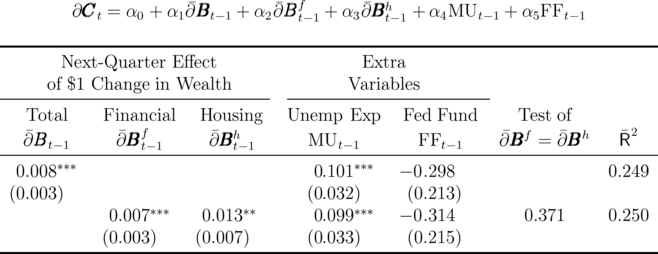

Concretely, CSS estimate an equation of the form

where the expectation of lagged consumption growth is constructed using data

available at date  (the lag is necessary to correct for measurement

error and time aggregation in the consumption data). At a quarterly

frequency, the serial correlation coefficient for the predictable component of

consumption growth in most countries (including the U.S.) is about

(the lag is necessary to correct for measurement

error and time aggregation in the consumption data). At a quarterly

frequency, the serial correlation coefficient for the predictable component of

consumption growth in most countries (including the U.S.) is about

(We neglect here the conceptually important distinction between spending on

durable goods, nondurables, and services. Although theory suggests that this

distinction should be important, and evidence does show that spending on

durables is much more variable than that on nondurables or services, we

find that the aggregate forecasting equation that lumps all spending

components together works about as well as what we are able to get by

disaggregating.)

For our projections here, we rely on an extension of the CSS methodology

designed to permit the measurement of wealth effects on consumption, developed

in Carroll, Otsuka, and Slacalek (2009) (henceforth, COS).

In addition to the above equation, COS estimate a simple relation between

consumption and wealth:

where  denotes aggregate consumption,

denotes aggregate consumption,  aggregate wealth,

aggregate wealth,  unemployment expectations (measured by the Michigan survey),

unemployment expectations (measured by the Michigan survey),  the

Federal funds rate,

the

Federal funds rate,  and

and  . Parameter

. Parameter

is the immediate (next-quarter) marginal propensity to consume out

of wealth. Because consumption responds slowly to shocks (

is the immediate (next-quarter) marginal propensity to consume out

of wealth. Because consumption responds slowly to shocks ( ),

the eventual marginal propensity to consume

),

the eventual marginal propensity to consume  is substantially larger:

is substantially larger:

.

.

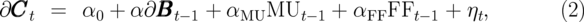

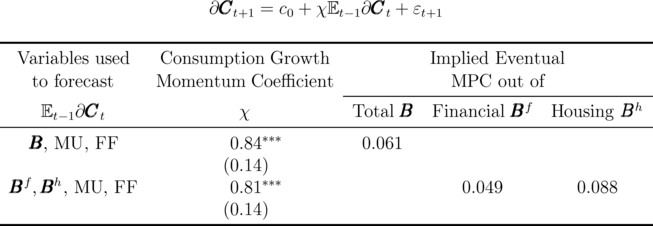

Estimates of the immediate and eventual marginal propensities to consume for the

most recent sample (1960Q1–2008Q4) are shown in Tables 1 and 2 respectively.

Our preferred model implies that the eventual effect on consumption of a $1

dollar increase in wealth is about 6 cents. The effect of an increase in housing

wealth—9 cents—is substantially larger than that of financial wealth—4

cents.

| Table 3: | Economic Scenarios: The Good, the Baseline and the Ugly |

Note:  : Mean growth of housing wealth, : Mean growth of housing wealth,  : Fed funds rate is approximated with Consensus forecasts of

three-month Treasury Bill rate. : Fed funds rate is approximated with Consensus forecasts of

three-month Treasury Bill rate.

|

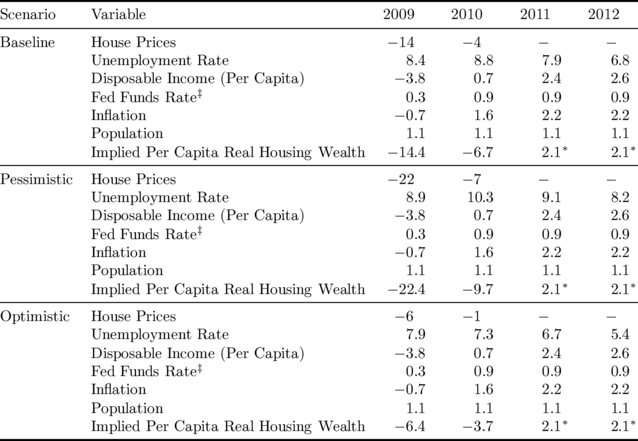

We use the COS model to investigate future consumption paths implied by

three alternative scenarios for the future dynamics of house prices as

described in Table 3 and shown in Figure 12. The baseline scenario is

motivated by the assumptions of the recent stress test of major banks

undertaken by the Federal Reserve, Office of the Comptroller of the

Currency, and Federal Deposit Insurance Corporation. That scenario

assumes that house prices fall by 14 percent and 4 percent in 2009 and

2010 respectively, in nominal terms, which implies a 14.4 percent fall

for per capita real housing wealth this year and 6.7 percent fall next

year.

The second, “pessimistic” scenario mirrors the adverse scenario in the stress

tests by imposing a 22 percent nominal house price fall in 2009 followed by a 7

percent fall in 2010 (22.4 and 9.7 percent respectively, in real per capita

terms).

The last, “optimistic” scenario is the mirror image of the pessimistic scenario

around the baseline. It imposes a 6 percent fall in nominal house prices in 2009

and a 1 percent fall in 2010.

In all three scenarios we assume that consumers form unemployment

expectations by updating slowly from experts’ unemployment expectations as

in Carroll (2003). (Motivated by the stress test assumptions, experts’

unemployment expectations vary across scenarios as given in Table 3.) Finally,

we use the expectations of economic forecasters reported by the Consensus

Economics survey (http://www.consensuseconomics.com/) as our best guess

about the future Fed funds rate.

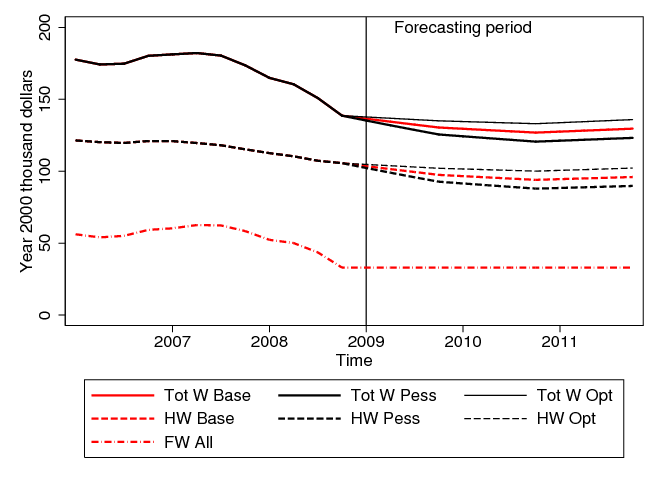

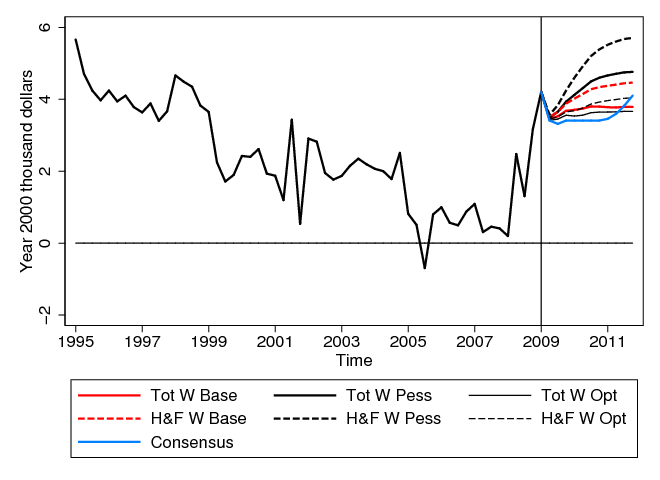

Figure 13 shows the projected consumption expenditure paths under the three

scenarios (of Table 3) and the two models—with total net worth, and

with wealth decomposed into separate housing and financial components

(Tables 1 and 2). We compare the six paths with the consumption

forecasts reported by Consensus Economics survey. Qualitatively, the

more pessimistic the scenario, the lower is consumption expenditure. In

addition, consumption projections of the disaggregated wealth model

(in which housing and financial wealth enter separately as independent

variables) are lower than those of the aggregate model because the estimated

MPC out of housing wealth is considerably larger than the MPC out of

financial wealth. Quantitatively, our models imply that per capita spending

will decrease from its current (2009Q4) level of $26,800 (in year 2000

dollars) by 0.6–1.5 percent before it starts to grow later this year or in

2010.

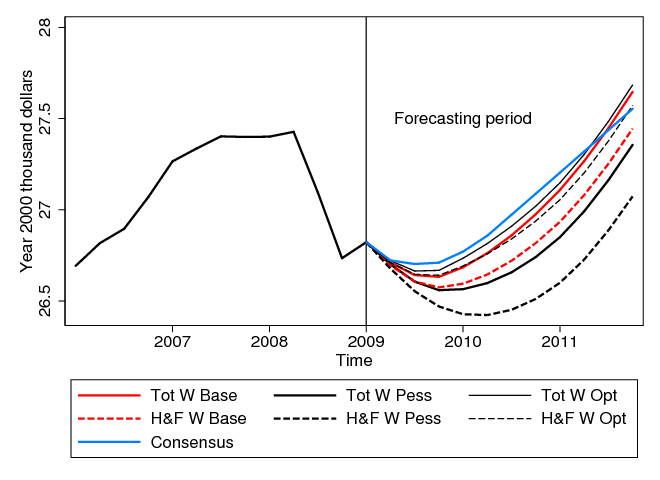

Figure 14 compares the saving rates with the benchmark saving rate implied by the Consensus

Economics survey.

Because of lower consumption paths our models generally predict higher saving

rates than the Consensus forecast. After the initial dip in 2009Q4 (caused by a

substantial fall in disposable income—3.5 percent in real per capita terms) the

saving rate typically tends to remain close to the current level of 4 percent but in

the most pessimistic scenario could increase to as much as 5.4 percent by the end

of 2011.

A more optimistic view is that the sluggishness in consumption growth in

historical data reflects the slow transmission of macroeconomic news to the

consumers’ consciousness; inattentive consumers are normally slow to react to

macroeconomic news because it takes them a while to notice it. This is the

optimistic interpretation of our empirical model’s results, because it would be

hard to argue that consumers have not noticed the current economic crisis.

Their adjustment may therefore have occurred much more quickly than

usual, so that the remaining degree of negative ‘momentum’ may be

negligible.

A further possibility worth mentioning is that spending on durable

goods may post sharp gains later this year; as Lawrence Summers has

pointed out, recent levels of automobile purchases are far below even the

level required merely to replace the stock that is depreciating due to

wear-and-tear or accidents. Indeed, a variety of measures from the recently

passed stimulus bill designed to encourage spending on durable goods

may make themselves felt later in the year and boost spending on those

categories.

But as noted above, the aggregate forecasting equation has tended to work

about as well for aggregate spending as for its components; we take this as

suggesting that spending on nondurable goods is likely to continue to be quite

weak even if durable goods spending recovers sharply. (In this case, one could

argue that consumers have indeed been ‘resting’ in their purchases of durable

goods).

Even if durables recover and nondurables stabilize in the near term, we are

inclined to believe that the end of the recent period of rapid credit expansion

portends a substantially higher saving rate two or three years hence than has

prevailed over the past few years. Returning to our remark in the introduction,

this would be the most favorable plausible scenario, because it would reflect a

path of Augustinian gradualism on the way to long-term reform. Such a

scenario would probably be the best outcome that can reasonably be hoped

for.

5 Conclusion

Since household spending has traditionally accounted for more than 2/3 of GDP,

consumer behavior always ends up being a decisive factor in macroeconomic

outcomes. But the degree of uncertainty about the spending outlook is

even greater now than usual. While our forecast is for slightly weaker

spending growth than called for by the Consensus survey of macroeconomic

forecasters, we would be remiss if we did not admit that the range of plausible

outcomes is very wide. No professional forecaster would be shocked if

the saving rate by the end of next year were as high as 8 percent (as

assumed in a pessimistic scenario in a recent report by Baily, Lund,

and Atkins (2009) of the McKinsey Global Institute) or as low as 2

percent.

Over the longer term, our best guess is that the gut-wrenching economic

uncertainty experienced in the current crisis will leave a lasting impression on

consumers’ attitudes toward debt; the combination of greater household

uncertainty and less adventurous credit supply by lenders, along with

households’ need to rebuild retirement and other wealth stocks devastated by the

crisis, will produce an eventual personal saving rate that is much higher than it

has been in many years.

References

BAILY, MARTIN N., SUSAN LUND, AND CHARLES ATKINS (2009): “Will US

Consumer Debt Reduction Cripple the Recovery?,” report, McKinsey Global Institute.

BOARD

OF GOVERNORS OF THE FEDERAL RESERVE SYSTEM (2009): “The Supervisory

Capital Assessment Program: Design and Implementation,” white paper, Available at

http://www.federalreserve.gov/newsevents/press/bcreg/20090424a.htm.

BOYD, DONALD J., AND LUCY DADAYAN (2009): “Sales Tax Decline

in Late 2008 Was the Worst in 50 Years,” State Revenue Report 75,

The Nelson A. Rockefeller Institute of Government, Available at

http://www.rockinst.org/pdf/government_finance/state_revenue_report/2009-04-14-(75)-state_revenue_report_sales_tax_decline.pdf.

CARROLL, CHRISTOPHER D. (2003): “Macroeconomic Expectations of Households

and Professional Forecasters,” Quarterly Journal of Economics, 118(1), 269–298,

Available at http://www.econ2.jhu.edu/people/ccarroll/epidemiologyQJE.pdf.

__________ (2009): “Lecture Notes: A Tractable

Model of Buffer Stock Saving,” Discussion paper, Johns Hopkins University, Available

at http://www.econ2.jhu.edu/people/ccarroll/public/lecturenotes/consumption.

CARROLL, CHRISTOPHER D., MISUZU OTSUKA, AND JIRKA SLACALEK (2009):

“How Large Are Housing and Financial Wealth Effects? A New Approach,”

Manuscript, Department of Economics, Johns Hopkins University, Available at

http://www.econ2.jhu.edu/people/ccarroll/papers/cosWealthEffects.

CARROLL, CHRISTOPHER D., MARTIN SOMMER, AND JIRI SLACALEK (2008):

“International Evidence on Sticky Consumption Growth,” Johns Hopkins University

Working Paper Number 542, Available at

http://www.econ2.jhu.edu/people/ccarroll/papers/cssIntlStickyC

http://www.econ2.jhu.edu/people/ccarroll/papers/cssIntlStickyC.pdf

http://www.econ2.jhu.edu/people/ccarroll/papers/cssIntlStickyC.zip.

DYNAN, KAREN E., AND DONALD L. KOHN (2007): “The Rise in U.S. Household

Indebtedness: Causes and Consequences,” International Finance Discussion Paper 37,

Board of Governors of the Federal Reserve System.

HALL, ROBERT E. (1978): “Stochastic Implications of the Life-Cycle/Permanent

Income Hypothesis: Theory and Evidence,” Journal of Political Economy, 96, 971–87,

Available at http://www.stanford.edu/~rehall/Stochastic-JPE-Dec-1978.pdf.

MIAN, ATIF, AND AMIR SUFI

(2008): “The Consequences of Mortgage Credit Expansion: Evidence from the 2007

Mortgage Default Crisis,” Forthcoming, Quarterly Journal of Economics, Available at

http://ideas.repec.org/p/nbr/nberwo/13936.html.

that relates a stylized consumer’s

optimal spending-to-labor-income ratio

that relates a stylized consumer’s

optimal spending-to-labor-income ratio  to the monetary-resources-to-labor-income

ratio

to the monetary-resources-to-labor-income

ratio  ; the consumer is assumed to be behaving according to a simple

buffer-stock saving model like that of Carroll (2009). This consumer is

impatient: In the absence of uncertainty, spending would exceed the amount

consistent with wealth maintenance. For such a consumer, precautionary motives

are the only reason to hold any positive wealth. (The consumption function is

concave because at lower and lower levels of wealth the consumer’s precautionary

motive gets stronger and stronger).

; the consumer is assumed to be behaving according to a simple

buffer-stock saving model like that of Carroll (2009). This consumer is

impatient: In the absence of uncertainty, spending would exceed the amount

consistent with wealth maintenance. For such a consumer, precautionary motives

are the only reason to hold any positive wealth. (The consumption function is

concave because at lower and lower levels of wealth the consumer’s precautionary

motive gets stronger and stronger).

Risk Rises

Risk Rises

![∂CCCt+1 = ς + χ Et- 2[∂CCCt ] + ϵt+1 (1)](ReformingOrResting26x.png)